United Airlines 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

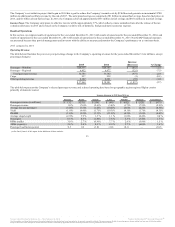

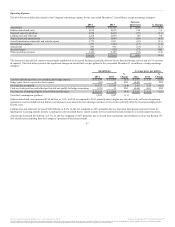

Aircraft maintenance materials and outside repairs decreased $128 million, or 7.2%, in 2015 as compared to 2014 primarily due to a year-over-year decrease

in significant airframe maintenance visits as a result of the cyclical timing of these visits, improvements in the efficiency of in-house maintenance programs, a

reduced volume of seat and landing gear maintenance and a reduction of flying hours under certain power-by-the-hour engine maintenance agreements,

partially offset by increases in expenses related to aircraft reliability projects and Wi-Fi systems maintenance.

Aircraft rent decreased $129 million or 14.6% in 2015 as compared to 2014 primarily due to lease expirations, the purchase or capital lease conversion of

several operating leased aircraft and lower lease renewal rates for certain aircraft.

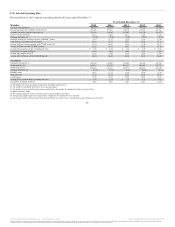

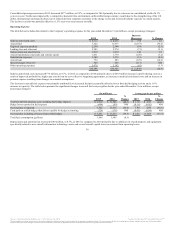

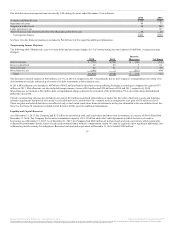

The table below presents special items incurred by the Company during the years ended December 31 (in millions):

Severance and benefit costs $107 $199

Impairment of assets 79 49

Integration-related costs 60 96

Labor agreement costs 18 —

(Gains) losses on sale of assets and other miscellaneous (gains) losses, net 62 99

Total special charges $326 $443

See Note 16 to the financial statements included in Part II, Item 8 of this report for additional information.

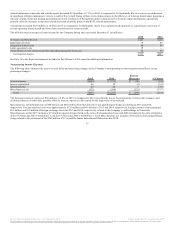

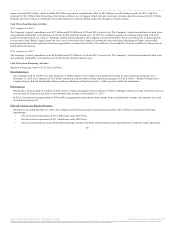

Nonoperating Income (Expense)

The following table illustrates the year-over-year dollar and percentage changes in the Company’s nonoperating income (expense) (in millions, except

percentage changes):

Interest expense $(669) $ (735) $ (66) (9.0)

Interest capitalized 49 52 (3) (5.8)

Interest income 25 22 3 13.6

Miscellaneous, net (352) (584) (232) (39.7)

Total $(947) $(1,245) $ (298) (23.9)

The decrease in interest expense of $66 million, or 9.0%, in 2015 as compared to 2014 was primarily due to the prepayment of certain debt issuances and

declining balances of other debt, partially offset by interest expense on debt issued for the acquisition of new aircraft.

Miscellaneous, net included losses of $80 million and $462 million from fuel derivatives not qualifying for hedge accounting in 2015 and 2014,

respectively. Foreign currency losses were approximately $129 million and $41 million in 2015 and 2014, respectively. Foreign currency results included

$61 million and $10 million of foreign exchange losses for 2015 and 2014, respectively, related to the Company’s cash holdings in Venezuela.

Miscellaneous, net for 2015 includes a $134 million special charge related to the write-off of unamortized non-cash debt discounts for the early redemption

of the 6% Notes due 2026 (“2026 Notes”) and the 6% Notes due 2028 (“2028 Notes”). 2014 Miscellaneous, net includes a $64 million debt extinguishment

charge related to the retirement of the $248 million 6% Convertible Junior Subordinated Debentures due 2030.

35

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.