United Airlines 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

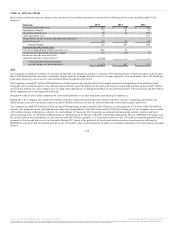

Express carriers under CPAs. In a separate but related amendment with Republic Airways Holdings Inc. and its subsidiary, Republic Airline Inc. (“Republic”),

United and Republic agreed to remove the remaining 13 Q400 aircraft from United Express service by the second quarter of 2016.

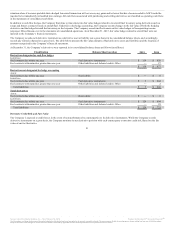

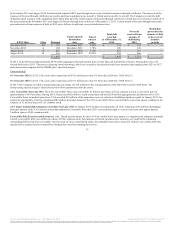

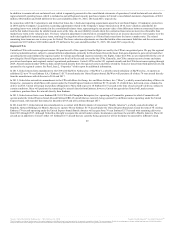

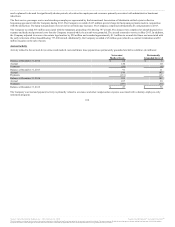

Our future commitments under our CPAs are dependent on numerous variables, and are therefore difficult to predict. The most important of these variables is

the number of scheduled block hours. Although we are not required to purchase a minimum number of block hours under certain of our CPAs, we have set

forth below estimates of our future payments under the CPAs based on our assumptions. United’s estimates of its future payments under all of the CPAs do not

include the portion of the underlying obligation for any aircraft leased to ExpressJet or deemed to be leased from other regional carriers and facility rent that

are disclosed as part of aircraft and nonaircraft operating leases. For purposes of calculating these estimates, we have assumed (1) the number of block hours

flown is based on our anticipated level of flight activity or at any contractual minimum utilization levels if applicable, whichever is higher, (2) that we will

reduce the fleet as rapidly as contractually allowed under each CPA, (3) that aircraft utilization, stage length and load factors will remain constant, (4) that

each carrier’s operational performance will remain at historic levels and (5) an annual projected inflation rate. These amounts exclude variable pass-through

costs such as fuel and landing fees, among others. Based on these assumptions as of December 31, 2015, our future payments through the end of the terms of

our CPAs are presented in the table below (in millions):

2016 $ 1,834

2017 1,884

2018 1,550

2019 1,290

2020 1,155

After 2020 4,932

$ 12,645

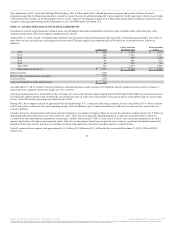

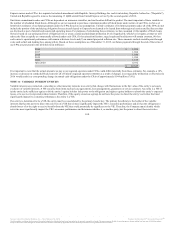

It is important to note that the actual amounts we pay to our regional operators under CPAs could differ materially from these estimates. For example, a 10%

increase or decrease in scheduled block hours for all of United’s regional operators (whether as a result of changes in average daily utilization or otherwise) in

2016 would result in a corresponding change in annual cash obligations under the CPAs of approximately $144 million (7.9%).

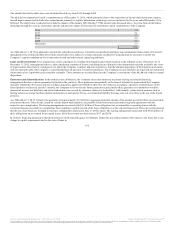

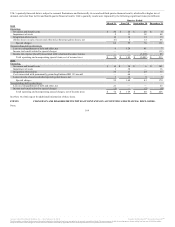

Variable interests are contractual, ownership or other monetary interests in an entity that change with fluctuations in the fair value of the entity’s net assets

exclusive of variable interests. A VIE can arise from items such as lease agreements, loan arrangements, guarantees or service contracts. An entity is a VIE if

(a) the entity lacks sufficient equity or (b) the entity’s equity holders lack power or the obligation and right as equity holders to absorb the entity’s expected

losses or to receive its expected residual returns. Therefore, if the equity owners as a group do not have the power to direct the entity’s activities that most

significantly impact its economic performance, the entity is a VIE.

If an entity is determined to be a VIE, the entity must be consolidated by the primary beneficiary. The primary beneficiary is the holder of the variable

interests that has the power to direct the activities of a VIE that (i) most significantly impact the VIE’s economic performance and (ii) has the obligation to

absorb losses of or the right to receive benefits from the VIE that could potentially be significant to the VIE. Therefore, the Company must identify which

activities most significantly impact the VIE’s economic performance and determine whether it, or another party, has the power to direct those activities.

100

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.