United Airlines 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

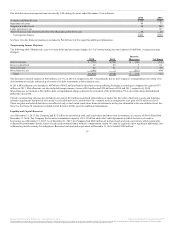

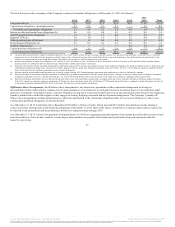

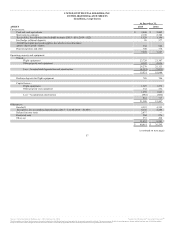

benefits to certain retirees reflected as “Other Benefits.” United also has retiree medical programs that permit retirees who meet certain age and service

requirements to continue medical coverage between retirement and Medicare eligibility. Eligible employees are required to pay a portion of the costs of their

retiree medical benefits, which in some cases may be offset by accumulated unused sick time at the time of their retirement. Plan benefits are subject to co-

payments, deductibles, and other limits as described in the plans.

The Company accounts for other postretirement benefits by recognizing the difference between plan assets and obligations, or the plan’s funded status, in its

financial statements. Other postretirement benefit expense is recognized on an accrual basis over employees’ approximate service periods and is generally

calculated independently of funding decisions or requirements. United has not been required to pre-fund its plan obligations, which has resulted in a

significant net obligation, as discussed below. The Company’s benefit obligation was $2.0 billion and $2.1 billion for the other postretirement benefit plans

at December 31, 2015 and 2014, respectively.

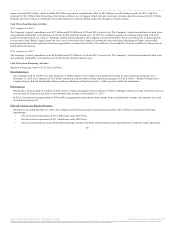

The calculation of other postretirement benefit expense and obligations requires the use of a number of assumptions, including the assumed discount rate for

measuring future payment obligations and the health care cost trend rate. The Company determines the appropriate discount rate for each of the plans based

on current rates on high quality corporate bonds that would generate the cash flow necessary to pay plan benefits when due. The Company’s weighted

average discount rate to determine its benefit obligations as of December 31, 2015 was 4.49%, as compared to 4.07% for December 31, 2014. The health care

cost trend rate assumed for 2015 was 7.00%, declining to 5.0% in 2023, as compared to assumed trend rate for 2016 of 6.75%, declining to 5.0% in 2023. A

1% increase in assumed health care trend rates would increase the Company’s total service and interest cost for the year ended December 31, 2015 by $13

million; whereas, a 1% decrease in assumed health care trend rates would decrease the Company’s total service and interest cost for the year ended

December 31, 2015 by $11 million. A one percentage point decrease in the weighted average discount rate would increase the Company’s postretirement

benefit liability by approximately $227 million and increase the estimated 2015 benefits expense by approximately $12 million.

Actuarial gains or losses are triggered by changes in assumptions or experience that differ from the original assumptions and prior service credits result from a

retroactive reduction in benefits due under the plans. Under the applicable accounting standards for postretirement welfare benefit plans, actuarial gains and

losses and prior service credits are not required to be recognized currently, but instead may be deferred as part of accumulated other comprehensive income

and amortized into expense over the average remaining service life of the covered active employees or the average life expectancy of inactive participants. At

December 31, 2015 and 2014, the Company had unrecognized actuarial gains for postretirement welfare benefit plans of $236 million and $233 million,

respectively, recorded in accumulated other comprehensive income.

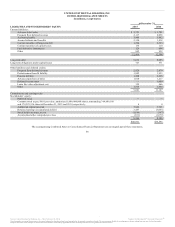

Income Taxes. The Company’s income tax benefit was $3.1 billion for the year ended December 31, 2015. A discrete tax benefit of $3.1 billion for the

reduction to the U.S. net federal and state deferred tax asset valuation allowance was included in the income tax benefit for the year ended December 31,

2015.

During 2015, after considering all positive and negative evidence and the four sources of taxable income, the Company concluded that its deferred income

tax assets are more likely than not to be realized. In evaluating the likelihood of utilizing the Company’s net federal and state deferred tax assets, the

significant relevant factors that the Company considered are: (1) its recent history and forecasted profitability; (2) growth in the U.S. and global economies;

and (3) future impact of taxable temporary differences. Although the Company was not in a three-year cumulative loss position at December 31, 2014,

management concluded that the low level of cumulative pre-tax income, coupled with the Company’s history of operating losses resulted in a determination

that a valuation allowance was still necessary. We considered past profitability and future expectations of profitability to determine whether it is more likely

than not that we will generate sufficient taxable income to realize our net deferred tax assets. Management placed significant weight on past performance (i.e.,

losses or near break-even results in 2009 to 2013) as it is more objectively verifiable than projections of future taxable income. However, during 2015, the

Company’s pre-tax profit of $4.2 billion benefited from lower oil prices and improved efficiency that resulted in significant taxable income. Additionally,

based upon current projection of future

48

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.