United Airlines 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

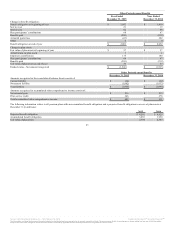

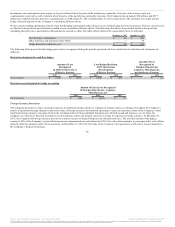

situation where it becomes probable that a hedged forecasted transaction will not occur, any gains and/or losses that have been recorded to AOCI would be

required to be immediately reclassified into earnings. All cash flows associated with purchasing and settling derivatives are classified as operating cash flows

in the statements of consolidated cash flows.

In addition to cash flow hedges, the Company from time to time enters into fair value hedges related to its aircraft fuel inventory using derivatives such as

swaps and futures contracts based on aircraft fuel. Under fair value hedge accounting, the Company records changes in the fair value of both the hedging

derivative and the hedged aircraft fuel inventory as fuel expense. The Company records ineffectiveness on fair value hedges as Nonoperating income

(expense): Miscellaneous, net in the statements of consolidated operations. As of December 31, 2015, fair value hedges related to aircraft fuel were not

material to the Company’s financial statements.

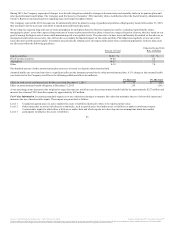

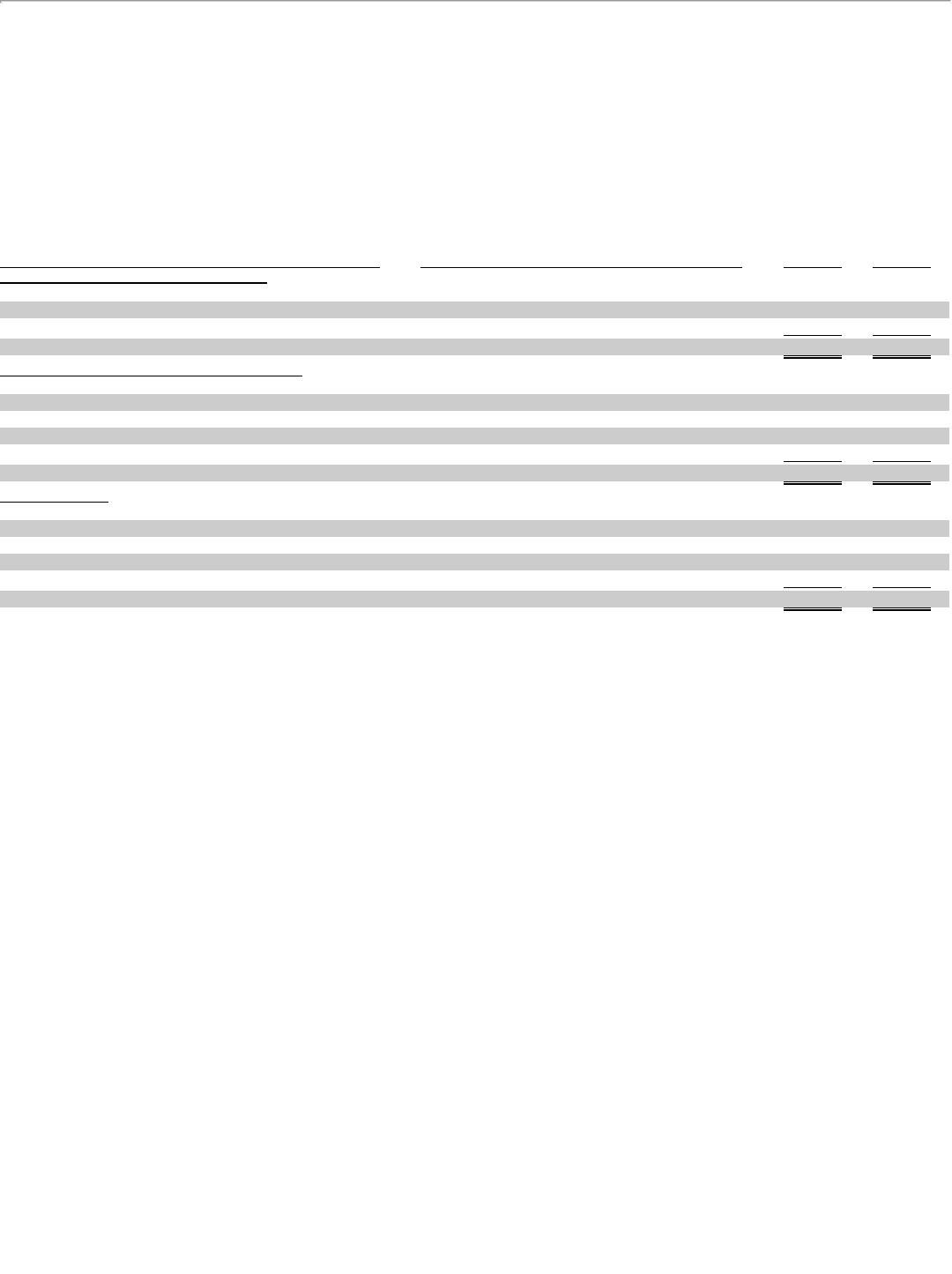

The Company records each derivative instrument as a derivative asset or liability (on a gross basis) in its consolidated balance sheets and, accordingly,

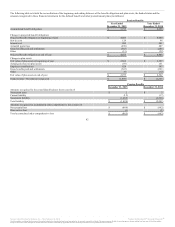

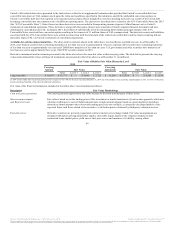

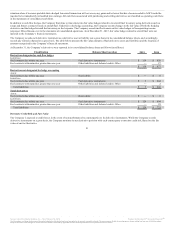

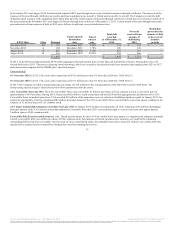

records any related collateral on a gross basis. The table below presents the fair value amounts of fuel derivative assets and liabilities and the location of

amounts recognized in the Company’s financial statements.

At December 31, the Company’s derivatives were reported in its consolidated balance sheets as follows (in millions):

Fuel contracts due within one year Fuel derivative instruments $ 119 $ 450

Fuel contracts with maturities greater than one year Other liabilities and deferred credits: Other — 27

$ 119 $ 477

Fuel contracts due within one year Receivables $ — $ 6

Fuel contracts due within one year Fuel derivative instruments $ 5 $ 244

Fuel contracts with maturities greater than one year Other liabilities and deferred credits: Other — 2

Total liabilities $ 5 $ 246

Fuel contracts due within one year Receivables $ — $ 6

Fuel contracts due within one year Fuel derivative instruments $ 124 $ 694

Fuel contracts with maturities greater than one year Other liabilities and deferred credits: Other — 29

Total liabilities $ 124 $ 723

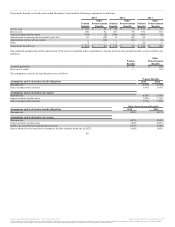

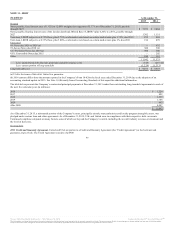

Derivative Credit Risk and Fair Value

The Company is exposed to credit losses in the event of non-performance by counterparties to its derivative instruments. While the Company records

derivative instruments on a gross basis, the Company monitors its net derivative position with each counterparty to monitor credit risk. Based on the fair

value of our fuel derivative

91

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.