United Airlines 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

℠

FORM 10-K

United Continental Holdings, Inc. - UAL

Filed: February 18, 2016 (period: December 31, 2015)

Annual report with a comprehensive overview of the company

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user

assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be

limited or excluded by applicable law. Past financial performance is no guarantee of future results.

Table of contents

-

Page 1

... FORM 10-K United Continental Holdings, Inc. - UAL Filed: February 18, 2016 (period: December 31, 2015) Annual report with a comprehensive overview of the company The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The... -

Page 2

... stock held by non-affiliates of United Continental Holdings, Inc. was $20,035,996,479 as of June 30, 2015, based on the closing price of $53.01 on the New York Stock Exchange reported for that date. There is no market for United Airlines, Inc. common stock. Indicate the number of shares outstanding... -

Page 3

... Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PTRT III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management... -

Page 4

... Francisco International Airport ("SFO") and Washington Dulles International Airport ("Washington Dulles"). 3 BUSINESS. Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or... -

Page 5

... us to add service to a new destination from a large number of cities using only one or a limited number of aircraft. As discussed under Alliances below, United is a member of Star Alliance, the world's largest alliance network. Financial information on the Company's operating revenues by geographic... -

Page 6

...by purchasing the goods and services of our network of non-airline partners, such as credit card issuers, retail merchants, hotels and car rental companies. Members can redeem mileage credits for free (other than taxes and government imposed fees), discounted or upgraded travel and non-travel awards... -

Page 7

Distribution Channels. The Company's airline seat inventory and fares are distributed through the Company's direct channels, traditional travel agencies and on-line travel agencies. The use of the Company's direct sales website, united.com, the Company's mobile applications and alternative ... -

Page 8

... changes to the Company's security processes, increasing the cost of its security procedures, and affecting its operations. International Regulation International air transportation is subject to extensive government regulation. In connection with the Company's international services, the Company... -

Page 9

... aviation policies may lead to the alteration or termination of air service agreements. Depending on the nature of any such change, the value of the Company's international route authorities and slot rights may be materially enhanced or diminished. Environmental Regulation The airline industry is... -

Page 10

... The Company can provide no assurance that a successful or timely resolution of these labor negotiations will be achieved. 9 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted... -

Page 11

... agreements would have an adverse financial impact on the Company. See Notes 15 and 16 to the financial statements included in Part II, Item 8 of this report for additional information on labor negotiations and costs. 10 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered... -

Page 12

... fuel prices and stagnant global economic growth. This increased competition in both domestic and international markets may have a material adverse effect on the Company's results of operations, financial condition or liquidity. 11 Source: United Continental Holdings, Inc., 10-K, February 18, 2016... -

Page 13

... its flights, result in the unauthorized release of confidential or otherwise protected information, result in increased costs, lost revenue and the loss or compromise of important data, and may adversely affect the Company's business, results of operations and financial condition. Current or future... -

Page 14

...position and results of operations. The Company has engaged an increasing number of third-party service providers to perform a large number of functions that are integral to its business, including regional operations, operation of customer service call centers, distribution and sale of airline seat... -

Page 15

...predict nor guarantee the continued timely availability of aircraft fuel throughout the Company's system. Market prices for aircraft fuel depend on a multitude of unpredictable factors beyond the Company's control. These factors include changes in global crude oil prices, aircraft fuel supply-demand... -

Page 16

... the general demand for air travel and may also eventually impact the Company's strategic growth and investment plans for the future. In addition, decreases in fuel prices for an extended period may result in increased industry capacity, increased competitive actions for market share and lower fares... -

Page 17

...the Company. Laws, regulations, taxes and airport rates and charges, both domestically and internationally, have been proposed from time to time that could significantly increase the cost of airline operations or reduce airline revenue. United provides air transportation under certificates of public... -

Page 18

... affect operations and increase operating costs in the airline industry. There are certain climate change laws and regulations that have already gone into effect 17 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information... -

Page 19

...for the acquisition of new aircraft and related spare engines. Although the Company's cash flows from operations and its available capital, including the proceeds from financing transactions, have been sufficient to meet these obligations and commitments to date, the Company's future liquidity could... -

Page 20

... competitive pressures and downturns in the travel business and the economy in general. The Company's substantial level of indebtedness and non-investment grade credit rating, as well as market conditions and the availability of assets as collateral for loans or other indebtedness, may make it... -

Page 21

... Company may be required to recognize impairments in the future due to, among other factors, extreme fuel price volatility, tight credit markets, a decline in the fair value of certain tangible or intangible assets, unfavorable trends in historical or forecasted results of operations and cash flows... -

Page 22

... section of the Company's website at http://ir.united.com. ITEM 1B. None. 21 UNRESOLVED STTFF COMMENTS. Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and... -

Page 23

...70 50 50 50 37 37 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any... -

Page 24

... headquarters and operations center in downtown Chicago, and certain administrative offices in downtown Houston. 23 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or... -

Page 25

...Company's financial condition and results of operations could be adversely affected in any particular period by the unfavorable resolution of one or more of these matters. ITEM 4. Not applicable. 24 MINE STFETY DISCLOSURES. Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered... -

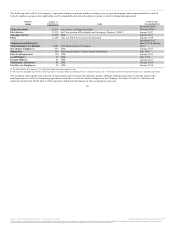

Page 26

... stock is listed on the New York Stock Exchange ("NYSE") under the symbol "UAL." The following table sets forth the ranges of high and low sales prices per share of UAL common stock during the last two fiscal years, as reported by the NYSE: UTL 2015 1st quarter 2nd quarter 3rd quarter 4th quarter... -

Page 27

... any filings by the Company under the Securities Act or the Exchange Act. The following table presents repurchases of UAL common stock made in the fourth quarter of 2015: Total number of shares purchased as part of publicly announced plans or programs (a)(b) Tpproximate dollar value of shares that... -

Page 28

... of an accounting standard update in 2015. See Note 1(t) Recently Issued Accounting Standards to the financial statements included in Part II, Item 8 of this report for additional information. 27 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document... -

Page 29

... number of hours per day that an aircraft flown in revenue service is operated (from gate departure to gate arrival). 28 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted... -

Page 30

..., see Note 16 to the financial statements included in Part II, Item 8 of this report. 29 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted... -

Page 31

...-party business expenses and fuel charges, third-party business expenses, fuel and profit sharing (a)See Note 16 to the financial statements included in Part II, Item 8 of this report for additional information. 30 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 32

...cash equivalents, short-term investments and available capacity under the revolving credit facility of the Company's Credit Agreement. UAL, United and Mileage Plus Holdings, LLC, a wholly-owned subsidiary of UAL and United, entered into a Second Amended and Restated CoBranded Card Marketing Services... -

Page 33

... of aircraft fuel, the Company may hedge a portion of its future fuel requirements. Labor. As of December 31, 2015, United had approximately 80% of employees represented by unions. We are in the process of negotiating joint collective bargaining agreements with our technicians and flight attendants... -

Page 34

... flights consist primarily of domestic routes): Increase (decrease) in 2015 from 2014 (a): Total Ttlantic Latin Mainline Domestic Pacific Regional Consolidated Passenger revenue (in millions) Passenger revenue Average fare per passenger Yield PRASM Average stage length Passengers RPMs (traffic... -

Page 35

... million increase in profit sharing costs as a result of improved profitability, higher pay rates driven by new collective bargaining agreements, an increase in medical and dental costs and an increase in pension expense resulting from changes in actuarial assumptions. The decrease in aircraft fuel... -

Page 36

... operating leased aircraft and lower lease renewal rates for certain aircraft. The table below presents special items incurred by the Company during the years ended December 31 (in millions): Severance and benefit costs Impairment of assets Integration-related costs Labor agreement costs (Gains... -

Page 37

...a strong domestic demand environment and a number of new long-haul routes that generated higher fares than the system average. Also in 2014, the Company improved its revenue management demand forecast process related to close-in bookings which improved yields. 2013 consolidated passenger revenue was... -

Page 38

... the Company's purchase of the leased aircraft. 37 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely... -

Page 39

... to provide security for obligations. Restricted cash and cash equivalents at December 31, 2014 totaled $320 million. 38 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or... -

Page 40

... long-term debt and capital lease obligations and future commitments for capital expenditures, including the acquisition of aircraft and related spare engines. The following is a discussion of the Company's sources and uses of cash from 2013 through 2015. Cash Flows from Operating Activities 2015... -

Page 41

.... • UAL used cash to repurchase all $311 million par value 2028 Notes. • UAL used cash to prepay, at par, $300 million principal amount of its $500 million term loan due September 2021 under the Credit Agreement. 40 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 42

... EETC offering in 2013, United recorded $1.8 billion of proceeds as debt during 2014. United borrowed a $500 million term loan under the Credit Agreement. Debt and Capital Lease Principal Payments During the year ended December 31, 2014, the Company made debt and capital lease principal payments of... -

Page 43

... 8 of this report. For information regarding non-cash investing and financing activities, see the Company's statements of consolidated cash flows. Credit Ratings. As of the filing date of this report, UAL and United had the following corporate credit ratings: UAL United *The credit agency does not... -

Page 44

... current year assumptions regarding United's pension plans. Represents contractual commitments for firm order aircraft and spare engines only and noncancelable commitments to purchase goods and services, primarily information technology support. In January 2016, UAL entered into a purchase agreement... -

Page 45

... for the Company's additional service to modify a previous sale. Therefore, the pricing of the change fee and the initial customer order are separately determined and represent distinct earnings processes. 44 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar... -

Page 46

... sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies and our participating airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or upgraded air travel and nontravel awards. The Company... -

Page 47

... weighted average ticket value on deferred revenue (in millions) $4,943 16% $ 60 Effective March 1, 2015, the Company modified its MileagePlus program for most tickets from a model in which members earned redeemable miles based on distance traveled to one based on ticket price (including base fare... -

Page 48

... expected long-term rate of return on plan assets by 50 basis points (from 7.0% to 6.5%) would increase estimated 2016 pension expense by approximately $15 million. Future pension obligations for United's plans were discounted using a weighted average rate of 4.58% at December 31, 2015. The Company... -

Page 49

...on current rates on high quality corporate bonds that would generate the cash flow necessary to pay plan benefits when due. The Company's weighted average discount rate to determine its benefit obligations as of December 31, 2015 was 4.49%, as compared to 4.07% for December 31, 2014. The health care... -

Page 50

... future taxable income; general economic conditions (including interest rates, foreign currency exchange rates, investment or credit market conditions, crude oil 49 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information... -

Page 51

... on short-term investments). The Company's policy is to manage interest rate risk through a combination of fixed and variable rate debt. The following table summarizes information related to the Company's interest rate market risk at December 31 (in millions): 2015 Variable rate debt Carrying value... -

Page 52

... in market conditions. The following table summarizes information related to the Company's cost of fuel and hedging (in millions, except percentages): Fuel Costs In 2015, fuel cost as a percent of total operating expenses (a) Impact of $1 increase in price per barrel of aircraft fuel on annual fuel... -

Page 53

...various points in time, resulting in a wide range of strike prices with several hedge counterparties. The table below provides a view of the economic impact of the hedge portfolio on the Company's 2016 fuel costs given significant moves (up to +/-30%) in market fuel prices from December 31, 2015 (in... -

Page 54

..., in all material respects, the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of December 31, 2015, based on criteria established in... -

Page 55

REPORT OF INDEPENDENT REGISTERED PUBLIC TCCOUNTING FIRM The Board of Directors and Stockholder of United Airlines, Inc. We have audited the accompanying consolidated balance sheets of United Airlines, Inc. (the "Company") as of December 31, 2015 and 2014, and the related statements of consolidated ... -

Page 56

...per share amounts) 2015 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Other operating revenue Operating expense: Salaries and related costs Aircraft fuel Regional capacity purchase Landing fees and other rent Depreciation and amortization Aircraft maintenance... -

Page 57

... Combined Notes to Consolidated Financial Statements are an integral part of these statements. 56 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is... -

Page 58

UNITED CONTINENTTL HOLDINGS, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares) TSSETS Current assets: Cash and cash equivalents Short-term investments Receivables, less allowance for doubtful accounts (2015-$18; 2014-$22) Fuel hedge collateral deposits Aircraft fuel, spare parts and ... -

Page 59

... shares) Tt December 31, LITBILITIES TND STOCKHOLDERS' EQUITY Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt Current maturities of capital leases Fuel derivative instruments Other 2015... -

Page 60

... charges, non-cash portion Other operating activities Changes in operating assets and liabilities (Increase) decrease in fuel hedge collateral Unrealized (gain) loss on fuel derivatives Decrease in other liabilities Decrease in frequent flyer deferred revenue and advanced purchase of miles (Increase... -

Page 61

... Combined Notes to Consolidated Financial Statements are an integral part of these statements. 60 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is... -

Page 62

...) 2015 Operating revenue: Passenger-Mainline Passenger-Regional Total passenger revenue Cargo Other operating revenue Operating expense: Salaries and related costs Aircraft fuel Regional capacity purchase Landing fees and other rent Depreciation and amortization Aircraft maintenance materials... -

Page 63

... change related to: Employee benefit plans Fuel derivative financial instruments Investments and other Other Total comprehensive income (loss), net The accompanying Combined Notes to Consolidated Financial Statements are an integral part of these statements. 62 Source: United Continental Holdings... -

Page 64

UNITED TIRLINES, INC. CONSOLIDTTED BTLTNCE SHEETS (In millions, except shares) Tt December 31, TSSETS Current assets: Cash and cash equivalents Short-term investments Receivables, less allowance for doubtful accounts (2015-$18; 2014-$22) Fuel hedge collateral deposits Aircraft fuel, spare parts and ... -

Page 65

... shares) Tt December 31, LITBILITIES TND STOCKHOLDER'S EQUITY Current liabilities: Advance ticket sales Frequent flyer deferred revenue Accounts payable Accrued salaries and benefits Current maturities of long-term debt Current maturities of capital leases Fuel derivative instruments Other 2015... -

Page 66

... charges, non-cash portion Other operating activities Changes in operating assets and liabilities (Increase) decrease in fuel hedge collateral Unrealized (gain) loss on fuel derivatives Decrease in other liabilities Decrease in frequent flyer deferred revenue and advanced purchase of miles (Increase... -

Page 67

... Combined Notes to Consolidated Financial Statements are an integral part of these statements. 66 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is... -

Page 68

... management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying notes. Actual results could differ from those estimates. Revenue Recognition-The Company records passenger ticket sales and tickets sold by other airlines for use on United... -

Page 69

... sell miles to these partners, which include credit card issuers, retail merchants, hotels, car rental companies and our participating airline partners. Miles can be redeemed for free (other than taxes and government imposed fees), discounted or upgraded air travel and non-travel awards. The Company... -

Page 70

... that process credit card ticket sales and cash collateral received from fuel hedge counterparties. Restricted cash is classified as short-term or long-term in the consolidated balance sheets based on the expected timing of return of the assets to the Company. Airline industry practice includes... -

Page 71

...amount we pay per flight hour or per cycle to the service provider in exchange for maintenance and repairs under a predefined maintenance program. Under PBTH agreements, the Company recognizes expense at a level rate per engine hour, unless the level of service effort and the related payments during... -

Page 72

... to the appropriate government agency. These fees are recorded on a net basis (excluded from operating revenue). Retirement of Leased Tircraft-The Company accrues for estimated lease costs over the remaining term of the lease at the present value of future minimum lease payments, net of estimated... -

Page 73

(s) Third-Party Business-The Company has third-party business revenue that includes fuel sales, catering, ground handling, maintenance services and frequent flyer award non-air redemptions, and third-party business revenue is recorded in Other operating revenue. The Company also incurs third-party ... -

Page 74

...remaining to spend under the 2015 Program. See Part II, Item 5, "Market for registrant's common equity, related stockholder matters and issuer purchases of equity securities" of this report for additional information. 73 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 75

... Company generally grants incentive compensation awards, including long-term equity-based awards, during the first quarter of the calendar year. In the first quarter of 2015, UAL granted share-based compensation awards 74 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered... -

Page 76

...20-day average closing price of UAL common stock immediately prior to the vesting date. The Company accounts for the RSUs as liability awards. The following table provides information related to UAL's share-based compensation plan cost for the years ended December 31 (in millions): 2015 Compensation... -

Page 77

... value of stock options at the grant date using a Black Scholes option pricing model. As of December 31, 2015, there were less than 0.5 million outstanding stock option awards, all of which were exercisable, with a weighted-average exercise price of $26.80. 76 Source: United Continental Holdings... -

Page 78

... periodic pension and other postretirement costs (see Note 8 of this report for additional information). 77 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed... -

Page 79

...080) 2014 Current Deferred $ $ 2013 Current Deferred $ $ 78 (18) (14) (32) $ $ (18) 1 (17) (17) 13 (4) $ $ (17) 13 (4) Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or... -

Page 80

...48) $(4,805) $(1,000) Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for... -

Page 81

... at 2015, 2014 and 2013, respectively. Included in the ending balance at 2015 is $21 million that would affect the Company's effective tax rate if recognized. The changes in unrecognized tax benefits relating to 80 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 82

... participants and will impact 2015 and 2014 pension and retiree medical expense as described below. 81 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is... -

Page 83

... plans (in millions): Pension Benefits Year Ended December 31, 2015 $ 3,795 Year Ended December 31, 2014 $ 4,068 Accumulated benefit obligation: Change in projected benefit obligation: Projected benefit obligation at beginning of year Service cost Interest cost Actuarial (gain) loss Gross benefits... -

Page 84

... obligation Accumulated benefit obligation Fair value of plan assets 83 2015 $ 4,292 3,655 2,794 2014 $ 4,625 3,930 2,387 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted... -

Page 85

...increase Pension Benefits 2015 2014 4.58% 4.20% 3.66% 3.66% 4.20% 7.40% 3.51% 5.10% 7.36% 3.50% Tssumptions used to determine benefit obligations Discount rate Tssumptions used to determine net expense Discount rate Expected return on plan assets Health care cost trend rate assumed for next year... -

Page 86

...amounts reported for the other postretirement plans. A 1% change in the assumed health care trend rate for the Company would have the following additional effects (in millions): Effect on total service and interest cost for the year ended December 31, 2015 Effect on postretirement benefit obligation... -

Page 87

... current value based on market expectations (including present value techniques, option-pricing and excess earnings models). The following tables present information about United's pension and other postretirement plan assets at December 31 (in millions): 2015 Pension Plan Assets: Equity securities... -

Page 88

... 2014 and 2013, respectively. Profit sharing expense is recorded as a component of Salaries and related costs in the Company's statements of consolidated operations. 87 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information... -

Page 89

... Company's financial statements as of December 31 (in millions): Total Cash and cash equivalents Short-term investments: Corporate debt Asset-backed securities Certificates of deposit placed through an account registry service ("CDARS") U.S. government and agency notes Auction rate securities Other... -

Page 90

... option pricing models that employ observable inputs. Inputs to the valuation models include contractual terms, market prices, yield curves, fuel price curves and measures of volatility, among others. 89 Fuel derivatives Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered... -

Page 91

... terms, risk-free interest rates and forward exchange rates. Fair values were based on either market prices or the discounted amount of future cash flows using our current incremental rate of borrowing for similar liabilities. United used a binomial lattice model to value the conversion options... -

Page 92

... operating cash flows in the statements of consolidated cash flows. In addition to cash flow hedges, the Company from time to time enters into fair value hedges related to its aircraft fuel inventory using derivatives such as swaps and futures contracts based on aircraft fuel. Under fair value hedge... -

Page 93

...2016. Net cash relates primarily to passenger ticket sales inflows partially offset by expenses paid in local currencies. At December 31, 2015, the fair value of the Company's foreign currency derivatives was not material to the Company's financial statements. 92 Source: United Continental Holdings... -

Page 94

... 2015, UAL and United were in compliance with their respective debt covenants. Continued compliance depends on many factors, some of which are beyond the Company's control, including the overall industry revenue environment and the level of fuel costs. Secured debt 2013 Credit and Guaranty Agreement... -

Page 95

... the term loans and any other outstanding borrowings under the Credit Agreement at par plus accrued and unpaid interest if certain changes of control of UAL occur. As of December 31, 2015, United had its entire capacity of $1.35 billion available under the revolving credit facility of the Company... -

Page 96

...August 2014, United created separate EETC pass-through trusts, each of which issued pass-through certificates. The proceeds of the issuance of the pass-through certificates are used to purchase equipment notes issued by United and secured by its aircraft. The Company records the debt obligation upon... -

Page 97

... to satisfy United's obligation upon conversion of the debt was an embedded call option on UAL common stock that was also required to be separated and accounted for as though it were a free-standing derivative. The fair value of the indenture derivative on a separate-entity reporting basis as of... -

Page 98

...other related aircraft. Secured by certain of United's international route authorities, specified takeoff and landing slots at certain airports and certain other assets. The Credit Agreement requires the Company to maintain at least $3.0 billion of unrestricted liquidity at all times, which includes... -

Page 99

... in early 2016. In addition, up to 14 more aircraft may be delivered over the next five years subject to certain conditions. United is the lessee of real property under long-term operating leases at a number of airports where we are also the guarantor of approximately $1.5 billion of underlying debt... -

Page 100

... United Express brand. SkyWest will purchase all of these 76-seat aircraft directly from the manufacturer with deliveries in 2016 and 2017. In 2015, United also entered into amendments to the CPA with Mesa Air Group, Inc. and Mesa Airlines, Inc. ("Mesa"), a wholly-owned subsidiary of Mesa Air Group... -

Page 101

...'s operational performance will remain at historic levels and (5) an annual projected inflation rate. These amounts exclude variable pass-through costs such as fuel and landing fees, among others. Based on these assumptions as of December 31, 2015, our future payments through the end of the terms of... -

Page 102

... in increases in the value of the aircraft. This is the case for many of our operating leases; however, leases of approximately 47 mainline jet aircraft contain a fixed-price purchase option that allow United to purchase the aircraft at predetermined prices on specified dates during the lease term... -

Page 103

...31, 2015 (as adjusted to include the order discussed above), United has secured backstop financing commitments from certain of its aircraft manufacturers for a limited number of its future aircraft deliveries, subject to certain customary conditions. Financing may be necessary to satisfy the Company... -

Page 104

...call options was exercisable because none of the required conditions to make an option exercisable by United was met. Credit Card Processing Agreements. The Company has agreements with financial institutions that process customer credit card transactions for the sale of air travel and other services... -

Page 105

... early-out program for its flight attendants. In 2014, more than 2,500 flight attendants elected to voluntarily separate from the Company and will receive a severance payment, with a maximum value of $100,000 per participant, based on years of service, with retirement dates through the end of 2016... -

Page 106

... the related non-cash debt discounts. The Company also recorded $10 million of foreign exchange losses in Venezuela in 2014. 2013 The Company offered a voluntary retirement program for its fleet service, passenger service, storekeeper and pilot work groups. Approximately 1,200 employees volunteered... -

Page 107

... voluntary employee early retirement programs. 106 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely... -

Page 108

... the value of its route network. The Company's operating revenue by principal geographic region (as defined by the U.S. Department of Transportation) for the years ended December 31 is presented in the table below (in millions): Domestic (U.S. and Canada) Pacific Atlantic Latin America Total 2015... -

Page 109

...9,036 1,081 823 2.24 2.24 9,313 625 28 0.08 0.07 $ $ $ $ Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or... -

Page 110

... - 5 179 53 (6) 226 $ $ $ $ Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all... -

Page 111

... their internal control over financial reporting. 110 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely... -

Page 112

... REGISTERED PUBLIC TCCOUNTING FIRM To the Board of Directors and Stockholders of United Continental Holdings, Inc. We have audited United Continental Holdings, Inc.'s (the "Company") internal control over financial reporting as of December 31, 2015, based on criteria established in Internal Control... -

Page 113

... 18, 2016 To the Stockholders of United Continental Holdings, Inc. Chicago, Illinois The management of United Continental Holdings, Inc. ("UAL") is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15... -

Page 114

..., Mr. Kenny served as Vice President and Controller of Continental. Mr. Kenny joined Continental in 1997. 113 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed... -

Page 115

... Principles," for its directors, officers and employees. The code serves as a "Code of Ethics" as defined by SEC regulations, and as a "Code of Business Conduct and Ethics" under the listed Company Manual of the NYSE. The code is available on the Company's website at http://ir.united.com. Waivers... -

Page 116

... of the effectiveness of internal control over financial reporting of United Continental Holdings, Inc. and its wholly-owned subsidiaries. Audit fees also include the audit of the consolidated financial statements of United, employee benefit plan audits, attestation services required by statute or... -

Page 117

...The financial statement schedule required by this item is listed below and included in this report after the signature page hereto. Schedule II-Valuation and Qualifying Accounts for the years ended December 31, 2015, 2014 and 2013. All other schedules are omitted because they are not applicable, not... -

Page 118

..., thereunto duly authorized. UNITED CONTINENTAL HOLDINGS, INC. UNITED AIRLINES, INC. (Registrants) By: /s/ Gerald Laderman Gerald Laderman Senior Vice President Finance and acting Chief Financial Officer Date: February 18, 2016 Pursuant to the requirements of the Securities Exchange Act of 1934... -

Page 119

... and Director (Principal Financial Officer) Vice President and Controller (Principal Accounting Officer) Director Director Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted... -

Page 120

...was created. (b) See Note 7 to the financial statements included in Part II, Item 8 of this report for additional information related to other valuation allowance adjustments. 119 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The... -

Page 121

...(b)(2) of Regulation S-K) (filed as Exhibit 2.1 to UAL's Form 8-K filed May 4, 2010, Commission file number 1-6033, and incorporated herein by reference) Agreement and Plan of Merger, dated as of March 28, 2013, by and between Continental Airlines, Inc. and United Air Lines, Inc. (filed as Exhibit... -

Page 122

... The Bank of New York Mellon Trust Company, N.A., as trustee (filed as Exhibit 4.1 to UAL's Form 8-K filed on May 19, 2014, Commission file number 1-6033, and incorporated herein by reference) Indenture, dated as of May 7, 2013, among United Continental Holdings, Inc., United Airlines, Inc. and The... -

Page 123

... to United Continental Holdings, Inc. Profit Sharing Plan (effective January 1, 2015) Employment Agreement, dated December 31, 2015, among United Continental Holdings, Inc., United Airlines, Inc. and Oscar Munoz (filed as Exhibit 10.1 to UAL's Form 8-K filed January 7, 2016, Commission file number... -

Page 124

... Plan (changing the name to United Continental Holdings, Inc. 2008 Incentive Compensation Plan) (filed as Annex A to UAL's Definitive Proxy Statement filed on April 26, 2013, Commission file number 1-6033, and incorporated herein by reference) Form of Stock Option Award Notice pursuant to the United... -

Page 125

... to the United Continental Holdings, Inc. Incentive Plan 2010) (as amended and restated February 21, 2013) (filed as Exhibit 10.43 to UAL's Form 10-K for the year ended December 31, 2012, Commission file number 1-6033, and incorporated herein by reference) United Continental Holdings, Inc. Long-Term... -

Page 126

... and Benefits for United Continental Holdings, Inc. Non-Employee Directors (filed as Exhibit 10.30 to UAL's Form 10-K for the year ended December 31, 2014, Commission file number 1-6033, and incorporated herein by reference) United Continental Holdings, Inc. 2006 Director Equity Incentive Plan (as... -

Page 127

... Airlines, Inc. Incentive Plan 2010, as amended and restated through February 17, 2010 (filed as Exhibit 10.2(a) to Continental's Form 10-K for the year ended December 31, 2009, Commission file number 1-10323, and incorporated herein by reference) United Air Lines, Inc. Management Cash Direct & Cash... -

Page 128

...and among Airbus S.A.S and United Air Lines, Inc. (filed as Exhibit 10.6 to UAL's Form 10-Q for the quarter ended June 30, 2010, Commission file number 1-6033, and incorporated herein by reference) Amendment No. 2 to the Airbus A350-900XWB Purchase Agreement, dated June 19, 2013 (filed as Exhibit 10... -

Page 129

... United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Amended and Restated Letter Agreement No. 3 to the Airbus A350-900XWB Purchase Agreement, dated June 19, 2013 (filed as Exhibit 10.10 to UAL's Form 10-Q for the quarter ended June 30, 2013, Commission file number... -

Page 130

... United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 4, including exhibits and side letters, to Purchase Agreement No. 1951, dated October 10, 1997 (filed as Exhibit 10.14(d) to Continental's Form 10-K for the year ended December 31, 1997, Commission file number... -

Page 131

...UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 14 to Purchase Agreement No. 1951, dated December 13, 1999 (filed as Exhibit 10.25(o) to Continental's Form 10-K for the year ended December 31, 1999, Commission file number... -

Page 132

...-K for the year ended December 31, 2001, Commission file number 1-10323, and incorporated herein by reference) Supplemental Agreement No. 26, including side letters, to Purchase Agreement No. 1951, dated March 29, 2002 (filed as Exhibit 10.4 to Continental's Form 10-Q for the quarter ended March 31... -

Page 133

... the year ended December 31, 2008, Commission file number 1-10323, and incorporated herein by reference) Supplemental Agreement No. 48 to Purchase Agreement No. 1951, dated January 29, 2009 (filed as Exhibit 10.3 to Continental's Form 10-Q for the quarter ended June 30, 2009, Commission file number... -

Page 134

...UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United UAL United Supplemental Agreement No. 49 to Purchase Agreement No. 1951, dated May 1, 2009 (filed as Exhibit 10.4 to Continental's Form 10-Q for the quarter ended June 30, 2009, Commission file number... -

Page 135

... Agreement No. 64 to Purchase Agreement No. 1951, dated June 12, 2015 (filed as Exhibit 10.2 for the quarter ended June 30, 2015, Commission file number 1-10323, and incorporated herein by reference) Aircraft General Terms Agreement, dated October 10, 1997, by and among Continental and Boeing (filed... -

Page 136

... Security Administration (filed as Exhibit 10.1 to Continental's Form 10-Q for the quarter ended June 30, 2003, Commission file number 1-10323, and incorporated herein by reference) Purchase Agreement No. PA-03784, dated July 12, 2012, between The Boeing Company and United Air Lines, Inc. (filed... -

Page 137

... United Continental Holdings, Inc. and United Airlines, Inc. (filed as Exhibit 10.3 to UAL's Form 10-Q for the quarter ended September 30, 2013, Commission file number 1-6033, and incorporated herein by reference) Supplemental Agreement No. 02 to Purchase Agreement No. 03776, dated January 14, 2015... -

Page 138

... the quarter ended June 30, 2015, Commission file number 1-10323, and incorporated by reference) Supplemental Agreement No. 6 to Purchase Agreement No. 3860, dated as of December 31, 2015 Credit and Guaranty Agreement, dated as of March 27, 2013, among Continental Airlines, Inc. and United Air Lines... -

Page 139

... Act of 2002) Interactive Data File 101 UAL United The following materials from each of United Continental Holdings, Inc.'s and United Airlines, Inc.'s Annual Reports on Form 10-K for the year ended December 31, 2015, formatted in XBRL (Extensible Business Reporting Language): (i) the Statements of... -

Page 140

... Percentage B Non-Union Group Code cQM (clight Qualified Management) Chelsea cood Service Management & Administrative Test Pilots None None None None * * * * * cMT cS SAL, MGT, OcC,SIA, SLS TPT 5 5 5 5 10 10 10 10 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 141

...this 30th day of December, 2015. UNITED CONTINENTAL HOLDINGS, INC. /s/ Michael P. Bonds Michael P. Bonds Executive Vice President, Human Resources and Labor Relations 2 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information... -

Page 142

...(or two first class domestic tickets) each year. Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The... -

Page 143

...amounts for each calendar year within such Performance Period based on the long term average interest rate incurred by the Company on book debt), and (D) the aggregate consolidated interest expense for such Performance Period on pension and post-retirement obligations less the aggregate consolidated... -

Page 144

...amounts for each calendar year within such Performance Period based on the long-term average interest rate incurred by the Company on book debt), and (D) the aggregate consolidated interest expense for such Performance Period on pension and post-retirement obligations less the aggregate consolidated... -

Page 145

...ohis Awhrd will be hn hmouno equhl oo (i) ohe number of RSUs subjeco oo 1 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate... -

Page 146

... ohe Awhrd is grhnoed.] 2 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks... -

Page 147

... Continental Airlines, Inc. and successor by merger to United Air Lines, Inc.) (Customer); WHEREAS, the parties hereto entered into Purchase Agreement No. 3860 dated September 27, 2012, as amended and supplemented ( Purchase Agreement), relating to the purchase and sale of Boeing model 787 aircraft... -

Page 148

... / UNITED AIRLINES, INC. PROPRIETARY Page 2 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The... -

Page 149

... / UNITED AIRLINES, INC. PROPRIETARY Page 3 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The... -

Page 150

... Vice President - Finance and acting Chief Financial Officer Title SA-6 BOEING / UNITED AIRLINES, INC. PROPRIETARY Page 4 Attorney-in-Fact Title UAL-PA-3860 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained... -

Page 151

... and Optional Features BFE Variables Customer Support Document Engine Escalation/Engine Warranty *** Service Life Policy Components TABLE OF CONTENTS, Page 1 of 5 BOEING/UNITED AIRLINES, INC. PROPRIETARY SA-6 SA-1 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 152

... TRENT 1000-*** Engines Attachment C, 787-8 with General Electric GEnx-1B*** and Rolls Royce TRENT 1000-*** P.A. 3860 TABLE OF CONTENTS, Page 2 of 4 BOEING / UNITED AIRLINES, INC. PROPRIETARY SA-1 SA-1 SA-1 SA-1 SA-6 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 153

...UNITED AIRLINES, INC. PROPRIETARY SA NUMBER SA-1 SA-6 SA-1 SA-2 SA-1 SA-1 SA-1 SA-1 SA-1 SA-1 SA-4 SA-1 SA-4 SA-4 SA-6 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted... -

Page 154

... 4 BOEING / UNITED AIRLINES, INC. PROPRIETARY DATED AS OF June 17, 2013 December 16, 2013 July 22, 2014 January 14, 2015 May 12, 2015 December 31, 2015 SA-6 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained... -

Page 155

...Delivery Number of Factor Factor Date Aircraft (Airframe) (Engine) Serial Escalation Estimate Number (Subject to Adv Payment Base Price Per A/P Change) Boeing Proprietary 787-10 with GE Engines Table 1 (SA-6), Page 1 Source: United Continental Holdings... -

Page 156

... thrust rating at GEnx-1B*** price. *** Escalation Factors*** *** Escalation Factors*** Boeing Proprietary 787-10 with GE Engines Table 1 (SA-6), Page 2 * ** Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained... -

Page 157

...C Aircraft" as such term is defined in ***, as amended and supplemented ***. Boeing / United Airlines, Inc. Proprietary 787-9 Table 1, Page 1, SA-6 APR 71359 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained... -

Page 158

... (BFE) Estimate: In-Flight Entertainment (IFE) Estimate: Non-Refundable Deposit/Aircraft at Def Agreement Option Exercise Expiry Date 787-10 GENX-1B *** pounds *** pounds 1 Detail Specification: Airframe Price Base Year/Escalation Formula: Engine Price Base Year/Escalation Formula:2 Airframe... -

Page 159

...by plus or minus one month. Boeing will advise Customer of the scheduled delivery month at the time of Customer's exercise of its rights. Boeing Proprietary 787-10 with GE Engines Table 1 (SA-6), Page 2 APR 64695-1F.TXT Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 160

... the Purchase Agreement and thereby remain entitled to the corresponding 787-*** Aircraft credit memoranda. UAL-PA-03860-LA-1209413A1R2 Special Matters BOEING / UNITED AIRLINES, INC. PROPRIETARY Page 1 SA-6 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar... -

Page 161

... by applicable law or governmental regulations. UAL-PA-03860-LA-1209413A1R2 Special Matters BOEING / UNITED AIRLINES, INC. PROPRIETARY Page 2 SA-6 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein... -

Page 162

...2015 UNITED AIRLINES, INC. By: /s/ Gerald Laderman Senior Vice President - Finance and acting Chief Financial Officer Page 3 SA-6 BOEING / UNITED AIRLINES, INC. PROPRIETARY Its: UAL-PA-03860-LA-1209413A1R2 Special Matters Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered... -

Page 163

...949 1,068 $2,017 1.40 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for... -

Page 164

...937 1,068 $2,005 1.41 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for... -

Page 165

...• Continental Airlines Purchasing Services LLC** • Continental Express, Inc. • Covia LLC** • Mileage Plus Holdings, LLC • MPH I, Inc. • Mileage Plus Marketing, Inc. • Mileage Plus, Inc. • Presidents Club of Guam, Inc. • United Aviation Fuels Corporation • United Airlines Business... -

Page 166

... financial statements and schedule of United Continental Holdings, Inc. and the effectiveness of internal control over financial reporting of United Continental Holdings, Inc., included in this Annual Report (Form 10-K) of United Continental Holdings, Inc. for the year ended December 31, 2015... -

Page 167

...financial statements and schedule of United Airlines, Inc., included in this Annual Report (Form 10-K) of United Airlines, Inc. for the year ended December 31, 2015. /s/ Ernst & Young LLP Chicago, Illinois February 18, 2016 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered... -

Page 168

... that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Brett J. Hart Brett J. Hart Acting Chief Executive Officer Date: February 18, 2016 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 169

...internal control over financial reporting. /s/ Gerald Laderman Gerald Laderman Senior Vice President Finance and acting Chief Financial Officer Date: February 18, 2016 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information... -

Page 170

... that involves management or other employees who have a significant role in the Company's internal control over financial reporting. /s/ Brett J. Hart Brett J. Hart Acting Chief Executive Officer Date: February 18, 2016 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by... -

Page 171

...internal control over financial reporting. /s/ Gerald Laderman Gerald Laderman Senior Vice President Finance and acting Chief Financial Officer Date: February 18, 2016 Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information... -

Page 172

... President Finance and acting Chief Financial Officer Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely... -

Page 173

...the financial condition and results of operations of United Airlines, Inc. Date: February 18, 2016 /s/ Brett J. Hart Brett J. Hart Acting Chief Executive Officer /s/ Gerald Laderman Gerald Laderman Senior Vice President Finance and acting Chief Financial Officer Source: United Continental Holdings... -

Page 174

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses ...