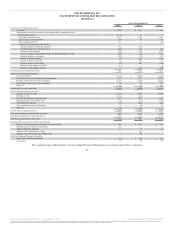

United Airlines 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

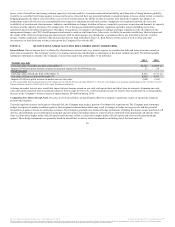

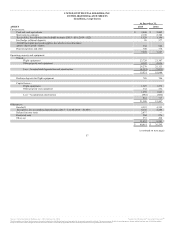

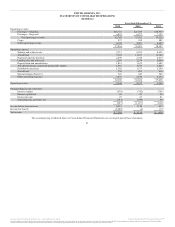

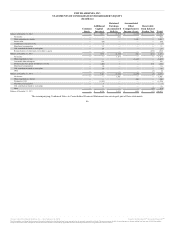

Cash Flows from Operating Activities:

Net income $ 7,340 $ 1,132 $ 571

Adjustments to reconcile net income to net cash provided by operating activities -

Deferred income taxes (3,177) 13 (14)

Depreciation and amortization 1,819 1,679 1,689

Special charges, non-cash portion 247 78 50

Other operating activities 115 (21) 18

Changes in operating assets and liabilities -

(Increase) decrease in fuel hedge collateral 551 (577) —

Unrealized (gain) loss on fuel derivatives (305) 436 (56)

Decrease in other liabilities (198) (238) (201)

Decrease in frequent flyer deferred revenue and advanced purchase of miles (200) (88) (415)

(Increase) decrease in other assets (160) (34) 164

Decrease in accounts payable (77) (251) (265)

Increase in advance ticket sales 52 296 45

(Increase) decrease in receivables (15) 209 (142)

Net cash provided by operating activities 5,992 2,634 1,444

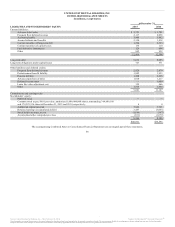

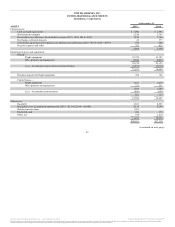

Cash Flows from Investing Activities:

Capital expenditures (2,747) (2,005) (2,164)

Proceeds from sale of short-term and other investments 2,707 3,112 2,827

Purchases of short-term and other investments (2,517) (3,569) (2,947)

Proceeds from sale of property and equipment 86 94 152

Other, net (22) 112 110

Net cash used in investing activities (2,493) (2,256) (2,022)

Cash Flows from Financing Activities:

Payments of long-term debt (2,178) (2,503) (2,185)

Repurchases of common stock (1,233) (312) —

Proceeds from issuance of long-term debt 1,073 1,432 1,423

Principal payments under capital leases (123) (127) (134)

Capitalized financing costs (37) (104) (103)

Proceeds from the exercise of stock options 16 60 29

Other (13) (42) (2)

Net cash used in financing activities (2,495) (1,596) (972)

Net increase (decrease) in cash and cash equivalents 1,004 (1,218) (1,550)

Cash and cash equivalents at beginning of year 2,002 3,220 4,770

Cash and cash equivalents at end of year $ 3,006 $ 2,002 $ 3,220

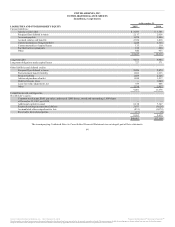

Investing and Financing Activities Not Affecting Cash:

Property and equipment acquired through the issuance of debt $ 866 $ 1,114 $ 229

Operating lease conversions to capital lease 285 — —

Exchange of convertible notes for common stock 202 260 240

Airport construction financing 17 14 40

Cash Paid (Refunded) During the Period for:

Interest (net of amounts capitalized) $ 660 $ 748 $ 752

Income taxes 15 (16) (20)

The accompanying Combined Notes to Consolidated Financial Statements are an integral part of these statements.

59

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.