United Airlines 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

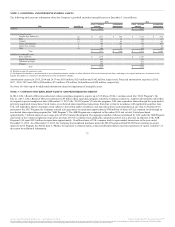

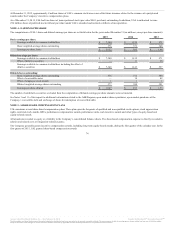

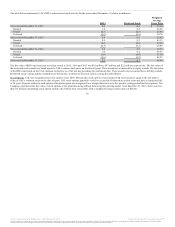

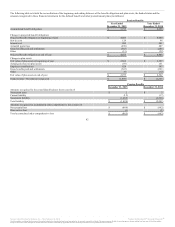

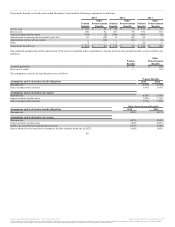

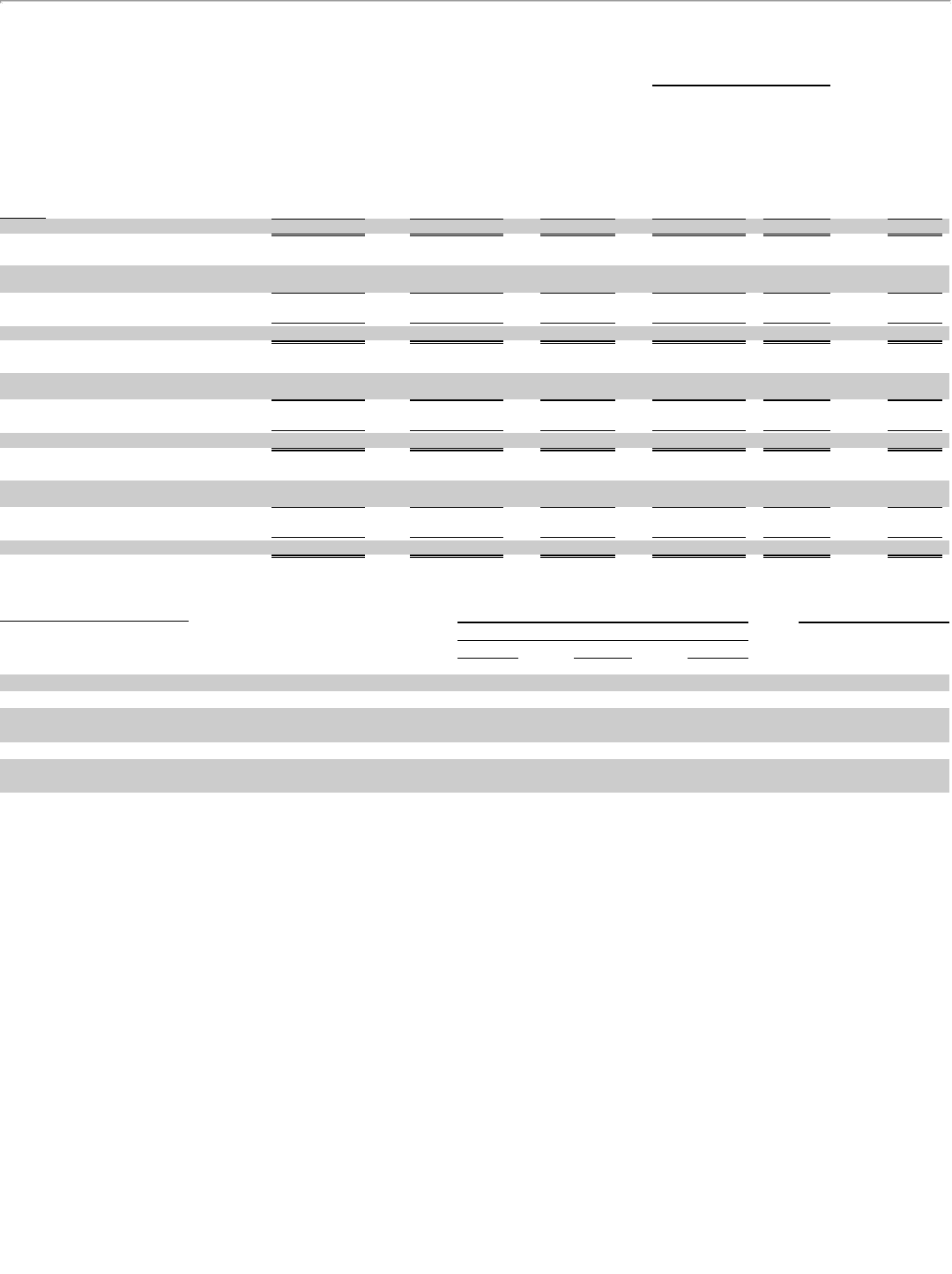

The tables below present the components of the Company’s accumulated other comprehensive income (loss) (“AOCI”), net of tax (in millions):

Balance at December 31, 2012 $ (927) $ (10) $ 6 $ (115) $ — (d) $ (1,046)

Other comprehensive income before

reclassifications (b) 1,584 (c) 39 7 — — 1,630

Amounts reclassified from accumulated other

comprehensive income (b) 42 (18) — — — 24

Net current-period other comprehensive income

(loss) 1,626 21 7 — — 1,654

Balance at December 31, 2013 $ 699 $ 11 $ 13 $ (115) $ — (d) $ 608

Other comprehensive loss before

reclassifications (b) (1,106)(c) (599) — — — (1,705)

Amounts reclassified from accumulated other

comprehensive income (b) (65) 89 (6) — — 18

Net current-period other comprehensive income

(loss) (1,171) (510) (6) — — (1,687)

Balance at December 31, 2014 $ (472) $ (499) $ 7 $ (115) $ — (d) $ (1,079)

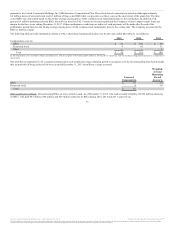

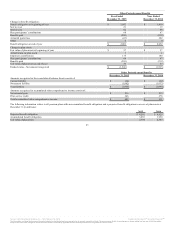

Other comprehensive income (loss) before

reclassifications 78 (c) (320) (4) (28) 115 (159)

Amounts reclassified from accumulated other

comprehensive income 31 604 — (11) (217) 407

Net current-period other comprehensive income

(loss) 109 284 (4) (39) (102) 248

Balance at December 31, 2015 $ (363) $ (215) $ 3 $ (154) $ (102) $ (831)

Derivatives designated as cash flow hedges

Fuel contracts-reclassifications of (gains) losses into earnings $ 604 $ 89 $ (18) Aircraft fuel

Amortization of pension and postretirement items

Amortization of unrecognized (gains) losses and prior

service cost and the effect of curtailments and settlements (e) 31 (65) 42 Salaries and related costs

Investments and other

Available-for-sale securities—reclassifications of gains into

earnings — (6) — Miscellaneous, net

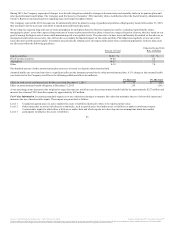

(a) UAL and United amounts are substantially the same except for an additional $1 million and $6 million of additional gains related to investments and other and an income tax benefit, respectively, at United

in 2013.

(b) Income tax expense for these items was offset by the Company’s valuation allowance.

(c) Prior service credits increased by $0 million, $3 million and $331 million and actuarial gains (losses) increased by approximately $78 million, $(1.1) billion and $1.3 billion for 2015, 2014 and 2013,

respectively.

(d) Deferred tax balance was offset by the Company’s valuation allowance.

(e) This accumulated other comprehensive income component is included in the computation of net periodic pension and other postretirement costs (see Note 8 of this report for additional information).

77

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.