United Airlines 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

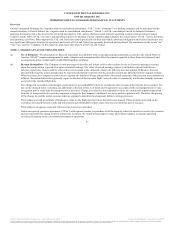

The Company records passenger revenue related to the air transportation element when the transportation is delivered. The other elements are

generally recognized as Other operating revenue when earned.

The Company accounts for miles sold and awarded that will never be redeemed by program members, which we refer to as breakage. The Company

reviews its breakage estimates annually based upon the latest available information regarding redemption and expiration patterns. Miles expire

after 18 months of member account inactivity.

The Company’s estimate of the expected expiration of miles requires significant management judgment. Current and future changes to expiration

assumptions or to the expiration policy, or to program rules and program redemption opportunities, may result in material changes to the deferred

revenue balance as well as recognized revenues from the programs.

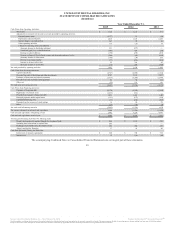

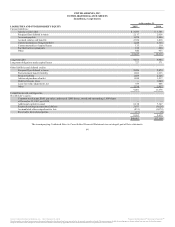

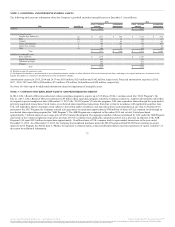

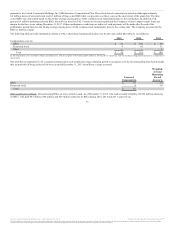

The following table provides additional information related to the frequent flyer program (in millions):

2015 $ 2,999 $ 1,050 $ 2,173 $ (224)

2014 2,861 882 2,178 (199)

2013 2,903 903 2,174 (174)

(a) This amount represents other revenue recognized during the period from the sale of miles to third parties, representing the marketing-related deliverable services component of the sale.

(b) This amount represents the increase to Frequent flyer deferred revenue during the period.

(c) This amount represents the net increase (decrease) in the advance purchase of miles obligation due to cash payments for the sale of miles in excess of (less than) miles awarded to customers.

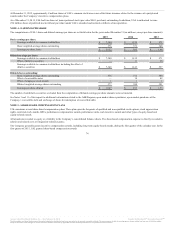

(d) Highly liquid investments with a maturity of three months or less on their acquisition date are

classified as cash and cash equivalents.

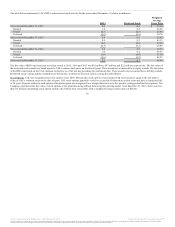

Restricted cash primarily includes cash collateral associated with workers’ compensation obligations, reserves for institutions that process credit

card ticket sales and cash collateral received from fuel hedge counterparties. Restricted cash is classified as short-term or long-term in the

consolidated balance sheets based on the expected timing of return of the assets to the Company. Airline industry practice includes classification

of restricted cash flows as either investing cash flows or operating cash flows. Cash flows related to restricted cash activity are classified as

investing activities because the Company considers restricted cash arising from these activities similar to an investment. The Company’s net cash

inflows associated with its restricted cash balances for the years ended December 31, 2015, 2014 and 2013 were $114 million, $75 million and

$52 million, respectively.

(e) Short-term investments are classified as available-for-sale and are stated at fair value. Realized gains and losses on sales

of investments are reflected in nonoperating income (expense) in the consolidated statements of operations. Unrealized gains and losses on

available-for-sale securities are reflected as a component of accumulated other comprehensive income (loss).

(f) The Company accounts for aircraft fuel, spare parts and supplies at average cost and provides an

obsolescence allowance for aircraft spare parts with an assumed residual value of 10% of original cost.

69

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.