Time Warner Cable 2012 Annual Report Download - page 44

Download and view the complete annual report

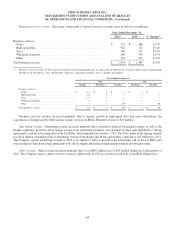

Please find page 44 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION

INTRODUCTION

Management’s discussion and analysis of results of operations and financial condition (“MD&A”) is a supplement to

the accompanying consolidated financial statements and provides additional information on Time Warner Cable Inc.’s

(together with its subsidiaries, “TWC” or the “Company”) business, current developments, financial condition, cash flows

and results of operations. MD&A is organized as follows:

•Overview. This section provides a general description of TWC’s business, as well as recent developments the

Company believes are important in understanding the results of operations and financial condition or in

understanding anticipated future trends.

•Financial statement presentation. This section provides a summary of how the Company’s operations are

presented in the accompanying consolidated financial statements.

•Results of operations. This section provides an analysis of the Company’s results of operations for the three years

ended December 31, 2012.

•Financial condition and liquidity. This section provides an analysis of the Company’s cash flows for the three

years ended December 31, 2012, as well as a discussion of the Company’s outstanding debt and commitments as of

December 31, 2012. Also included is a discussion of the amount of financial capacity available to fund the

Company’s future commitments, as well as a discussion of other financing arrangements.

•Market risk management. This section discusses how the Company monitors and manages exposure to potential

gains and losses arising from changes in market rates and prices, such as interest and foreign currency exchange

rates.

•Critical accounting policies and estimates. This section discusses accounting policies and estimates that require

the use of assumptions that were uncertain at the time the estimate was made and that could have a material effect

on the Company’s consolidated results of operations or financial condition if there were changes in the estimate or

if a different estimate were made. The Company’s significant accounting policies, including those considered to be

critical accounting policies and estimates, are summarized in Note 3 to the accompanying consolidated financial

statements.

•Caution concerning forward-looking statements. This section provides a description of the use of forward-looking

information appearing in this report, including in MD&A and the consolidated financial statements. Such

information is based on management’s current expectations about future events, which are subject to uncertainty

and changes in circumstances. Refer to Item 1A, “Risk Factors,” in Part I of this report for a discussion of the risk

factors applicable to the Company.

OVERVIEW

TWC is among the largest providers of video, high-speed data and voice services in the U.S., with technologically

advanced, well-clustered cable systems located mainly in five geographic areas – New York State (including New York

City), the Carolinas, the Midwest (including Ohio, Kentucky and Wisconsin), Southern California (including Los Angeles)

and Texas. As discussed below in “Recent Developments,” on February 29, 2012, TWC completed its acquisition of Insight

Communications Company, Inc. and its subsidiaries (“Insight”). As of December 31, 2012, TWC served approximately

15.2 million customers (approximately 14.7 million residential services customers and 563,000 business services customers)

who subscribed to one or more of its three primary services, totaling approximately 28.9 million primary service units.

TWC offers video, high-speed data and voice services to residential and business services customers over the

Company’s broadband cable systems. TWC’s business services also include networking and transport services (including cell

tower backhaul services) and managed and outsourced information technology (“IT”) solutions and cloud services. During

2012, TWC generated total revenue of approximately $21.4 billion. Of this total, approximately $18.2 billion and $1.9 billion

34