United Airlines 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

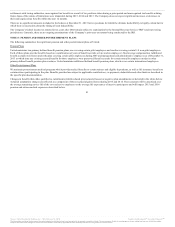

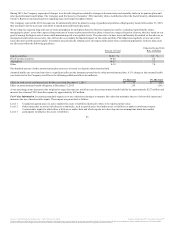

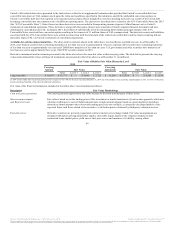

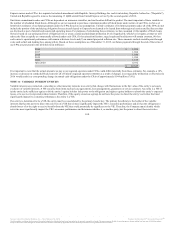

Fair value is determined with a formula utilizing observable inputs. Significant inputs to the valuation models include

contractual terms, risk-free interest rates and forward exchange rates.

Fair values were based on either market prices or the discounted amount of future cash flows using our current

incremental rate of borrowing for similar liabilities.

United used a binomial lattice model to value the conversion options and the supplemental derivative assets.

Significant binomial model inputs that are not objectively determinable include volatility and the Company’s credit

risk component of the discount rate.

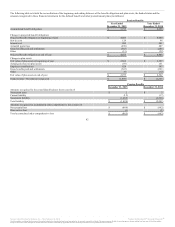

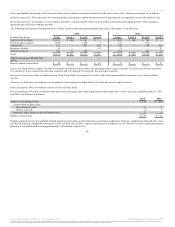

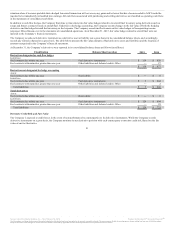

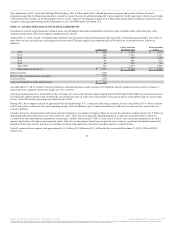

Fuel Derivatives

The Company may hedge a portion of its future fuel requirements to protect against increases in the price of fuel. The Company may restructure hedges in

response to market conditions prior to their original settlement dates which may result in changes in hedge coverage levels and the potential recognition of

gains or losses on such hedge contracts. As of December 31, 2015, the Company had hedged approximately 17% of its projected fuel requirements (652

million gallons) for 2016, with commonly used financial hedge instruments based on aircraft fuel or crude oil. As of December 31, 2015, the Company had

fuel hedges expiring through December 2016.

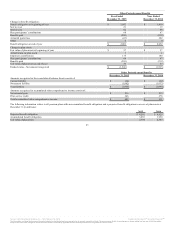

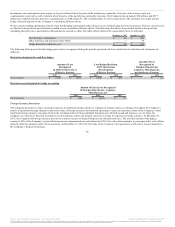

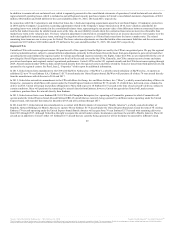

As required, the Company assesses the effectiveness of each of its individual hedges on a quarterly basis. The Company also examines the effectiveness of its

entire hedging program on a quarterly basis utilizing statistical analysis. This analysis involves utilizing regression and other statistical analyses that

compare changes in the price of aircraft fuel to changes in the prices of the commodities used for hedging purposes.

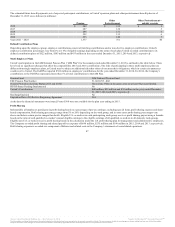

Upon proper qualification, the Company accounts for certain fuel derivative instruments as cash flow hedges. All derivatives designated as hedges that meet

certain requirements are granted hedge accounting treatment. The types of instruments the Company utilizes that qualify for hedge accounting treatment

typically include swaps, call options, collars (which consist of a purchased call option and a sold put option), four-way collars (a collar with a higher strike

sold call option and a lower strike purchased put option) and other combinations of options. Generally, utilizing hedge accounting, all periodic changes in

the fair value of derivatives designated as hedges that are considered to be effective are recorded in AOCI until the underlying fuel is consumed and recorded

in fuel expense. The Company is exposed to the risk that its hedges may not be effective in offsetting changes in the cost of fuel and that its hedges may not

continue to qualify for hedge accounting. Hedge ineffectiveness results when the change in the fair value of the derivative instrument exceeds the change in

the value of the Company’s expected future cash outlay to purchase and consume fuel. To the extent that the periodic changes in the fair value of the

derivatives are not effective, that ineffectiveness is classified as Nonoperating income (expense): Miscellaneous, net in the statements of consolidated

operations.

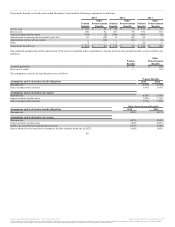

The Company also uses certain combinations of derivative contracts that are economic hedges but do not qualify for hedge accounting under GAAP.

Additionally, the Company may enter into contracts at different times and later combine those contracts into structures designated for hedge accounting. As

with derivatives that qualify for hedge accounting, the economic hedges and individual contracts are part of the Company’s program to mitigate the adverse

financial impact of potential increases in the price of fuel. The Company records changes in the fair value of these various contracts that are not designated

for hedge accounting to Nonoperating income (expense): Miscellaneous, net in the statements of consolidated operations.

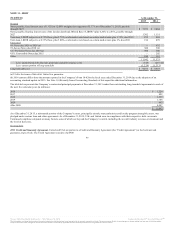

If the Company settles a derivative prior to its contractual settlement date, then the cumulative gain or loss recognized in AOCI at the termination date

remains in AOCI until the forecasted transaction occurs. In a

90

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.