Time Warner Cable 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

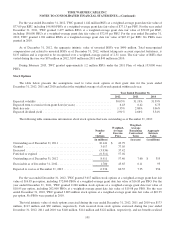

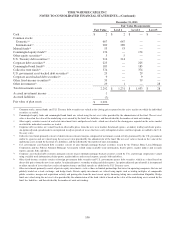

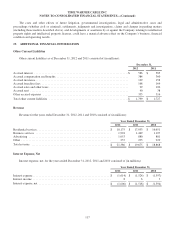

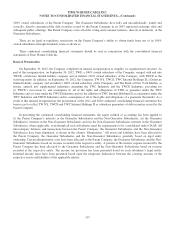

The differences between income tax (benefit) provision expected at the U.S. federal statutory income tax rate of 35%

and income tax (benefit) provision provided for the years ended December 31, 2012, 2011 and 2010 are as follows (in

millions):

Year Ended December 31,

2012 2011 2010

Income tax provision at U.S. federal statutory rate .........................$ 1,168 $ 862 $ 769

State and local taxes (tax benefits), net of federal tax effects ................. 31 (76) 66

Equity-based compensation ........................................... — 12 61

Other ............................................................. (22) (3) (13)

Total .............................................................$ 1,177 $ 795 $ 883

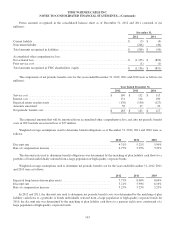

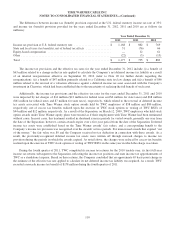

The income tax provisions and the effective tax rates for the year ended December 31, 2012 include (i) a benefit of

$63 million related to a change in the tax rate applied to calculate the Company’s net deferred income tax liability as a result

of an internal reorganization effective on September 30, 2012 (refer to Note 20 for further details regarding the

reorganization); (ii) a benefit of $47 million primarily related to a California state tax law change and (iii) a benefit of $46

million related to the reversal of a valuation allowance against a deferred income tax asset associated with the Company’s

investment in Clearwire, which had been established due to the uncertainty of realizing the full benefit of such asset.

Additionally, the income tax provisions and the effective tax rates for the years ended December 31, 2011 and 2010

were impacted by net charges of $14 million ($12 million for federal taxes and $2 million for state taxes) and $68 million

($61 million for federal taxes and $7 million for state taxes), respectively, which related to the reversal of deferred income

tax assets associated with Time Warner stock option awards held by TWC employees of $58 million and $80 million,

respectively, net of excess tax benefits realized upon the exercise of TWC stock options or vesting of TWC RSUs of

$44 million and $12 million, respectively. As a result of the Separation, on March 12, 2009, TWC employees who held stock

option awards under Time Warner equity plans were treated as if their employment with Time Warner had been terminated

without cause. In most cases, this treatment resulted in shortened exercise periods for vested awards, generally one year from

the date of the Separation; however, certain awards expire over a five-year period from the date of the Separation. Deferred

income tax assets were established based on the Time Warner awards’ fair values, and a corresponding benefit to the

Company’s income tax provision was recognized over the awards’ service periods. For unexercised awards that expired “out

of the money,” the fair value was $0 and the Company received no tax deduction in connection with these awards. As a

result, the previously-recognized deferred income tax assets were written off through noncash charges to income tax

provision during the periods in which the awards expired. As noted above, the charges were reduced by excess tax benefits

realized upon the exercise of TWC stock options or vesting of TWC RSUs in the same year in which the charge was taken.

During the fourth quarter of 2011, TWC completed its income tax returns for the 2010 taxable year, its first full-year

income tax returns subsequent to the Separation, reflecting the income tax positions and state income tax apportionments of

TWC as a standalone taxpayer. Based on these returns, the Company concluded that an approximate 65 basis point change in

the estimate of the effective tax rate applied to calculate its net deferred income tax liability was required. As a result, TWC

recorded a noncash income tax benefit of $178 million during the fourth quarter of 2011.

110