Time Warner Cable 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

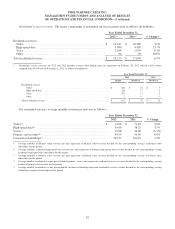

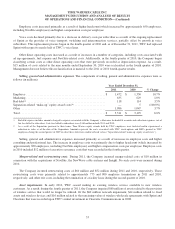

Interest expense, net. Interest expense, net, increased as a result of higher average debt outstanding during 2012

compared to 2011, partially offset by a decrease in the average interest rate on such debt. The increase in average debt

outstanding was primarily due to the public debt issuances in May and September 2011 (the “2011 Bond Offerings”) and the

2012 Bond Offerings, partially offset by the maturities of TWE’s 10.150% senior notes due May 2012 ($250 million in

aggregate principal amount), TWC’s 5.400% senior notes due July 2012 ($1.5 billion in aggregate principal amount) and

TWCE’s 8.875% senior notes due October 2012 ($350 million in aggregate principal amount).

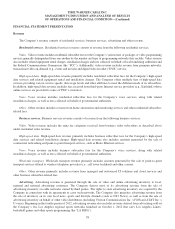

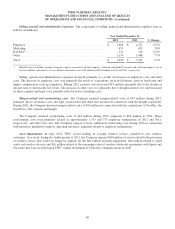

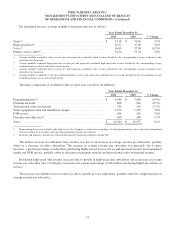

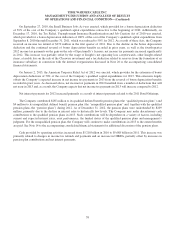

Other income (expense), net. Other income (expense), net, detail is shown in the table below (in millions):

Year Ended December 31,

2012 2011

Income (loss) from equity-method investments, net(a)(b) .................................$ 454 $ (88)

Gain on sale of investment in Clearwire(b) ............................................ 64 —

Loss on equity award reimbursement obligation to Time Warner(c) ........................ (9) (5)

Other investment losses(d) ......................................................... (12) —

Other ......................................................................... — 4

Other income (expense), net .......................................................$ 497 $ (89)

(a) Income from equity-method investments, net, in 2012 primarily consists of a pretax gain of $430 million associated with SpectrumCo’s sale of its

advanced wireless spectrum licenses to Verizon Wireless (discussed above in “Overview—Recent Developments—Wireless-related Transactions”).

(b) Loss from equity-method investments, net, in 2011 primarily consists of losses incurred by Clearwire Communications. As of the end of the third

quarter of 2011, the balance of the Company’s investment in Clearwire Communications was $0 and, as discussed above in “Overview—Recent

Developments—Wireless-related Transactions,” on September 27, 2012, the Company sold all of its interest in Clearwire, resulting in the gain noted

above.

(c) See Note 10 to the accompanying consolidated financial statements for a discussion of the Company’s accounting for its equity award reimbursement

obligation to Time Warner Inc. (“Time Warner”).

(d) Other investment losses in 2012 represents an impairment of the Company’s investment in Canoe Ventures LLC (“Canoe”), an equity-method investee

engaged in the development of advanced advertising platforms. The impairment was recognized as a result of Canoe’s announcement during the first

quarter of 2012 of a restructuring that significantly curtailed its operations.

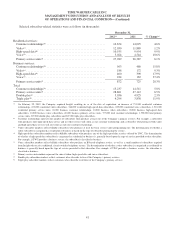

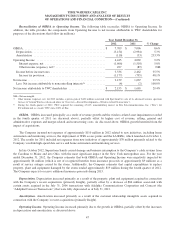

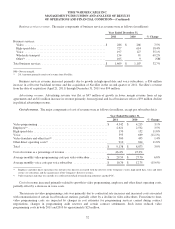

Income tax provision. In 2012 and 2011, the Company recorded income tax provisions of $1.177 billion and

$795 million, respectively. The effective tax rates were 35.3% and 32.3% for 2012 and 2011, respectively.

The income tax provisions and the effective tax rates for 2012 include (i) a benefit of $63 million related to a change in

the tax rate applied to calculate the Company’s net deferred income tax liability as a result of an internal reorganization

effective on September 30, 2012 (discussed further in Note 20 to the accompanying consolidated financial statements); (ii) a

fourth-quarter benefit of $47 million primarily related to a California state tax law change; (iii) a benefit of $46 million

related to the reversal of a valuation allowance against a deferred income tax asset associated with the Company’s investment

in Clearwire (discussed further in “Overview—Recent Developments—Wireless-related Transactions”); and (iv) a charge of

$15 million related to the recording of a deferred income tax liability associated with a partnership basis difference.

During the fourth quarter of 2011, TWC completed its income tax returns for the 2010 taxable year, its first full-year

income tax returns subsequent to the Company’s separation from Time Warner on March 12, 2009 (the “Separation”),

reflecting the income tax positions and state income tax apportionments of TWC as a standalone taxpayer. Based on these

returns, the Company concluded that an approximate 65 basis point change in the estimate of the effective tax rate applied to

calculate its net deferred income tax liability was required. As a result, TWC recorded a noncash income tax benefit of

$178 million during the fourth quarter of 2011. The income tax provision and the effective tax rate for 2011 also included a

benefit related to 2010 of $9 million from the domestic production activities deduction under Section 199 of the Internal

Revenue Code of 1986, as amended.

48