Time Warner Cable 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

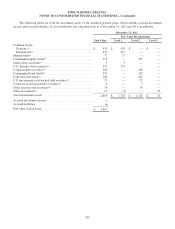

RSUs, including RSUs subject to performance-based vesting conditions (“PBUs”), generally vest equally on each of the

third and fourth anniversary of the grant date, subject to continued employment and, in the case of PBUs, subject to the

satisfaction and certification of the applicable performance conditions. RSUs provide for accelerated vesting upon the

grantee’s termination of employment after reaching a specified age and years of service and, in the case of PBUs, subject to

the satisfaction and certification of the applicable performance conditions. PBUs are subject to forfeiture if the applicable

performance condition is not satisfied. RSUs awarded to non-employee directors are not subject to vesting or forfeiture

restrictions and the shares underlying the RSUs will generally be issued in connection with a director’s termination of service

as a director. Pursuant to the directors’ compensation program, certain directors with more than three years of service on the

Board of Directors have elected an in-service vesting period for their RSU awards. Holders of RSUs are generally entitled to

receive cash dividend equivalents or retained distributions related to regular cash dividends or other distributions,

respectively, paid by TWC. In the case of PBUs, the receipt of the dividend equivalents is subject to the satisfaction and

certification of the applicable performance conditions. Retained distributions are subject to the vesting requirements of the

underlying RSUs.

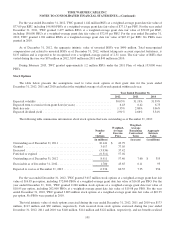

Stock options, including stock options subject to performance-based vesting conditions (“PBOs”), have exercise prices

equal to the fair market value of TWC common stock at the date of grant. Generally, stock options vest ratably over a four-

year vesting period and expire ten years from the date of grant, subject to continued employment and, in the case of PBOs,

subject to the satisfaction and certification of the applicable performance condition. Certain stock option awards provide for

accelerated vesting upon the grantee’s termination of employment after reaching a specified age and years of service and, in

the case of PBOs, subject to the satisfaction and certification of the applicable performance conditions. PBOs are subject to

forfeiture if the applicable performance condition is not satisfied.

Upon the exercise of a stock option or the vesting of a RSU, shares of TWC common stock may be issued from

authorized but unissued shares or from treasury stock, if any.

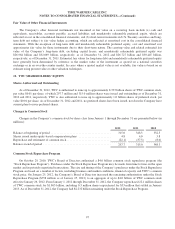

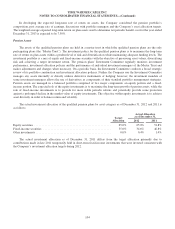

Special Dividend Retained Distribution

In connection with the Separation, on March 12, 2009, TWC paid a special cash dividend to holders of record on

March 11, 2009 of TWC’s Class A common stock and Class B common stock (the “Special Dividend”). In connection with

the Special Dividend, holders of RSUs could elect to receive the retained distribution on their RSUs related to the Special

Dividend (the “Special Dividend Retained Distribution”) in the form of cash (payable, without interest, upon vesting of the

underlying RSUs) or in the form of additional RSUs (with the same vesting dates as the underlying RSUs). In connection

with these elections and in conjunction with the payment of the Special Dividend, during the first quarter of 2009, the

Company established a liability of $46 million in other liabilities and TWC shareholders’ equity in the consolidated balance

sheet for the Special Dividend Retained Distribution to be paid in cash, taking into account estimated forfeitures. During the

years ended December 31, 2012, 2011 and 2010, the Company made cash payments of $16 million, $14 million and $6

million, respectively, against the Special Dividend Retained Distribution liability, which are included in other financing

activities in the consolidated statement of cash flows. As of December 31, 2012, the remaining Special Dividend Retained

Distribution liability was $6 million and is classified in other current liabilities in the consolidated balance sheet.

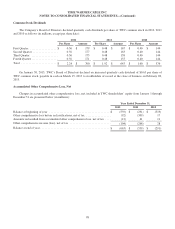

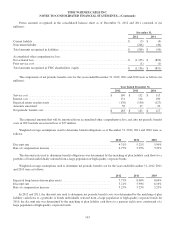

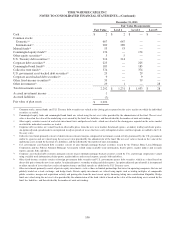

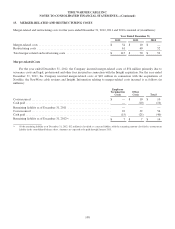

Restricted Stock Units

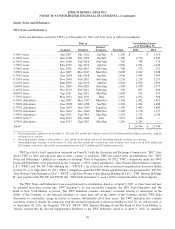

The following table summarizes information about unvested RSUs for the year ended December 31, 2012:

Number

of

Units

Weighted-

Average

Grant Date

Value

(in millions)

Unvested as of December 31, 2011 ................................................. 5.315 $ 53.74

Granted ....................................................................... 1.442 77.09

Vested ........................................................................ (1.465) 52.21

Forfeited ...................................................................... (0.252) 61.54

Unvested as of December 31, 2012 ................................................. 5.040 60.47

100