United Airlines 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

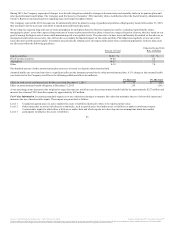

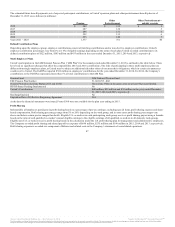

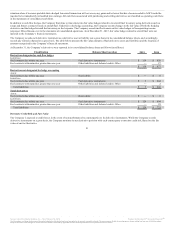

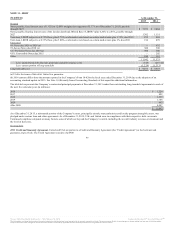

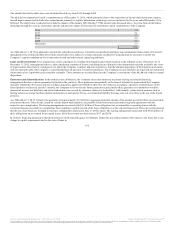

million term loan due April 2019 (of which $875 million was outstanding as of December 31, 2015) (the “Term Loan due 2019”), a $500 million term loan

due September 2021 (of which $194 million was outstanding as of December 31, 2015) (the “Term Loan due 2021”) and a $1.35 billion revolving credit

facility, with $1.35 billion being available for drawing until April 2018 and $1.315 billion being available for drawing until January 2019.

The term loans under the Credit Agreement bear interest at a variable rate equal to LIBOR plus a margin of, in the case of the Term Loan due 2019, 2.75% per

annum and, in the case of the Term Loan due 2021, 3.0% per annum, subject in each case to a 0.75% floor. Borrowings under the revolving credit facility of

the Credit Agreement bear interest at a variable rate equal to LIBOR plus a margin of 3.0% per annum, or another rate based on certain market interest rates,

plus a margin of 2.0% per annum. The principal amount of the term loans must be repaid in consecutive quarterly installments of 0.25% of the original

principal amount thereof, with any unpaid balance due, in the case of the Term Loan due 2019, on April 1, 2019 and, in the case of the Term Loan due 2021,

on September 15, 2021. United may prepay all or a portion of the term loans from time to time, at par plus accrued and unpaid interest. United pays a

commitment fee equal to 0.75% per-annum on the undrawn amount available under the revolving credit facility.

The Term Loan due 2021 ranks pari passu with the Term Loan due 2019 that United originally borrowed under the Credit Agreement. The Credit Agreement

requires United to repay the term loans and any other outstanding borrowings under the Credit Agreement at par plus accrued and unpaid interest if certain

changes of control of UAL occur.

As of December 31, 2015, United had its entire capacity of $1.35 billion available under the revolving credit facility of the Company’s Credit Agreement.

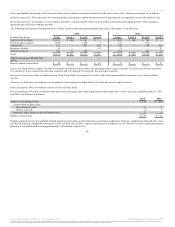

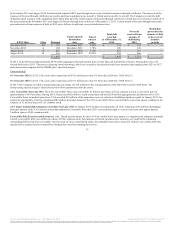

As of December 31, 2015, United had cash collateralized $70 million of letters of credit. United also had $437 million of performance bonds relating to

various real estate, customs and aircraft financing obligations at December 31, 2015. Most of the letters of credit have evergreen clauses and are expected to

be renewed on an annual basis and the performance bonds have expiration dates through 2019.

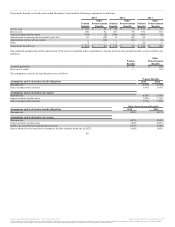

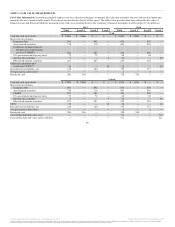

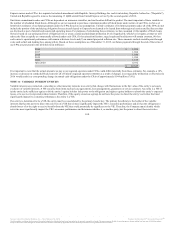

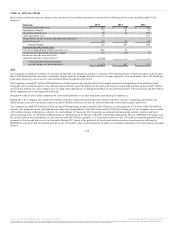

EETCs. United has $7.8 billion principal amount of equipment notes outstanding issued under EETC financings included in notes payable in the table of

outstanding debt above. Generally, the structure of these EETC financings consist of pass-through trusts created by United to issue pass-through certificates,

which represent fractional undivided interests in the respective pass-through trusts and are not obligations of United. The proceeds of the issuance of the

pass-through certificates are used to purchase equipment notes which are issued by United and secured by its aircraft. The payment obligations under the

equipment notes are those of United. Proceeds received from the sale of pass-through certificates are initially held by a depositary in escrow for the benefit of

the certificate holders until United issues equipment notes to the trust, which purchases such notes with a portion of the escrowed funds. These escrowed

funds are not guaranteed by United and are not reported as debt on United’s consolidated balance sheet because the proceeds held by the depositary are not

United’s assets.

94

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.