United Airlines 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

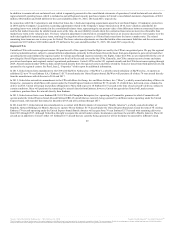

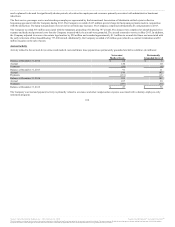

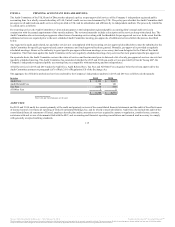

permitted the exchange and repatriations of local currency since mid-2014. As a result, the Company changed the exchange rate from historical SICAD rates

to a combination of SIMADI and SICAD rates based on projections of future cash payments. Including this adjustment, the Company’s resulting cash balance

held in Venezuelan bolivars at December 31, 2015 is approximately $13 million.

2014

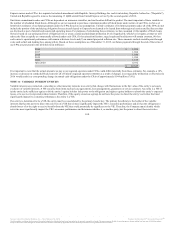

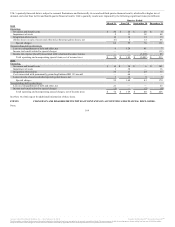

The Company recorded $141 million of severance and benefit costs related primarily to a voluntary early-out program for its flight attendants. More than

2,500 participants elected a one-time opportunity to voluntarily separate from the Company and will receive a severance payment, with a maximum value of

$100,000 per participant, based on years of service, with retirement dates through the end of 2016. In addition, the Company recorded $58 million of

severance and benefits primarily related to reductions of management and front-line employees, including from Hopkins International Airport (“Cleveland”),

as part of its cost savings initiatives. The Company is currently evaluating its options regarding its long-term contractual lease commitments at Cleveland.

The capacity reductions at Cleveland may result in further special charges, which could be significant, related to our contractual commitments.

The Company recorded a charge of $16 million ($10 million net of related income tax benefits) related to its annual assessment of impairment of its

indefinite-lived intangible assets (certain international Pacific routes). In addition, the Company also recorded $33 million for charges related primarily to

impairment of its flight equipment held for disposal associated with its Boeing 737-300 and 737-500 fleets.

Integration-related costs included compensation costs related to systems integration, training, severance and relocation for employees.

The Company recorded $66 million for the permanent grounding of 21 of the Company’s Embraer ERJ 135 regional aircraft under lease through 2018, which

included an accrual for remaining lease payments and an amount for maintenance return conditions. The Company decided to permanently ground these 21

Embraer ERJ 135 aircraft as a result of new Embraer E175 regional jet deliveries, the impact of pilot shortages at regional carriers and fuel prices. In addition,

the Company also recorded $33 million for losses on the sale of assets and other special charges.

United used cash to retire, at par, the entire $248 million principal balance of the 6% Convertible Debentures and the 6% Convertible Preferred Securities,

Term Income Deferrable Equity Securities (TIDES) and incurred $64 million of expense primarily associated with the write-off of the related non-cash debt

discounts. The Company also recorded $10 million of foreign exchange losses in Venezuela in 2014.

2013

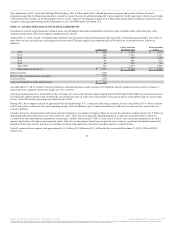

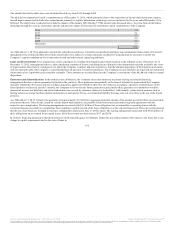

The Company offered a voluntary retirement program for its fleet service, passenger service, storekeeper and pilot work groups. Approximately 1,200

employees volunteered under the program during the fourth quarter of 2013 and United recorded approximately $64 million of severance and benefit costs

for the programs. The Company also offered voluntary leave of absence programs which allowed for continued medical coverage for flight attendants who

volunteered during the leave of absence period, resulting in a charge of approximately $26 million. The remaining $15 million of severance and benefit costs

was related to involuntary severance programs associated with flight attendants and other work groups.

The Company recorded $32 million of impairment charges of its flight equipment held for disposal associated with its Boeing 737-300 and 737-500 fleets

and $1 million on an intangible asset for a route to Manila in order to reflect the estimated fair value of this asset as part of the Company’s annual impairment

test of indefinite-lived intangible assets.

Integration-related costs included compensation costs related to systems integration and training, branding activities, new uniforms, write-off or acceleration

of depreciation on systems and facilities that were no longer

105

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.