United Airlines 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

prices, costs of aircraft fuel and energy refining capacity in relevant markets); economic and political instability and other risks of doing business globally;

its ability to cost-effectively hedge against increases in the price of aircraft fuel; any potential realized or unrealized gains or losses related to fuel or currency

hedging programs; the effects of any hostilities, act of war or terrorist attack; the ability of other air carriers with whom the Company has alliances or

partnerships to provide the services contemplated by the respective arrangements with such carriers; disruptions to its regional network; the costs and

availability of aviation and other insurance; industry consolidation or changes in airline alliances; competitive pressures on pricing and demand; its capacity

decisions and the capacity decisions of its competitors; U.S. or foreign governmental legislation, regulation and other actions (including open skies

agreements and environmental regulations); the impact of regulatory, investigative and legal proceedings and legal compliance risks; the impact of any

management changes; our CEO’s health prognosis and return to work on a full-time basis; labor costs; its ability to maintain satisfactory labor relations and

the results of the collective bargaining agreement process with its union groups; any disruptions to operations due to any potential actions by its labor

groups; weather conditions; and other risks and uncertainties set forth under Part I, Item 1A., Risk Factors, of this report, as well as other risks and

uncertainties set forth from time to time in the reports the Company files with the SEC.

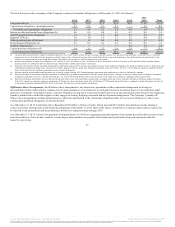

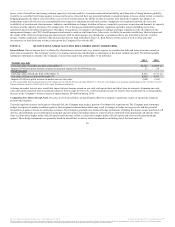

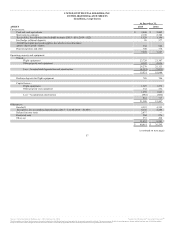

Our net income (loss) is affected by fluctuations in interest rates (e.g. interest expense on variable rate debt and interest income earned on

short-term investments). The Company’s policy is to manage interest rate risk through a combination of fixed and variable rate debt. The following table

summarizes information related to the Company’s interest rate market risk at December 31 (in millions):

Carrying value of variable rate debt at December 31 $2,345 $2,495 (a)

Impact of 100 basis point increase on projected interest expense for the following year 23 24

Carrying value of fixed rate debt at December 31 8,552 8,771 (a)

Fair value of fixed rate debt at December 31 9,022 9,971

Impact of 100 basis point increase in market rates on fair value (369) (385)

(a) 2014 amount differs from the amount reported in the Company’s Form 10-K for the fiscal year ended December 31, 2014 due to the adoption of an accounting standard update in 2015. See Note 1(t) to the

financial statements included in Part II, Item 8 of this report for additional information.

A change in market interest rates would also impact interest income earned on our cash, cash equivalents and short-term investments. Assuming our cash,

cash equivalents and short-term investments remain at their average 2015 levels, a 100 basis point increase in interest rates would result in a corresponding

increase in the Company’s interest income of approximately $54 million during 2016.

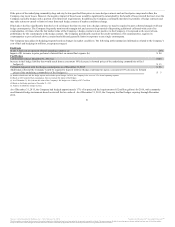

Commodity Price Risk (Aircraft Fuel). The price level of aircraft fuel can significantly affect the Company’s operations, results of operations, financial

position and liquidity.

To protect against increases in the prices of aircraft fuel, the Company may hedge a portion of its future fuel requirements. The Company may restructure

hedges in response to market conditions prior to their original settlement dates which may result in changes in hedge coverage levels and the potential

recognition of gains or losses on such hedge contracts. The Company generally uses financial hedge instruments including fixed-price swaps, purchased call

options, and commonly used combinations using put and call options including collars (a sold put option combined with a purchased call option), three-

ways (a collar with a higher strike sold call option) and four-way collars (a collar with a higher strike sold call option and a lower strike purchased put

option). These hedge instruments are generally based on aircraft fuel or closely related commodities including diesel fuel and crude oil.

50

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.