United Airlines 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

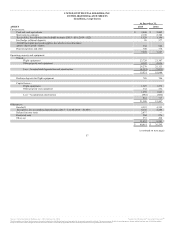

earnings, the Company evaluated the NOLs expiration periods and change in ownership limitations under Section 382 of the Internal Revenue Code of 1986,

as amended, and determined the NOLs would be realized before expiring beginning in 2025. Therefore, the Company released almost all of its valuation

allowance in 2015, resulting in a $3.1 billion benefit in its provision for income taxes. The valuation allowance recorded in accumulated other

comprehensive income (loss) (“AOCI”) in prior years was released through the income statement and resulted in remaining debits within AOCI of $285

million and $180 million related to pension and derivatives, respectively, which will not be recognized into income tax expense until either the plans are

exited or the Company no longer has any outstanding derivatives.

The Company has retained a valuation allowance of $48 million against certain state and local NOLs and credit carryforwards at the end of 2015. The

Company expects these NOLs and credits will expire unused due to limited carryforward periods. The ability to utilize these state NOLs and credits will be

evaluated on a quarterly basis to determine if there are any significant events or any prudent and feasible tax planning strategies that would affect the

Company’s ability to realize these deferred tax assets.

The Company has a net deferred tax asset totaling $2.0 billion as of December 31, 2015 that relates primarily to its federal and state NOL carryforwards. The

federal and state NOL carryforwards relate to prior years’ NOLs, which may be used to reduce tax liabilities in future years. These tax benefits are mostly

attributable to federal pre-tax NOL carryforwards of $8.0 billion for UAL. If not utilized, these federal pre-tax NOLs will expire as follows (in billions): $2.1 in

2025, $2.0 in 2026, $1.4 in 2027 and $2.5 after 2028. In addition, the majority of tax benefits of the state net operating losses of $103 million for UAL will

expire over a five to 20-year period. Additionally, the Company has $232 million of alternative minimum tax credit carryforwards which do not expire.

Certain statements throughout Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and elsewhere in this

report are forward-looking and thus reflect the Company’s current expectations and beliefs with respect to certain current and future events and financial

performance. Such forward-looking statements are and will be subject to many risks and uncertainties relating to the Company’s operations and business

environment that may cause actual results to differ materially from any future results expressed or implied in such forward-looking statements. Words such as

“expects,” “will,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “goals” and similar expressions are intended to identify

forward-looking statements.

Additionally, forward-looking statements include statements which do not relate solely to historical facts, such as statements which identify uncertainties or

trends, discuss the possible future effects of current known trends or uncertainties or which indicate that the future effects of known trends or uncertainties

cannot be predicted, guaranteed or assured. All forward-looking statements in this report are based upon information available to the Company on the date of

this report. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future

events, changed circumstances or otherwise, except as required by applicable law.

The Company’s actual results could differ materially from these forward-looking statements due to numerous factors including, without limitation, the

following: its ability to comply with the terms of its various financing arrangements; the costs and availability of financing; its ability to maintain adequate

liquidity; its ability to execute its operational plans and revenue-generating initiatives, including optimizing its revenue; its ability to control its costs,

including realizing benefits from its resource optimization efforts, cost reduction initiatives and fleet replacement programs; its ability to utilize its net

operating losses; its ability to attract and retain customers; demand for transportation in the markets in which it operates; an outbreak of a disease that affects

travel demand or travel behavior; demand for travel and the impact that global economic conditions have on customer travel patterns; excessive taxation and

the inability to offset future taxable income; general economic conditions (including interest rates, foreign currency exchange rates, investment or credit

market conditions, crude oil

49

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.