Time Warner Cable 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

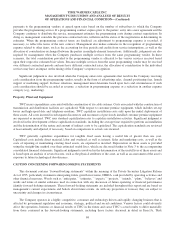

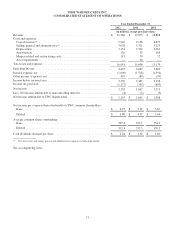

TIME WARNER CABLE INC.

CONSOLIDATED STATEMENT OF EQUITY

Common

Stock

Additional

Paid-in

Capital

Retained

Earnings

(Accumulated

Deficit)

Accumulated

Other

Comprehensive

Loss, Net

Non-

controlling

Interests

Total

Equity

(in millions)

Balance as of December 31, 2009 . . . $ 4 $ 9,813 $ (813) $ (319) $ 4 $ 8,689

Net income ................... — — 1,308 — 5 1,313

Other comprehensive income .... — — — 28 — 28

Comprehensive income ........... — — 1,308 28 5 1,341

Equity-based compensation

expense ...................... — 109 — — — 109

Shares issued upon the exercise

of TWC stock options .......... — 122 — — — 122

Taxes paid in lieu of shares issued for

equity-based compensation ...... — (9) — — — (9)

Cash dividends declared ($1.60 per

common share) ................ — (432) (144) — — (576)

Repurchase and retirement of

common stock ................ (1) (217) (297) — — (515)

Other changes(a) ................. — 58 — — (2) 56

Balance as of December 31, 2010 . . . 3 9,444 54 (291) 7 9,217

Net income ................... — — 1,665 — 2 1,667

Other comprehensive loss ....... — — — (268) — (268)

Comprehensive income (loss) ...... — — 1,665 (268) 2 1,399

Equity-based compensation

expense ...................... — 113 — — — 113

Shares issued upon the exercise

of TWC stock options .......... — 114 — — — 114

Taxes paid in lieu of shares issued for

equity-based compensation ...... — (29) — — — (29)

Cash dividends declared ($1.92 per

common share) ................ — (632) (11) — — (643)

Repurchase and retirement of

common stock ................ — (992) (1,640) — — (2,632)

Other changes .................. — — — — (2) (2)

Balance as of December 31, 2011 . . . 3 8,018 68 (559) 7 7,537

Net income ................... — — 2,155 — 4 2,159

Other comprehensive loss ....... — — — (104) — (104)

Comprehensive income (loss) ...... — — 2,155 (104) 4 2,055

Equity-based compensation

expense ...................... — 130 — — — 130

Excess tax benefit realized from

equity-based compensation ...... — 62 — — — 62

Shares issued upon the exercise of

TWC stock options ............ — 140 — — — 140

Taxes paid in lieu of shares issued for

equity-based compensation ...... — (45) — — — (45)

Cash dividends declared ($2.24 per

common share) ................ — (143) (557) — — (700)

Repurchase and retirement of

common stock ................ — (562) (1,303) — — (1,865)

Acquisition of noncontrolling

interest ...................... — (27) — — (5) (32)

Other changes .................. — 3 — — (2) 1

Balance as of December 31, 2012 . . . $ 3 $ 7,576 $ 363 $ (663) $ 4 $ 7,283

(a) Amount primarily represents the true-up of TWC’s deferred income tax asset associated with vested Time Warner Inc. stock options.

See accompanying notes.

74