United Airlines 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

which the interest rate is based on LIBOR, for certain other increased costs that the lenders incur in carrying these loans as a result of any change in law,

subject in most cases to obligations of the lenders to take certain limited steps to mitigate the requirement for, or the amount of, such increased costs. At

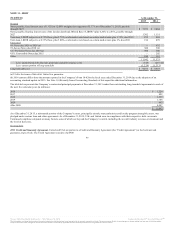

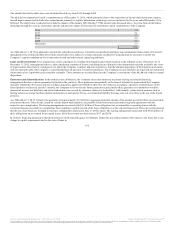

December 31, 2015, the Company had $2.4 billion of floating rate debt and $118 million of fixed rate debt, with remaining terms of up to 12 years, that are

subject to these increased cost provisions. In several financing transactions involving loans or leases from non-U.S. entities, with remaining terms of up to 12

years and an aggregate balance of $2.4 billion, the Company bears the risk of any change in tax laws that would subject loan or lease payments thereunder to

non-U.S. entities to withholding taxes, subject to customary exclusions.

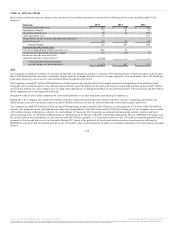

Fuel Consortia. United participates in numerous fuel consortia with other air carriers at major airports to reduce the costs of fuel distribution and storage.

Interline agreements govern the rights and responsibilities of the consortia members and provide for the allocation of the overall costs to operate the

consortia based on usage. The consortia (and in limited cases, the participating carriers) have entered into long-term agreements to lease certain airport fuel

storage and distribution facilities that are typically financed through tax-exempt bonds (either special facilities lease revenue bonds or general airport

revenue bonds), issued by various local municipalities. In general, each consortium lease agreement requires the consortium to make lease payments in

amounts sufficient to pay the maturing principal and interest payments on the bonds. As of December 31, 2015, approximately $1.3 billion principal amount

of such bonds were secured by significant fuel facility leases in which United participates, as to which United and each of the signatory airlines has provided

indirect guarantees of the debt. As of December 31, 2015, the Company’s contingent exposure was approximately $224 million principal amount of such

bonds based on its recent consortia participation. The Company’s contingent exposure could increase if the participation of other air carriers decreases. The

guarantees will expire when the tax-exempt bonds are paid in full, which ranges from 2017 to 2041. The Company did not record a liability at the time these

indirect guarantees were made.

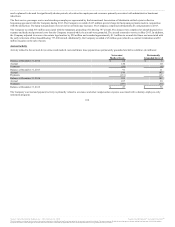

Regional Capacity Purchase. As of December 31, 2015, United had 279 call options to purchase regional jet aircraft being operated by certain regional

carriers. At December 31, 2015, none of the call options was exercisable because none of the required conditions to make an option exercisable by United

was met.

Credit Card Processing Agreements. The Company has agreements with financial institutions that process customer credit card transactions for the sale of air

travel and other services. Under certain of the Company’s credit card processing agreements, the financial institutions in certain circumstances have the right

to require that the Company maintain a reserve equal to a portion of advance ticket sales that has been processed by that financial institution, but for which

the Company has not yet provided the air transportation. Such financial institutions may require additional cash or other collateral reserves to be established

or additional withholding of payments related to receivables collected if the Company does not maintain certain minimum levels of unrestricted cash, cash

equivalents and short-term investments (collectively, “Unrestricted Liquidity”). The Company’s current level of Unrestricted Liquidity is substantially in

excess of these minimum levels.

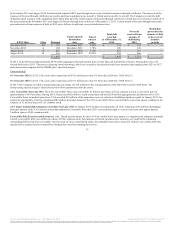

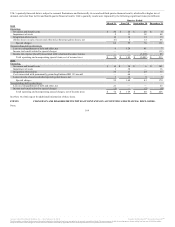

Labor Negotiations. As of December 31, 2015, United, including its subsidiaries, had approximately 84,000 employees. Approximately 80% of United’s

employees were represented by various U.S. labor organizations as of December 31, 2015.

The Company has reached joint collective bargaining agreements with the majority of its employee groups since the merger transaction in 2010. The

Company continues to negotiate in mediation for a joint flight attendant collective bargaining agreement, extensions to the IAM represented employees’

agreements and a joint technician and related employees’ collective bargaining agreement following the rejected proposal for ratification of a joint

technician and related employees’ agreement. The Company can provide no assurance that a successful or timely resolution of these labor negotiations will

be achieved.

103

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.