Time Warner Cable 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

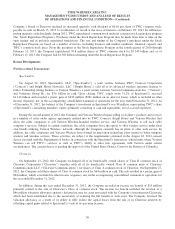

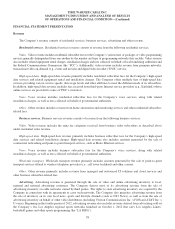

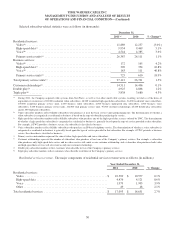

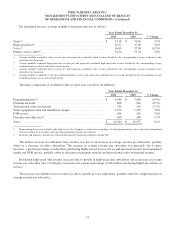

Selected subscriber-related statistics were as follows (in thousands):

December 31,

2012(a) 2011 % Change(a)

Residential services:

Customer relationships(b) ........................................ 14,674 14,025 4.6%

Video(c) ...................................................... 12,030 11,889 1.2%

High-speed data(d) ............................................. 10,935 9,954 9.9%

Voice(e) ...................................................... 5,024 4,544 10.6%

Primary service units(f) .......................................... 27,989 26,387 6.1%

Business services:

Customer relationships(b) ........................................ 563 486 15.8%

Video(c) ...................................................... 188 172 9.3%

High-speed data(d) ............................................. 460 390 17.9%

Voice(e) ...................................................... 224 163 37.4%

Primary service units(f) .......................................... 872 725 20.3%

Total:

Customer relationships(b) ........................................ 15,237 14,511 5.0%

Primary service units(f) .......................................... 28,861 27,112 6.5%

Double play(g) ................................................. 5,036 4,925 2.3%

Triple play(h) .................................................. 4,294 3,838 11.9%

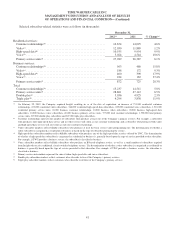

(a) On February 29, 2012, the Company acquired Insight, resulting in, as of the date of acquisition, an increase of 751,000 residential customer

relationships, 673,000 residential video subscribers, 548,000 residential high-speed data subscribers, 289,000 residential voice subscribers, 1,510,000

residential primary service units, 26,000 business customer relationships, 10,000 business video subscribers, 20,000 business high-speed data

subscribers, 10,000 business voice subscribers, 40,000 business primary service units, 777,000 total customer relationships, 1,550,000 total primary

service units, 319,000 double play subscribers and 227,000 triple play subscribers.

(b) Customer relationships represent the number of subscribers who purchase at least one of the Company’s primary services. For example, a subscriber

who purchases only high-speed data service and no video service will count as one customer relationship, and a subscriber who purchases both video

and high-speed data services will also count as only one customer relationship.

(c) Video subscriber numbers reflect billable subscribers who purchase at least the basic service video programming tier. The determination of whether a

video subscriber is categorized as residential or business is based on the type of subscriber purchasing the service.

(d) High-speed data subscriber numbers reflect billable subscribers who purchase any of the high-speed data services offered by TWC. The determination

of whether a high-speed data subscriber is categorized as residential or business is generally based upon the type of service provided to that subscriber.

For example, if TWC provides a business service, the subscriber is classified as business.

(e) Voice subscriber numbers reflect billable subscribers who purchase an IP-based telephony service, as well as a small number of subscribers acquired

from Insight who receive traditional, circuit-switched telephone service. The determination of whether a voice subscriber is categorized as residential or

business is generally based upon the type of service provided to that subscriber. For example, if TWC provides a business service, the subscriber is

classified as business.

(f) Primary service unit numbers represent the sum of video, high-speed data and voice subscribers.

(g) Double play subscriber numbers reflect customers who subscribe to two of the Company’s primary services.

(h) Triple play subscriber numbers reflect customers who subscribe to all three of the Company’s primary services.

41