United Airlines 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

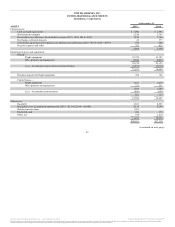

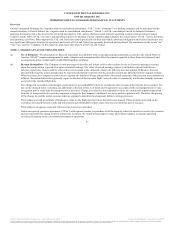

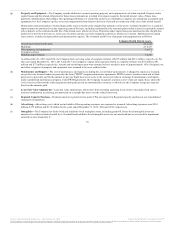

(g) The Company records additions to owned operating property and equipment at cost when acquired. Property under

capital leases and the related obligation for future lease payments are recorded at an amount equal to the initial present value of those lease

payments. Modifications that enhance the operating performance or extend the useful lives of airframes or engines are capitalized as property and

equipment. It is the Company’s policy to record compensation from delays in delivery of aircraft as a reduction of the cost of the related aircraft.

Depreciation and amortization of owned depreciable assets is based on the straight-line method over the assets’ estimated useful lives. Leasehold

improvements are amortized over the remaining term of the lease, including estimated facility renewal options when renewal is reasonably assured

at key airports, or the estimated useful life of the related asset, whichever is less. Properties under capital leases are amortized on the straight-line

method over the life of the lease or, in the case of certain aircraft, over their estimated useful lives, whichever is shorter. Amortization of capital

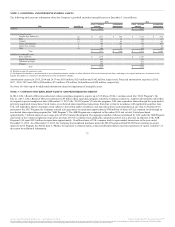

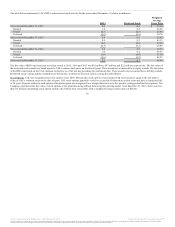

lease assets is included in depreciation and amortization expense. The estimated useful lives of property and equipment are as follows:

Aircraft and related rotable parts 25 to 30

Buildings 25 to 45

Other property and equipment 3 to 15

Computer software 5

Building improvements 1 to 40

As of December 31, 2015 and 2014, the Company had a carrying value of computer software of $279 million and $281 million, respectively. For

the years ended December 31, 2015, 2014 and 2013, the Company’s depreciation expense related to computer software was $93 million, $81

million and $72 million, respectively. Aircraft and aircraft spare parts were assumed to have residual values of approximately 10% of original cost,

and other categories of property and equipment were assumed to have no residual value.

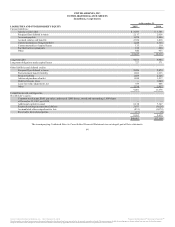

(h) The cost of maintenance and repairs, including the cost of minor replacements, is charged to expense as incurred,

except for costs incurred under our power-by-the-hour (“PBTH”) engine maintenance agreements. PBTH contracts transfer certain risk to third-

party service providers and fix the amount we pay per flight hour or per cycle to the service provider in exchange for maintenance and repairs

under a predefined maintenance program. Under PBTH agreements, the Company recognizes expense at a level rate per engine hour, unless the

level of service effort and the related payments during the period are substantially consistent, in which case the Company recognizes expense

based on the amounts paid.

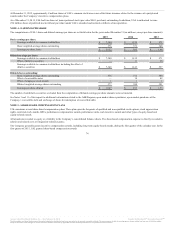

(i) Lease fair value adjustments, which arose from recording operating leases at fair value under fresh start or

business combination accounting, are amortized on a straight-line basis over the related lease term.

(j) Payments made to regional carriers under CPAs are reported in Regional capacity purchase in our consolidated

statements of operations.

(k) Advertising costs, which are included in Other operating expenses, are expensed as incurred. Advertising expenses were $201

million, $179 million and $178 million for the years ended December 31, 2015, 2014 and 2013, respectively.

(l) The Company has finite-lived and indefinite-lived intangible assets, including goodwill. Finite-lived intangible assets are

amortized over their estimated useful lives. Goodwill and indefinite-lived intangible assets are not amortized but are reviewed for impairment

annually or more frequently if

70

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.