United Airlines 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

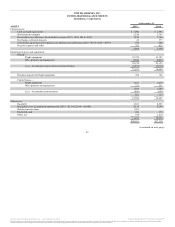

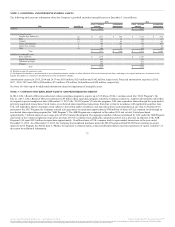

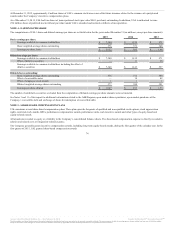

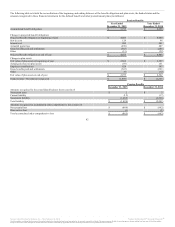

The following table presents information about the Company’s goodwill and other intangible assets at December 31 (in millions):

Goodwill $ 4,523 $ 4,523

Finite-lived intangible assets

Frequent flyer database (b) 22 $ 1,177 $ 702 $ 1,177 $ 624

Hubs 20 145 74 145 67

Contracts 12 135 86 155 86

Patents and tradenames 3 108 108 108 108

Airport slots and gates 8 97 97 97 97

Other 25 109 77 109 67

Total $ 1,771 $ 1,144 $ 1,791 $ 1,049

Indefinite-lived intangible assets

Route authorities $ 1,570 $ 1,589

Airport slots and gates 942 956

Tradenames and logos 593 593

Alliances 404 404

Total $ 3,509 $ 3,542

(a) Weighted average life expressed in years.

(b) The frequent flyer database is amortized based on an accelerated amortization schedule to reflect utilization of the assets. Estimated cash flows correlating to the expected attrition rate of customers in the

frequent flyer database is considered in the determination of the amortization schedules.

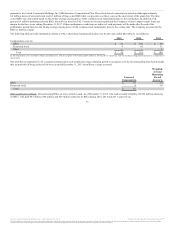

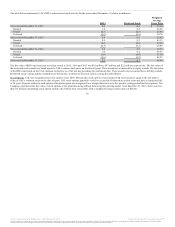

Amortization expense in 2015, 2014 and 2013 was $105 million, $128 million and $142 million, respectively. Projected amortization expense in 2016,

2017, 2018, 2019 and 2020 is $90 million, $79 million, $70 million, $64 million and $58 million, respectively.

See Note 16 of this report for additional information related to impairment of intangible assets.

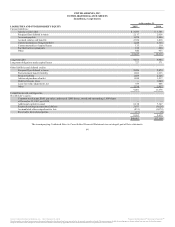

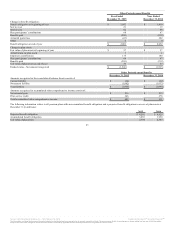

In 2014, UAL’s Board of Directors authorized a share repurchase program to acquire up to $1 billion of UAL’s common stock (the “2014 Program”). On

July 21, 2015, UAL’s Board of Directors authorized a $3 billion share repurchase program, which the Company expects to complete substantially earlier than

its original expected completion date of December 31, 2017 (the “2015 Program”). Under the programs, UAL may repurchase shares through the open market,

privately negotiated transactions, block trades, or accelerated share repurchase transactions from time to time in accordance with applicable securities laws.

UAL will repurchase shares of common stock subject to prevailing market conditions, and may discontinue such repurchases at any time. In October 2015,

pursuant to the 2015 Program, the Company entered into agreements to repurchase approximately $300 million of shares of UAL common stock through an

accelerated share repurchase program (the “ASR Program”). The ASR Program was completed in November 2015 and in total, United purchased

approximately 5 million shares at an average price of $58.14 under the program. The aggregate number of shares repurchased by UAL under the ASR Program

was based on the volume-weighted average price per share of UAL’s common stock during the calculation period, less a discount. In addition to the ASR

Program, UAL spent $932 million to repurchase approximately 16 million shares of UAL common stock in open market transactions in the year ended

December 31, 2015. As of December 31, 2015, the Company had completed purchases under the 2014 Program and had $2.4 billion remaining to spend

under the 2015 Program. See Part II, Item 5, “Market for registrant’s common equity, related stockholder matters and issuer purchases of equity securities” of

this report for additional information.

73

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.