Time Warner Cable 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

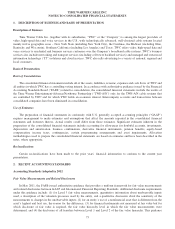

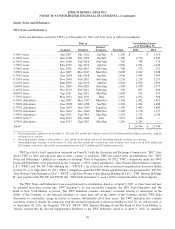

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

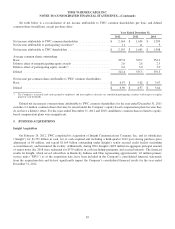

terms of the contracts. The fair value of the Time Warner Inc. (“Time Warner”) equity award reimbursement obligation is

estimated using the Black-Scholes model. Refer to Note 10 for further details.

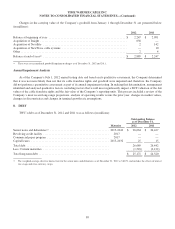

Fair Value Measurements

The fair value of an asset or liability is based on the assumptions that market participants would use in pricing the asset or

liability. Valuation techniques consistent with the market approach, income approach and/or cost approach are used to measure

fair value. The Company follows a three-tiered fair value hierarchy when determining the inputs to valuation techniques. The

fair value hierarchy prioritizes the inputs to valuation techniques into three broad levels in order to maximize the use of

observable inputs and minimize the use of unobservable inputs. The levels of the fair value hierarchy are as follows:

• Level 1: consists of financial instruments whose values are based on quoted market prices for identical financial

instruments in an active market.

• Level 2: consists of financial instruments whose values are determined using models or other valuation

methodologies that utilize inputs that are observable either directly or indirectly, including (i) quoted prices for

similar assets or liabilities in active markets, (ii) quoted prices for identical or similar assets or liabilities in markets

that are not active, (iii) pricing models whose inputs are observable for substantially the full term of the financial

instrument and (iv) pricing models whose inputs are derived principally from or corroborated by observable market

data through correlation or other means for substantially the full term of the financial instrument.

• Level 3: consists of financial instruments whose values are determined using pricing models that utilize significant

inputs that are primarily unobservable, discounted cash flow methodologies, or similar techniques, as well as

instruments for which the determination of fair value requires significant management judgment or estimation.

Noncontrolling Interests

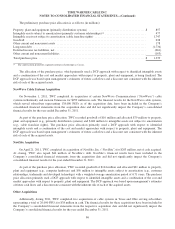

During the fourth quarter of 2012, TWC acquired the remaining 45.81% noncontrolling interest in Erie

Telecommunications, Inc. (“Erie”) for $32 million and, as a result, TWC owns 100% of Erie. This acquisition was recorded

as an equity transaction and is reflected as a financing activity in the consolidated statement of cash flows. As a result, the

carrying balance of this noncontrolling interest of $5 million was eliminated, and the remaining $27 million, representing the

difference between the purchase price and carrying balance, was recorded as a reduction to additional paid-in capital.

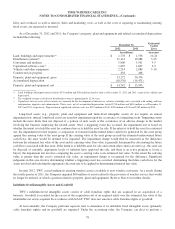

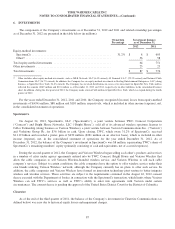

Revenue and Costs

Revenue is principally derived from residential services, business services, advertising and other services.

Residential services revenue consists of (i) video revenue, including residential subscriber fees for the Company’s

various tiers or packages of video programming services, related equipment rental and installation charges, fees collected on

behalf of governmental authorities, as well as revenue from premium networks, transactional video-on-demand and digital

video recorder service; (ii) high-speed data revenue, including residential subscriber fees for the Company’s high-speed data

services and related equipment rental and installation charges; (iii) voice revenue, including residential subscriber fees for the

Company’s voice services and related installation charges and fees collected on behalf of governmental authorities and

(iv) other revenue consisting primarily of revenue from home automation and monitoring services and other residential

subscriber-related fees.

Business services revenue consists of (i) video revenue, including the same fee categories received from business video

subscribers as described above under residential video revenue; (ii) high-speed data revenue, including business subscriber

fees for the Company’s high-speed data services and related installation charges, as well as amounts generated by the sale of

commercial networking and point-to-point transport services; (iii) voice revenue, including business subscriber fees for the

Company’s voice services and related installation charges and fees collected on behalf of governmental authorities;

(iv) wholesale transport revenue, including amounts generated by the sale of point-to-point transport services offered to

wireless telephone providers (i.e., cell tower backhaul) and other carriers and (v) other revenue primarily consisting of

revenue from managed and outsourced IT solutions and cloud services and other business subscriber-related fees.

80