United Airlines 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

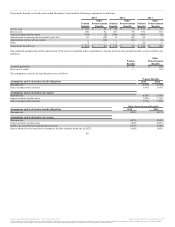

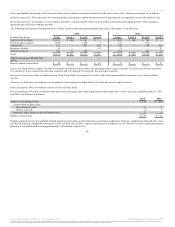

instruments, our counterparties may require us to post collateral when the price of the underlying commodity decreases, and we may require our

counterparties to provide us with collateral when the price of the underlying commodity increases. The Company had on deposit $26 million and $577

million of collateral with fuel derivative counterparties as of December 31, 2015 and December 31, 2014, respectively. The collateral is recorded as Fuel

hedge collateral deposits on the Company’s consolidated balance sheets.

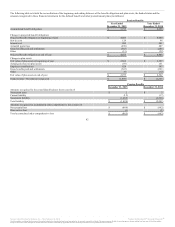

We have master trading agreements with all of our fuel hedging counterparties that allow us to net our fuel hedge derivative positions. We have elected not to

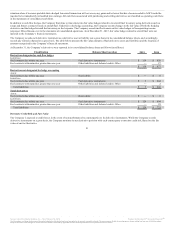

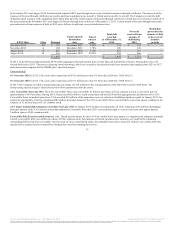

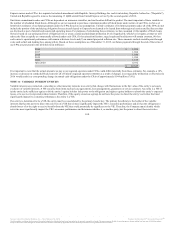

net the fair value positions and collateral recorded on our consolidated balance sheets. The following table shows the potential net fair value positions

(including fuel derivatives and related collateral) had we elected to offset. The table reflects offset at the counterparty level (in millions):

Fuel derivative instruments $ 98 $ 209

Other liabilities and deferred credits: Other — 30

Hedge derivatives liabilities, net $ 98 $ 239

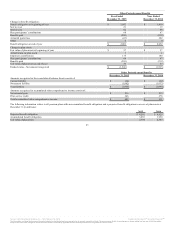

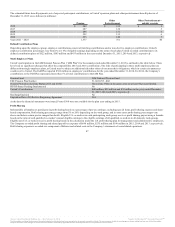

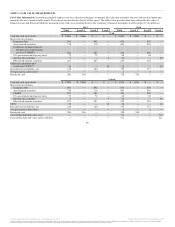

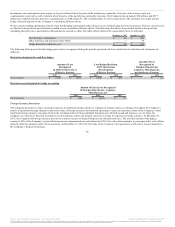

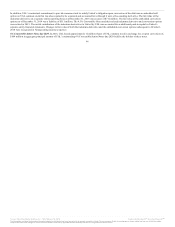

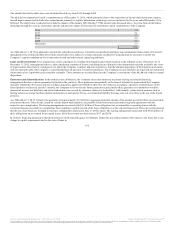

The following tables present the fuel hedge gains (losses) recognized during the periods presented and their classification in the financial statements (in

millions):

Fuel contracts $ (320) $ (599) $ (604) $ (89) $ — $ (3)

Fuel contracts $ (80) $ (462) $ 79

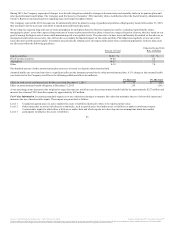

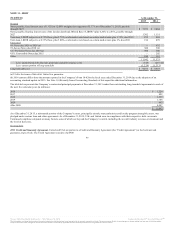

Foreign Currency Derivatives

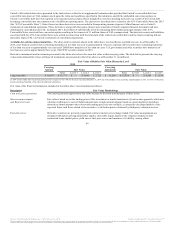

The Company generates revenues and incurs expenses in numerous foreign currencies. Changes in foreign currency exchange rates impact the Company’s

results of operations through changes in the dollar value of foreign currency-denominated operating revenues and expenses. Some of the Company’s more

significant foreign currency exposures include the Canadian dollar, Chinese renminbi, European euro, British pound and Japanese yen. At times, the

Company uses derivative financial instruments, such as options, collars and forward contracts, to hedge its exposure to foreign currency. At December 31,

2015, the Company had foreign currency derivative contracts in place to hedge European euro denominated sales. The notional amount of the hedges

equates to 18% of the Company’s projected European euro denominated net cash inflows for 2016. Net cash relates primarily to passenger ticket sales inflows

partially offset by expenses paid in local currencies. At December 31, 2015, the fair value of the Company’s foreign currency derivatives was not material to

the Company’s financial statements.

92

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.