Time Warner Cable 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

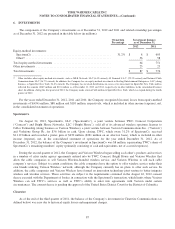

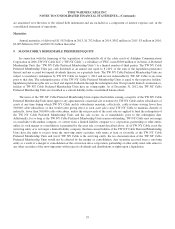

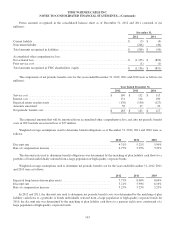

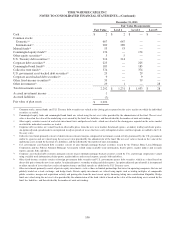

Fair Value of Other Financial Instruments

The Company’s other financial instruments not measured at fair value on a recurring basis include (a) cash and

equivalents, receivables, accounts payable, accrued liabilities and mandatorily redeemable preferred equity, which are

reflected at cost in the consolidated financial statements, and (b) short-term investments in U.S. Treasury securities and long-

term debt not subject to fair value hedge accounting, which are reflected at amortized cost in the consolidated financial

statements. With the exception of long-term debt and mandatorily redeemable preferred equity, cost and amortized cost

approximates fair value for these instruments due to their short-term nature. The carrying value and related estimated fair

value of the Company’s long-term debt, excluding capital leases, and mandatorily redeemable preferred equity was

$26.964 billion and $32.069 billion, respectively, as of December 31, 2012 and $26.727 billion and $30.445 billion,

respectively, as of December 31, 2011. Estimated fair values for long-term debt and mandatorily redeemable preferred equity

have generally been determined by reference to the market value of the instrument as quoted on a national securities

exchange or in an over-the-counter market. In cases where a quoted market value is not available, fair value is based on an

estimate using present value or other valuation techniques.

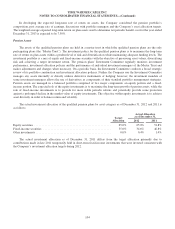

12. TWC SHAREHOLDERS’ EQUITY

Shares Authorized and Outstanding

As of December 31, 2012, TWC is authorized to issue up to approximately 8.333 billion shares of TWC common stock,

par value $0.01 per share, of which 297.7 million and 315.0 million shares were issued and outstanding as of December 31,

2012 and 2011, respectively. TWC is also authorized to issue up to approximately 1.0 billion shares of preferred stock, par

value $0.01 per share. As of December 31, 2012 and 2011, no preferred shares have been issued, nor does the Company have

current plans to issue preferred shares.

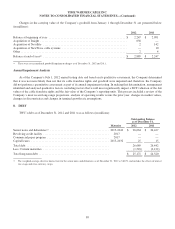

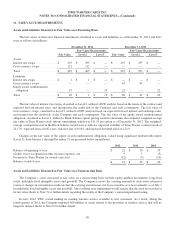

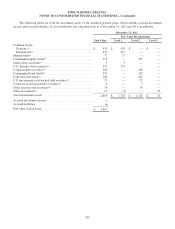

Changes in Common Stock

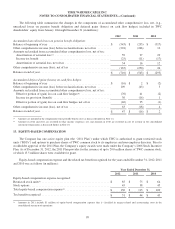

Changes in the Company’s common stock by share class from January 1 through December 31 are presented below (in

millions):

2012 2011 2010

Balance at beginning of period ......................................... 315.0 348.3 352.5

Shares issued under equity-based compensation plans ...................... 4.8 4.0 3.8

Repurchase and retirement of common stock .............................. (22.1) (37.3) (8.0)

Balance at end of period .............................................. 297.7 315.0 348.3

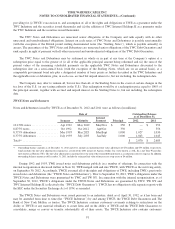

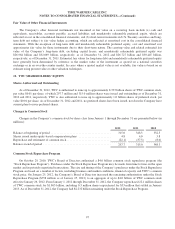

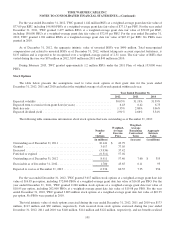

Common Stock Repurchase Program

On October 29, 2010, TWC’s Board of Directors authorized a $4.0 billion common stock repurchase program (the

“Stock Repurchase Program”). Purchases under the Stock Repurchase Program may be made from time to time on the open

market and in privately negotiated transactions. The size and timing of the Company’s purchases under the Stock Repurchase

Program are based on a number of factors, including business and market conditions, financial capacity and TWC’s common

stock price. On January 25, 2012, the Company’s Board of Directors increased the remaining authorization under the Stock

Repurchase Program ($758 million as of January 25, 2012) to an aggregate of up to $4.0 billion of TWC common stock

effective January 26, 2012. From January 1, 2012 through December 31, 2012, the Company repurchased 22.1 million shares

of TWC common stock for $1.865 billion, including 0.3 million shares repurchased for $33 million that settled in January

2013. As of December 31, 2012, the Company had $2.232 billion remaining under the Stock Repurchase Program.

97