United Airlines 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

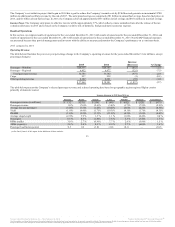

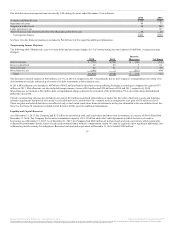

wages, decreased $0.2 billion, which included $0.5 billion in pension contributions offset by $0.2 billion in profit sharing accruals. In 2014, cash flow

decreased by $0.1 billion from the posting of fuel hedge collateral, net of changes in fuel derivative positions. Accounts payable decreased by $0.3 billion

primarily due to the timing of settlements with airline partners for interline billing along with changes in various accruals.

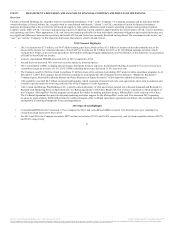

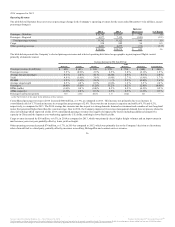

Cash Flows from Investing Activities

The Company’s capital expenditures were $2.7 billion and $2.0 billion in 2015 and 2014, respectively. The Company’s capital expenditures for both years

were primarily attributable to the purchase of aircraft, facility and fleet-related costs. In 2015, the Company announced a strategic partnership with Azul

Linhas Aereas Brasileiras S.A. (“Azul”). Through a wholly-owned subsidiary, the Company invested $100 million for an economic stake of approximately

five percent in Azul, Brazil’s largest carrier by cities served, which provides a range of customer benefits including codesharing of flights, joint loyalty

program participation and expanded connection opportunities on routes between the U.S. and Brazil, a key market for United, in addition to other points in

North and South America.

The Company’s capital expenditures were $2.0 billion and $2.2 billion in 2014 and 2013, respectively. The Company’s capital expenditures for both years

were primarily attributable to the purchase of aircraft, facility and fleet-related costs.

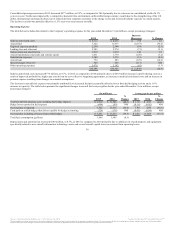

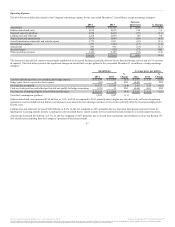

Cash Flows from Financing Activities

Significant financing events in 2015 were as follows:

Share Repurchases

The Company used $1.2 billion of cash to purchase 21 million shares of its common stock during 2015 under its share repurchase programs. As of

December 31, 2015, the Company has $2.4 billion remaining to spend under its share repurchase program. See Part II, Item 5, “Market for Registrant’s

Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” of this report for additional information.

Debt Issuances

During 2015, United issued $1.4 billion of debt related to enhanced equipment trust certificate (“EETC”) offerings to finance aircraft. United has received

and recorded all of the proceeds from its pass-through trusts as debt as of December 31, 2015.

In 2015, United borrowed approximately $590 million aggregate principal amount from various financial institutions to finance the purchase of several

aircraft delivered in 2015.

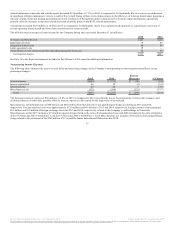

Debt and Capital Lease Principal Payments

During the year ended December 31, 2015, the Company made debt and capital lease principal payments of $2.3 billion, including the following

prepayments:

• UAL used cash to repurchase all $321 million par value 2026 Notes.

• UAL used cash to repurchase all $311 million par value 2028 Notes.

• UAL used cash to prepay, at par, $300 million principal amount of its $500 million term loan due September 2021 under the Credit Agreement.

40

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.