United Airlines 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

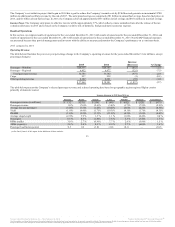

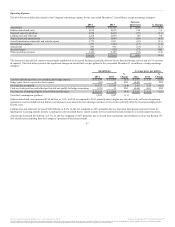

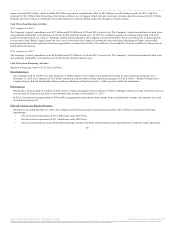

As is the case with many of our principal competitors, we have a high proportion of debt compared to capital. We have a significant amount of fixed

obligations, including debt, aircraft leases and financings, leases of airport property and other facilities and pension funding obligations. At December 31,

2015, the Company had approximately $11.8 billion of debt and capital lease obligations, including $1.4 billion that are due within the next 12 months. In

addition, we have substantial noncancelable commitments for capital expenditures, including the acquisition of new aircraft and related spare engines. As of

December 31, 2015, our current liabilities exceeded our current assets by approximately $4.6 billion. However, approximately $5.9 billion of our current

liabilities are related to our Advance ticket sales and Frequent flyer deferred revenue, both of which largely represent revenue to be recognized for travel in

the near future and not actual cash outlays. The deficit in working capital does not have an adverse impact to our cash flows, liquidity or operations. The

Company made principal payments of debt and capital lease obligations totaling $2.3 billion in 2015.

The Company will continue to evaluate opportunities to prepay its debt, including open market repurchases, to reduce its indebtedness and related interest.

For 2016, the Company expects between $2.7 billion and $2.9 billion of gross capital expenditures. See Notes 11 and 15 to the financial statements included

in Part II, Item 8 of this report for additional information on commitments.

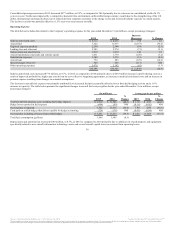

As of December 31, 2015, a substantial portion of the Company’s assets, principally aircraft, route authorities and loyalty program intangible assets, was

pledged under various loan and other agreements. See Note 11 to the financial statements included in Part II, Item 8 of this report for additional information

on assets provided as collateral by the Company.

Although access to the capital markets improved in recent years as evidenced by our financing transactions, we cannot give any assurances that we will be

able to obtain additional financing or otherwise access the capital markets in the future on acceptable terms, or at all. We must sustain our profitability and/or

access the capital markets to meet our significant long-term debt and capital lease obligations and future commitments for capital expenditures, including the

acquisition of aircraft and related spare engines.

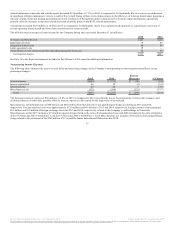

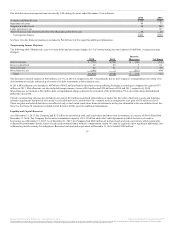

The following is a discussion of the Company’s sources and uses of cash from 2013 through 2015.

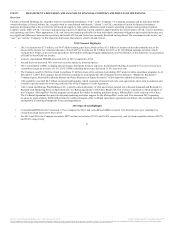

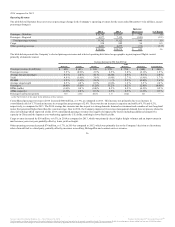

Cash Flows from Operating Activities

Cash flow provided by operations for the year ended December 31, 2015 was $6.0 billion compared to $2.6 billion in the same period in 2014. The $3.4

billion increase is primarily attributable to an increase of $3.1 billion in income before income taxes and a $0.4 billion increase in non-cash items for the year

ended December 31, 2015 as compared to the same period in 2014. Working capital changes reduced cash flow from operations by $0.1 billion year-over-

year in 2015 as compared to 2014. The following were significant working capital items in 2015: Cash flow increased by $0.2 billion from the return of

hedge collateral net of the impact of changes in fuel derivative positions. Cash flow from other liabilities, including accrued wages, decreased $0.2 billion,

which included $0.8 billion in pension contributions offset by $0.7 billion in profit sharing accruals to be paid in 2016. Frequent flyer deferred revenue and

advanced purchase of miles decreased $0.2 billion.

Cash flow provided by operations for the year ended December 31, 2014 was $2.6 billion compared to $1.4 billion in the same period in 2013. The $1.2

billion increase was primarily attributable to an increase of $0.6 billion in income before income taxes and $0.6 billion of changes in working capital items

year-over-year in 2014 as compared to 2013. The following were significant working capital items in 2014: Cash flow from advance ticket sales increased by

$0.3 billion. Accounts receivable decreased by $0.2 billion mainly due to the timing of settlements with airline partners for interline billing. Cash flow from

other liabilities, including accrued

39

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.