United Airlines 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

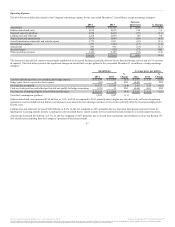

The Company records an estimate of breakage revenue on the flight date for tickets that will expire unused. These estimates are based on the evaluation of

actual historical results and forecasted trends. Refundable tickets expire after one year from the date of issuance.

In May 2014, the Financial Accounting Standards Board (“FASB”) amended the FASB Accounting Standards Codification and created a new Topic 606,

. This amendment prescribes that an entity should recognize revenue to depict the transfer of promised goods or

services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The

amendment supersedes the revenue recognition requirements in Topic 605, , and most industry-specific guidance throughout the

Industry Topics of the Codification. The amendment will become effective for the Company’s annual and interim reporting periods beginning after

December 15, 2017. Under the new standard, certain airline ancillary fees directly related to passenger revenue tickets, such as airline change fees and

baggage fees, are likely to no longer be considered distinct performance obligations separate from the passenger travel component. In addition, the change

fees which were previously recognized when received, will likely be recognized when transportation is provided. The Company is evaluating other impacts

on its consolidated financial statements.

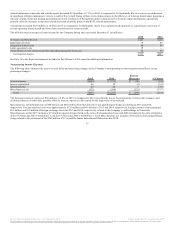

Frequent Flyer Accounting. The Company’s MileagePlus program is designed to increase customer loyalty. Program participants earn miles by flying on

United and certain other participating airlines. Program participants can also earn miles through purchases from other non-airline partners that participate in

the Company’s loyalty program. We sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies and our

participating airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or upgraded air travel and non-

travel awards. The Company records its obligation for future award redemptions using a deferred revenue model.

In the case of the sale of air services, the Company recognizes a portion of the ticket sales as revenue when the air transportation occurs and defers a portion

of the ticket sale representing the value of the related miles as a multiple-deliverable revenue arrangement. The miles are recorded in Frequent flyer deferred

revenue on the Company’s consolidated balance sheet and recognized into revenue when the transportation is provided.

The Company determines the estimated selling price of air transportation and miles as if each element is sold on a separate basis. The total consideration from

each ticket sale is then allocated to each of these elements individually on a pro rata basis.

The Company’s estimated selling price of miles is based on an equivalent ticket value less fulfillment discount, which incorporates the expected redemption

of miles, as the best estimate of selling price for these miles. The equivalent ticket value is based on the prior 12 months’ weighted average equivalent ticket

value of similar fares as those used to settle award redemptions while taking into consideration such factors as redemption pattern, cabin class, loyalty status

and geographic region. The estimated selling price of miles is adjusted by a fulfillment discount that considers a number of factors, including redemption

patterns of various customer groups.

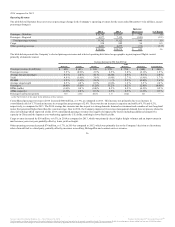

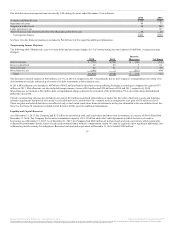

United has a significant contract to sell MileagePlus miles to its co-branded credit card partner, Chase. United identified the following significant revenue

elements in the Co-Brand Agreement: the air transportation element represented by the value of the mile (generally resulting from its redemption for future air

transportation and whose fair value is described above); use of the United brand and access to MileagePlus member lists; advertising; and other travel related

benefits.

The fair value of the elements is determined using management’s estimated selling price of each element. The objective of using the estimated selling price

based methodology is to determine the price at which we would transact a sale if the product or service were sold on a stand-alone basis. Accordingly, we

determine our best estimate of selling price by considering multiple inputs and methods including, but not limited to, discounted cash flows, brand value,

volume discounts, published selling prices, number of miles awarded and number of miles redeemed. The Company estimated the selling prices and volumes

over the term of the Co-Brand Agreement in order to determine the allocation of proceeds to each of the multiple elements to be delivered. We also evaluate

volumes on an annual basis, which may result in a change in the allocation of estimated selling price on a prospective basis.

45

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.