United Airlines 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

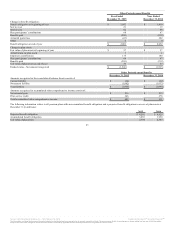

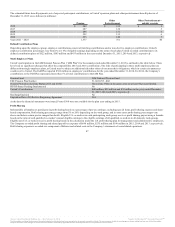

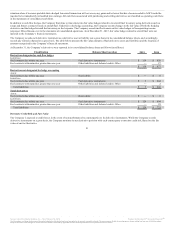

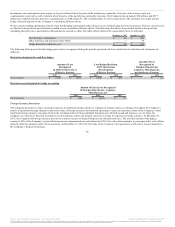

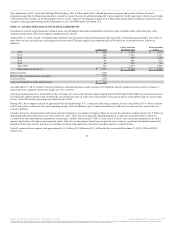

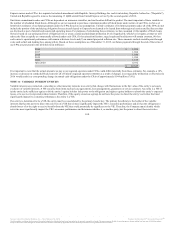

Secured

Notes payable, fixed interest rates of 1.42% to 12.00% (weighted average rate of 5.37% as of December 31, 2015), payable

through 2027 $ 7,971 $ 7,464

Notes payable, floating interest rates of the London Interbank Offered Rate (“LIBOR”) plus 0.20% to 2.85%, payable through

2027 1,302 1,151

Term loan, LIBOR subject to a 0.75% floor, plus 2.75%, or alternative rate based on certain market rates plus 1.75%, due 2019 875 884

Term loan, LIBOR subject to a 0.75% floor, plus 3.00%, or alternative rate based on certain market rates plus 2%, due 2021 194 499

Unsecured

6% Notes due 2026 to 2028 (a) — 632

6% Senior Notes due 2020 (a) 300 300

6.375% Senior Notes due 2018 (a) 300 300

4.5% Convertible Notes due 2015 — 202

Other 100 101

11,042 11,533

Less: unamortized debt discount, premiums and debt issuance costs (145) (267) (b)

Less: current portion of long-term debt (1,224) (1,313)

Long-term debt, net $ 9,673 $ 9,953

(a) UAL is the issuer of this debt. United is a guarantor.

(b) 2014 amount differs from the amount reported in the Company’s Form 10-K for the fiscal year ended December 31, 2014 due to the adoption of an

accounting standard update in 2015. See Note 1(t) Recently Issued Accounting Standards of this report for additional information.

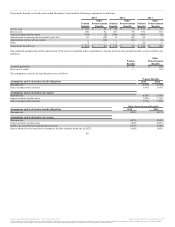

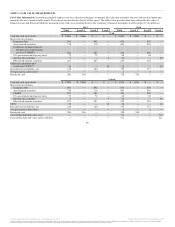

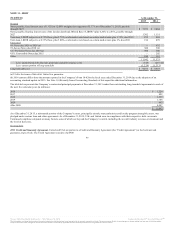

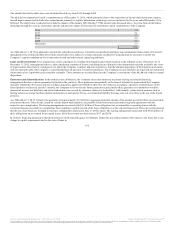

The table below presents the Company’s contractual principal payments at December 31, 2015 under then-outstanding long-term debt agreements in each of

the next five calendar years (in millions):

2016 $ 1,224

2017 822

2018 1,359

2019 1,788

2020 942

After 2020 4,907

$ 11,042

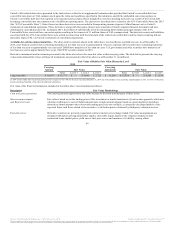

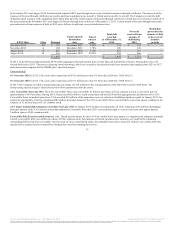

As of December 31, 2015, a substantial portion of the Company’s assets, principally aircraft, route authorities and loyalty program intangible assets, was

pledged under various loan and other agreements. As of December 31, 2015, UAL and United were in compliance with their respective debt covenants.

Continued compliance depends on many factors, some of which are beyond the Company’s control, including the overall industry revenue environment and

the level of fuel costs.

2013 Credit and Guaranty Agreement. United and UAL are parties to a Credit and Guaranty Agreement (the “Credit Agreement”) as the borrower and

guarantor, respectively. The Credit Agreement consists of a $900

93

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.