Time Warner Cable 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

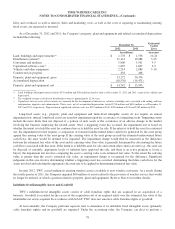

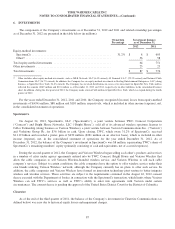

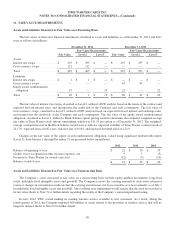

6. INVESTMENTS

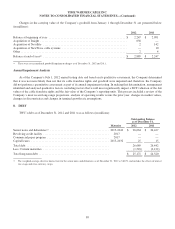

The components of the Company’s investments as of December 31, 2012 and 2011 and related ownership percentages

as of December 31, 2012 are presented in the table below (in millions):

Ownership

Percentage

Investment Balance

as of December 31,

2012 2011

Equity-method investments:

SpectrumCo ...................................................... 31.2% $ 8 $ 693

Other(a) .......................................................... 56 58

Total equity-method investments ....................................... 64 751

Other investments ................................................... 23 23

Total investments ................................................... $ 87 $ 774

(a) Other includes other equity-method investments, such as MLB Network, LLC (6.4% owned), iN Demand L.L.C. (29.3% owned) and National Cable

Communications LLC (16.7% owned). In addition, the Company has an equity-method investment in Sterling Entertainment Enterprises, LLC (doing

business as SportsNet New York, 26.8% owned). The Company has received distributions in excess of its investment in SportsNet New York and has

reflected this amount ($189 million and $101 million as of December 31, 2012 and 2011, respectively) in other liabilities in the consolidated balance

sheet. In addition, during the first quarter of 2012, the Company made a loan of $40 million to SportsNet New York, which was repaid during the fourth

quarter of 2012.

For the years ended December 31, 2012, 2011 and 2010, the Company recognized (income) losses from equity-method

investments of $(454) million, $88 million and $110 million, respectively, which is included in other income (expense), net,

in the consolidated statement of operations.

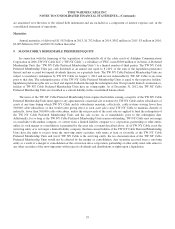

SpectrumCo

On August 24, 2012, SpectrumCo, LLC (“SpectrumCo”), a joint venture between TWC, Comcast Corporation

(“Comcast”) and Bright House Networks, LLC (“Bright House”), sold all of its advanced wireless spectrum licenses to

Cellco Partnership (doing business as Verizon Wireless), a joint venture between Verizon Communications Inc. (“Verizon”)

and Vodafone Group Plc, for $3.6 billion in cash. Upon closing, TWC, which owns 31.2% of SpectrumCo, received

$1.112 billion and recorded a pretax gain of $430 million ($261 million on an after-tax basis), which is included in other

income (expense), net, in the consolidated statement of operations for the year ended December 31, 2012. As of

December 31, 2012, the balance of the Company’s investment in SpectrumCo was $8 million, representing TWC’s share of

SpectrumCo’s remaining members’ equity (primarily consisting of cash and equivalents, net of accrued expenses).

During the second quarter of 2012, the Company and Verizon Wireless began selling each other’s products and services

in a number of cities under agency agreements entered into by TWC, Comcast, Bright House and Verizon Wireless that

allow the cable companies to sell Verizon Wireless-branded wireless service, and Verizon Wireless to sell each cable

company’s services. Subject to certain conditions, the cable companies have the option to offer wireless service under their

own brands utilizing Verizon Wireless’ network, although the Company currently has no plans to offer such service. In

addition, the cable companies and Verizon Wireless have formed an innovation technology joint venture to better integrate

wireless and wireline services. These activities are subject to the requirements contained in the August 16, 2012 consent

decree executed with the Department of Justice in connection with the SpectrumCo transaction, which limits where Verizon

Wireless can sell TWC’s services as well as TWC’s ability to enter into agreements with Verizon under certain

circumstances. The consent decree is pending the approval of the United States District Court for the District of Columbia.

Clearwire

As of the end of the third quarter of 2011, the balance of the Company’s investment in Clearwire Communications (as

defined below) was zero due to historical equity losses and impairment charges.

87