Time Warner Cable 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

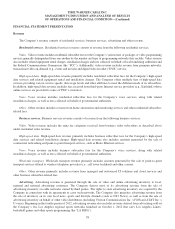

were from the provision of residential and business services, respectively. TWC also sells advertising to a variety of national,

regional and local customers, which resulted in advertising revenue of $1.1 billion during 2012. Additionally, TWC

generated $257 million of revenue from other sources during 2012.

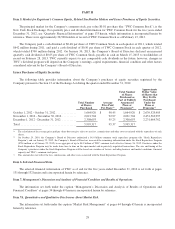

As of December 31, 2012, TWC had approximately 12.0 million residential video subscribers, 10.9 million residential

high-speed data subscribers and 5.0 million residential voice subscribers, as well as 188,000 business video subscribers,

460,000 business high-speed data subscribers and 224,000 business voice subscribers. TWC markets its services separately

and in “bundled” packages of multiple services and features. As of December 31, 2012, 61.2% of TWC’s customers

subscribed to two or more of its primary services, including 28.2% of its customers who subscribed to all three primary

services.

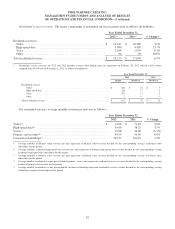

TWC believes it will continue to increase business services revenue for the foreseeable future through growth in

customers, an increasing percentage of customers purchasing more services, as well as higher-priced tiers of service, and

price increases. TWC also believes it will continue to increase residential services revenue for the foreseeable future,

primarily through growth in residential high-speed data revenue, which is expected to increase due to growth in subscribers,

an increasing percentage of subscribers purchasing higher-priced tiers of service and price increases (including equipment

rental fees). Future revenue growth rates will depend on the Company’s ability to attract, retain and upsell customers and

increase pricing, which can be impacted by competitive factors, the state of the economy and regulation.

TWC faces intense competition for residential services customers from a variety of alternative communications,

information and entertainment delivery sources. TWC competes with incumbent local telephone companies and other

overbuilders across each of its primary residential services. Some of these competitors offer a broad range of services with

features and functions comparable to those provided by TWC and in bundles similar to those offered by TWC, sometimes

including wireless service. Each of TWC’s residential services also faces competition from other companies that provide

services on a stand-alone basis. TWC’s residential video service faces competition from direct broadcast satellite services,

and increasingly from companies that deliver content to consumers over the Internet and on mobile devices. TWC’s

residential high-speed data and voice services face competition from wireless Internet and voice providers. TWC’s

residential voice service also faces competition from “over-the-top” phone services and other alternatives.

TWC also competes across each of its business high-speed data, networking and voice services with incumbent local

exchange carriers (“ILECs”), competitive local exchange carriers (“CLECs”) and interexchange carriers (“IXCs”). TWC’s

cell tower backhaul service also faces competition from ILECs and CLECs, as well as other carriers, such as metro and

regional fiber providers. TWC’s business video service faces competition from direct broadcast satellite providers. TWC also

competes with cloud, hosting and related service providers and application-service providers. Technological advances and

product innovations have increased and will likely continue to increase the number of alternatives available to TWC’s current

and potential residential and business services customers, further intensifying competition.

TWC faces intense competition in its advertising business across many different platforms and from a wide range of

local and national competitors. Competition has increased and will likely continue to increase as new formats for advertising

seek to attract the same advertisers. TWC competes for advertising revenue against, among others, local broadcast stations,

national cable and broadcast networks, radio, newspapers, magazines and outdoor advertisers, as well as Internet companies.

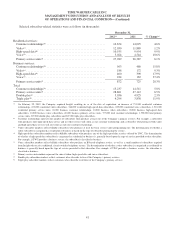

For the year ended December 31, 2012, video programming and employee costs represented 34.1% and 33.4%,

respectively, of the Company’s total operating expenses. Video programming costs are expected to continue to increase,

reflecting rate increases on existing programming services (particularly sports-related programming) and the carriage of new

networks, partially offset by a decline in total video subscribers and the removal of certain existing, low-performing

networks. TWC expects that its video programming costs as a percentage of video revenue will continue to increase, in part

due to the more competitive environment discussed above. Employee costs are also expected to continue to increase as a

result of many factors, including higher compensation expenses and headcount, reflecting the Company’s investment in

business services, regional sports networks and other areas of growth.

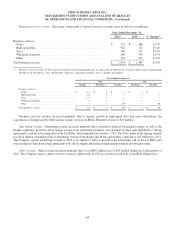

Consistent with the Company’s overall balance sheet management strategy, during 2012, TWC paid quarterly cash

dividends to TWC stockholders totaling $700 million, or $2.24 per share of TWC common stock. On January 30, 2013, the

35