United Airlines 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• The Company took delivery of 11 new Boeing 787-9 Dreamliners in 2015, bringing its total Dreamliner fleet to 25 aircraft. The Company also

took delivery of 23 new Boeing 737-900ERs, 11 new Embraer E175s and four used Boeing 737-700 aircraft in 2015. United exited from

scheduled service 13 Boeing 757-200s, 46 Embraer ERJ 145s and one Boeing 747-400. The Company also exited one Boeing 747-400 operating

exclusively in charter service.

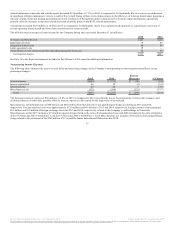

• Effective March 1, 2015, the Company modified its MileagePlus program for most tickets from the prior model in which members earn redeemable

miles based on distance traveled to the current model, which is based on ticket price (including base fare and carrier imposed surcharges). Members

are now able to earn between five and eleven miles per dollar spent based on their MileagePlus status. The modified program enhances the rewards

for customers who spend more with United and gives them improved mileage-earning opportunities.

Set forth below is a discussion of the principal matters that we believe could impact our financial and operating performance and cause our results of

operations in future periods to differ materially from our historical operating results and/or from our anticipated results of operations described in the forward-

looking statements in this report. See Item 1A., Risk Factors, of this report and the factors described under “Forward-Looking Information” below for

additional discussion of these and other factors that could affect us.

The Company is committed to improving the efficiency and quality of all aspects of its business in 2016. Key initiatives for the year include improving our

operational reliability and the handling of customers during irregular operations, such as adverse weather, refurbishing aircraft interiors, investing in our

airports and taking delivery of more than 30 new, highly-efficient and customer-pleasing aircraft.

Economic Conditions. The economic outlook for the aviation industry in 2016 is characterized by expected slow or modest U.S. and global economic

growth. In such conditions, we expect a modest increase in the demand for air travel. Continuing economic uncertainty, along with the strengthening U.S.

dollar, is providing uncertainty in key Asian and European markets, and along with continued political and socioeconomic tensions in regions such as the

Middle East, may result in diminished demand for air travel. The global economy is also being impacted by declining oil prices, putting pressure on certain

geographic markets.

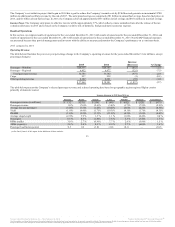

Capacity. Over the past three years, the Company leveraged the flexibility of its fleet to better match capacity with market demand. In 2016, the Company

expects consolidated ASMs to grow between 1.5% and 2.5% year-over-year.

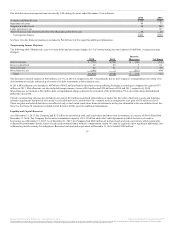

Fuel. The Company’s average aircraft fuel price per gallon including related taxes was $1.94 in 2015 as compared to $2.99 in 2014. Since 2014, the price of

jet fuel has declined and remains volatile. Based on projected fuel consumption in 2016, a one dollar change in the price of a barrel of crude oil would

change the Company’s annual fuel expense by approximately $94 million. To protect against increases in the prices of aircraft fuel, the Company may hedge

a portion of its future fuel requirements.

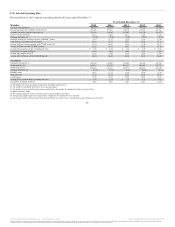

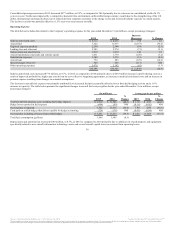

Labor. As of December 31, 2015, United had approximately 80% of employees represented by unions. We are in the process of negotiating joint collective

bargaining agreements with our technicians and flight attendants and negotiating extensions to the IAM represented employees’ agreements. The Company

cannot predict the outcome of negotiations with its unionized employee groups, although significant increases in the pay and benefits resulting from new

collective bargaining agreements would have a material financial impact on the Company. The cost associated with the ratification of the pilots’ agreement

will add an additional approximate 1.5 points of non-fuel unit cost in both the first-quarter and full-year 2016 versus 2015.

CASM. In 2016, the Company expects CASM, excluding fuel, third-party business expense, profit sharing, special charges and the impact of the recently

ratified pilot agreement to be up between 0.5% and 1.5% year-over-year. We are unable to project CASM on a GAAP basis as the nature and amount of

special charges are not determinable at this time.

32

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.