United Airlines 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

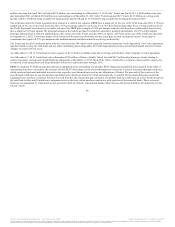

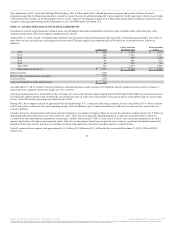

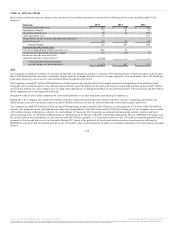

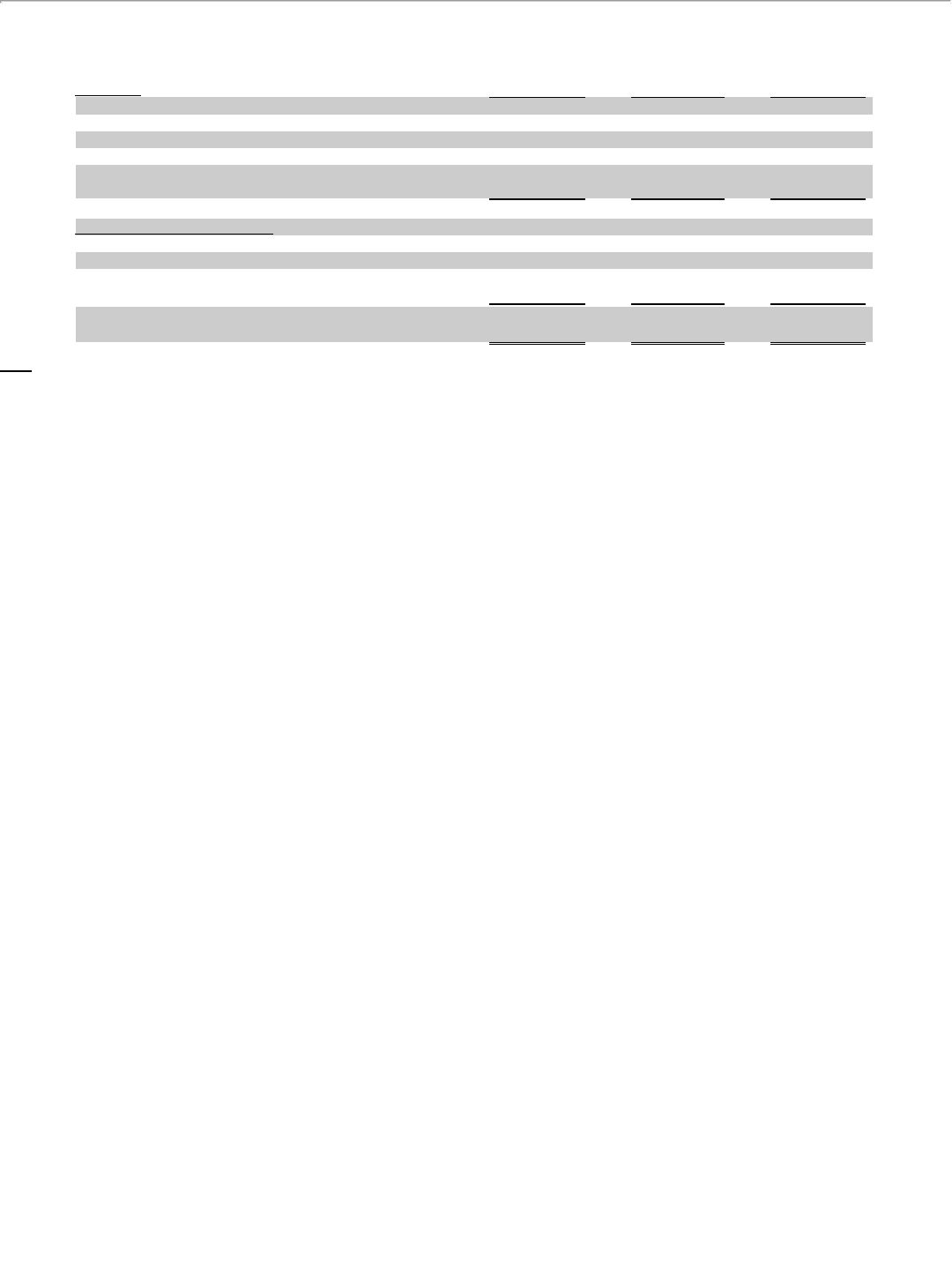

Special items classified as special charges in the statements of consolidated operations consisted of the following for the years ended December 31 (in

millions):

Operating:

Severance and benefit costs $ 107 $ 199 $ 105

Impairment of assets 79 49 33

Integration-related costs 60 96 205

Labor agreement costs 18 — 127

(Gains) losses on sale of assets and other miscellaneous

(gains) losses, net 62 99 50

Special charges 326 443 520

Nonoperating and income taxes:

Loss on extinguishment of debt and other, net 202 74 —

Income tax benefit related to special charges (11) (10) (7)

Income tax benefit associated with

valuation allowance release (Note 7) (3,130) — —

Total operating and nonoperating

special charges, net of income taxes $ (2,613) $ 507 $ 513

2015

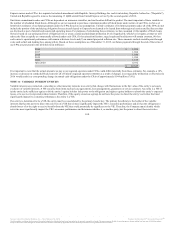

The Company recorded $107 million of severance and benefit costs primarily related to a voluntary early-out program for its flight attendants. In 2014, more

than 2,500 flight attendants elected to voluntarily separate from the Company and will receive a severance payment, with a maximum value of $100,000 per

participant, based on years of service, with retirement dates through the end of 2016.

The Company recorded $33 million ($22 million net of related income tax benefit) related to its annual assessment of impairment of its indefinite-lived

intangible assets (certain domestic slots and international Pacific routes), $8 million for the write-off of unexercised aircraft purchase options and $7 million

for inventory held for sale. The Company also recorded other impairments, including $10 million for discontinued internal software projects and $10 million

for the impairment of several engines held for sale.

Integration-related costs include compensation costs related primarily to systems integration and training for employees.

During 2015, the Company also recorded $32 million related to charges for legal matters, $18 million related to collective bargaining agreements, $16

million for the cease use of an aircraft under lease and $14 million for losses on the sale of aircraft and other miscellaneous gains and losses.

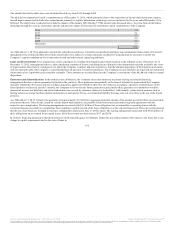

The Company recorded $202 million of losses as part of Nonoperating income (expense): Miscellaneous, net due primarily to the write-off of $134 million

related to the unamortized non-cash debt discount from the extinguishment of the 2026 Notes and the 2028 Notes. During 2015, the Company also recorded

a $61 million foreign exchange loss related to its cash holdings in Venezuela. The Venezuelan government has maintained currency controls and fixed

official exchange rates (i.e. Sistema Complementario de Administracion de Divisas (“SICAD”), and Sistema Marginal de Divisas (“SIMADI”)) for many years.

Previously, airlines were permitted to use the more favorable SICAD rate (currently 13.5 Venezuelan bolivars to one U.S. dollar) if repatriating profits and for

payments of local goods and services in Venezuela. During 2015, many of the payments for local goods and services have transitioned to utilizing the

SIMADI rate (currently 200 Venezuelan bolivars to one U.S. dollar) or have been required to be paid in U.S. dollars. Furthermore, the Venezuelan government

has not

104

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.