United Airlines 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

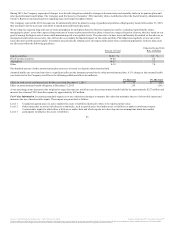

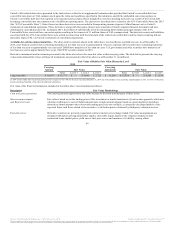

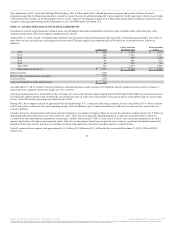

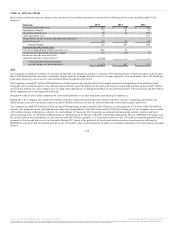

In November 2015 and August 2014, United created separate EETC pass-through trusts, each of which issued pass-through certificates. The proceeds of the

issuance of the pass-through certificates are used to purchase equipment notes issued by United and secured by its aircraft. The Company records the debt

obligation upon issuance of the equipment notes rather than upon the initial issuance of the pass-through certificates. United has received and recorded all of

the proceeds from the November 2015 and August 2014 pass-through trusts as debt as of December 31, 2015. Certain details of the pass-through trusts with

proceeds received from issuance of debt in 2015 are as follows (in millions, except stated interest rate):

November 2015 AA $ 334 December 2027 3.45% $ 334 $ 334 $ —

November 2015 A 100 December 2022 3.70% 100 100 —

August 2014 A 823 September 2026 3.75% 823 711 —

August 2014 B 238 September 2022 4.625% 238 206 —

$ 1,495 $ 1,495 $ 1,351 $ —

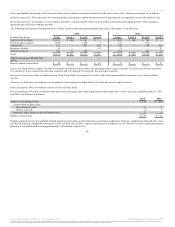

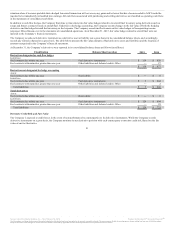

In 2015, United borrowed approximately $590 million aggregate principal amount from various financial institutions to finance the purchase of several

aircraft delivered in 2015. The notes evidencing these borrowings, which are secured by the related aircraft, have maturity dates ranging from 2025 to 2027

and interest rates comprised of the LIBOR plus a specified margin.

6% Notes due 2026. In 2015, UAL used cash to repurchase all $321 million par value 6% Notes due 2026 (the “2026 Notes”).

6% Notes due 2028. In 2015, UAL used cash to repurchase all $311 million par value 6% Notes due 2028 (the “2028 Notes”).

In 2015, the Company recorded a nonoperating special charge of $134 million for the extinguishment of the 2026 Notes and the 2028 Notes. The

nonoperating special charge is related to the write-off of unamortized debt discounts.

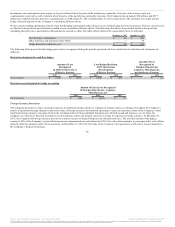

4.5% Convertible Notes due 2015. The 4.5% Convertible Notes were convertible by holders into shares of UAL common stock at a conversion price of

approximately $18.93 per share. During 2014, United used $62 million of cash to purchase and retire $28 million aggregate principal amount of its 4.5%

Convertible Notes in market transactions. UAL recorded $34 million of the repurchase cost as a reduction of additional paid-in capital. In January 2015, the

holders of substantially all of the remaining $202 million principal amount of the 4.5% Convertible Notes exercised their conversion option resulting in the

issuance of 11 million shares of UAL common stock.

4.5% Senior Limited-Subordination Convertible Notes due 2021. In January 2014, holders of substantially all of the remaining $156 million outstanding

principal amount of the 4.5% Senior Limited-Subordination Convertible Notes due 2021 exercised their right to convert such notes into approximately

5 million shares of UAL common stock.

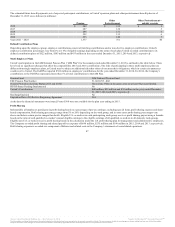

Convertible Debt Securities and Derivatives. UAL, United and the trustee for the 4.5% Convertible Notes were parties to a supplemental indenture that made

United’s convertible debt convertible into shares of UAL common stock. For purposes of United separate-entity reporting, as a result of the remaining

outstanding debt having been convertible into the stock of a non-consolidated entity, the embedded conversion options in United’s convertible debt were

required to be separated and accounted for as though they were free-standing derivatives.

95

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.