United Airlines 2015 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United Continental Holdings, Inc. (together with its consolidated subsidiaries, “UAL” or the “Company”) is a holding company and its principal, wholly-

owned subsidiary is United Airlines, Inc. (together with its consolidated subsidiaries, “United”). As UAL consolidates United for financial statement

purposes, disclosures that relate to activities of United also apply to UAL, unless otherwise noted. United’s operating revenues and operating expenses

comprise nearly 100% of UAL’s revenues and operating expenses. In addition, United comprises approximately the entire balance of UAL’s assets, liabilities

and operating cash flows. When appropriate, UAL and United are named specifically for their individual contractual obligations and related disclosures and

any significant differences between the operations and results of UAL and United are separately disclosed and explained. We sometimes use the words “we,”

“our,” “us,” and the “Company” in this report for disclosures that relate to all of UAL and United.

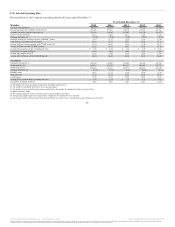

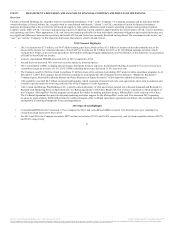

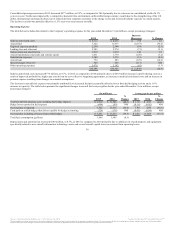

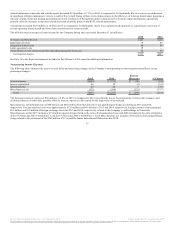

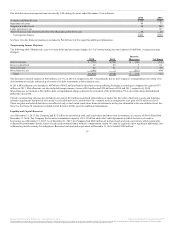

• 2015 net income was $7.3 billion, or $19.47 diluted earnings per share, which reflects $3.1 billion of income tax benefits primarily due to the

release of the income tax valuation allowance. Non-GAAP net income was $4.5 billion for 2015, or $11.88 diluted earnings per share, which

excludes $2.6 billion of special items and reflects $249 million of Hedge Program Adjustments. See Part II, Item 6 of this report for a reconciliation

of GAAP to Non-GAAP net income.

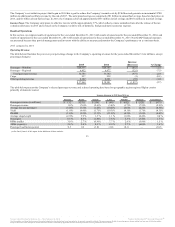

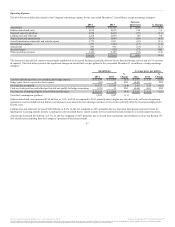

• United’s consolidated PRASM decreased 4.4% in 2015 compared to 2014.

• Aircraft fuel cost decreased 36% year-over-year due mainly to lower fuel prices.

• 2015 consolidated CASM, excluding special charges, third-party business expenses, fuel and profit sharing, decreased 0.7% year-over-year on a

consolidated capacity increase of 1.6%. 2015 CASM, including those items, decreased 11.9% year-over-year.

• The Company used $1.2 billion of cash to purchase 21 million shares of its common stock during 2015 under its share repurchase programs. As of

December 31, 2015, the Company has $2.4 billion remaining to spend under the 2015 Program. See Part II, Item 5, “Market for Registrant’s

Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” of this report for additional information.

• UAL ended the year with $6.5 billion in unrestricted liquidity, which consisted of unrestricted cash, cash equivalents, short-term investments and

available capacity under the revolving credit facility of the Company’s Credit Agreement.

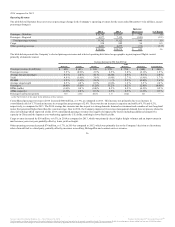

• UAL, United and Mileage Plus Holdings, LLC, a wholly-owned subsidiary of UAL and United, entered into a Second Amended and Restated Co-

Branded Card Marketing Services Agreement (the “Co-Brand Agreement”) with Chase Bank USA, N.A. (“Chase”), pursuant to which members of

the Company’s MileagePlus loyalty program earn frequent flyer miles for making purchases using a MileagePlus credit card issued by Chase.

The Co-Brand Agreement also provides for joint marketing and other support for the MileagePlus credit card. This increased 2015 operating

revenues by approximately $200 million from the combined impact of the Co-Brand Agreement, agreements ancillary to the Co-Brand Agreement

and updated accounting assumptions for accounting purposes.

• Consolidated RPMs for 2015 increased 1.5% as compared to 2014, and consolidated ASMs increased 1.6% from the prior year, resulting in a

consolidated load factor of 83.4% in 2015.

• For 2015 and 2014, the Company recorded a DOT on-time arrival rate of 78.1% and 76.0%, respectively, and a system completion factor of 98.7%

and 98.6%, respectively.

31

® ®

®

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.