Time Warner Cable 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

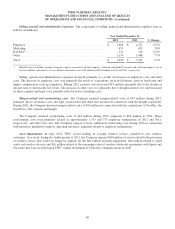

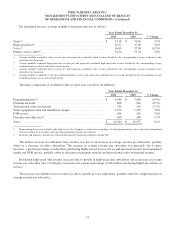

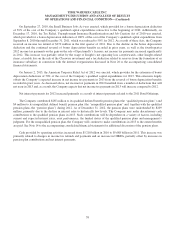

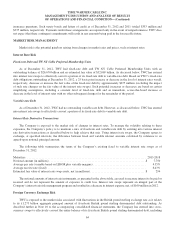

Other expense, net. Other expense, net, detail is shown in the table below (in millions):

Year Ended December 31,

2011 2010

Loss from equity-method investments, net(a) ........................................$ (88) $ (110)

Gain (loss) on equity award reimbursement obligation to Time Warner(b) ................. (5) 5

Other ....................................................................... 4 6

Other expense, net ............................................................$ (89) $ (99)

(a) Loss from equity-method investments, net, primarily consists of losses incurred by Clearwire Communications. As of the end of the third quarter of

2011, the balance of the Company’s investment in Clearwire Communications was reduced to $0.

(b) See Note 10 to the accompanying consolidated financial statements for a discussion of the Company’s accounting for its equity award reimbursement

obligation to Time Warner.

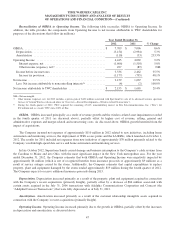

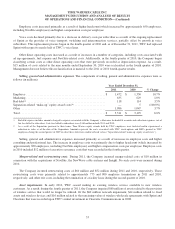

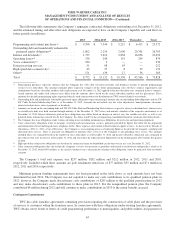

Income tax provision. In 2011 and 2010, the Company recorded income tax provisions of $795 million and $883

million, respectively. The effective tax rates were 32.3% and 40.2% for 2011 and 2010, respectively.

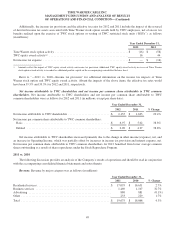

During the fourth quarter of 2011, TWC completed its income tax returns for the 2010 taxable year, its first full-year

income tax returns subsequent to the Separation, reflecting the income tax positions and state income tax apportionments of

TWC as a standalone taxpayer. Based on these returns, the Company concluded that an approximate 65 basis point change in

the estimate of the effective tax rate applied to calculate its net deferred income tax liability was required. As a result, TWC

recorded a noncash income tax benefit of $178 million during the fourth quarter of 2011. The income tax provision and the

effective tax rate for 2011 also included a benefit of $14 million (which includes $9 million that related to 2010) from the

domestic production activities deduction under Section 199 of the Internal Revenue Code of 1986, as amended.

The income tax provision and the effective tax rate for 2010 benefited from an adjustment of $29 million to the

Company’s valuation allowance for deferred income tax assets associated with its investment in Clearwire Communications.

The income tax provision and the effective tax rate for 2010 were also impacted by legislation enacted in California in

October 2010 that reversed the changes in methodology of California income tax apportionment included in the 2009

California state budget, which resulted in a decrease in the Company’s state deferred income tax liabilities and a

corresponding noncash tax benefit of $40 million, which was recorded in the fourth quarter of 2010.

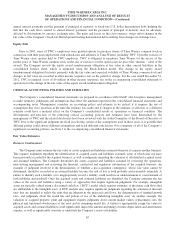

Additionally, the income tax provisions and the effective tax rates for 2011 and 2010 were impacted by the reversal of

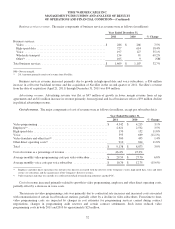

deferred income tax assets associated with Time Warner stock option awards held by TWC employees, net of excess tax

benefits realized upon the exercise of TWC stock options or vesting of TWC RSUs, as follows (in millions):

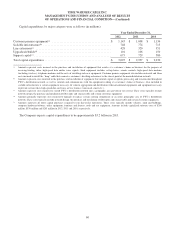

Year Ended December 31,

2011 2010

Time Warner stock option activity ...............................................$ (58) $ (80)

TWC equity award activity ..................................................... 44 12

Net income tax expense ........................................................$ (14) $ (68)

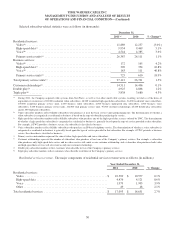

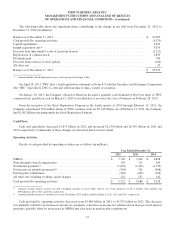

As a result of the Separation, on March 12, 2009, TWC employees who held stock option awards under Time Warner

equity plans were treated as if their employment with Time Warner had been terminated without cause. In most cases, this

treatment resulted in shortened exercise periods for vested awards, generally one year from the date of the Separation;

however, certain awards expire over a five-year period from the date of the Separation. Deferred income tax assets were

established based on the Time Warner awards’ fair values, and a corresponding benefit to the Company’s income tax

provision was recognized over the awards’ service periods. For unexercised awards that expired “out of the money,” the fair

value was $0 and the Company received no tax deduction in connection with these awards. As a result, the previously-

recognized deferred income tax assets were written off through noncash charges to income tax provision during the periods

in which the awards expired. As noted above, the charges were reduced by excess tax benefits realized upon the exercise of

TWC stock options or vesting of TWC RSUs in the same year in which the charge was taken.

55