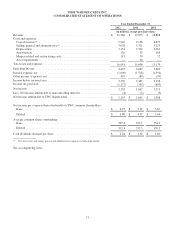

Time Warner Cable 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Description of Business

Time Warner Cable Inc. (together with its subsidiaries, “TWC” or the “Company”) is among the largest providers of

video, high-speed data and voice services in the U.S., with technologically advanced, well-clustered cable systems located

mainly in five geographic areas – New York State (including New York City), the Carolinas, the Midwest (including Ohio,

Kentucky and Wisconsin), Southern California (including Los Angeles) and Texas. TWC offers video, high-speed data and

voice services to residential and business services customers over the Company’s broadband cable systems. TWC’s business

services also include networking and transport services (including cell tower backhaul services) and managed and outsourced

information technology (“IT”) solutions and cloud services. TWC also sells advertising to a variety of national, regional and

local customers.

Basis of Presentation

Basis of Consolidation

The consolidated financial statements include all of the assets, liabilities, revenue, expenses and cash flows of TWC and

all entities in which TWC has a controlling voting interest. In accordance with authoritative guidance issued by the Financial

Accounting Standards Board (“FASB”) related to consolidation, the consolidated financial statements include the results of

the Time Warner Entertainment-Advance/Newhouse Partnership (“TWE-A/N”) only for the TWE-A/N cable systems that

are controlled by TWC and for which TWC holds an economic interest. Intercompany accounts and transactions between

consolidated companies have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”)

requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial

statements and footnotes thereto. Actual results could differ from those estimates. Significant estimates inherent in the

preparation of the consolidated financial statements include accounting for allowances for doubtful accounts, investments,

depreciation and amortization, business combinations, derivative financial instruments, pension benefits, equity-based

compensation, income taxes, contingencies, certain programming arrangements and asset impairments. Allocation

methodologies used to prepare the consolidated financial statements are based on estimates and have been described in the

notes, where appropriate.

Reclassifications

Certain reclassifications have been made to the prior years’ financial information to conform to the current year

presentation.

2. RECENT ACCOUNTING STANDARDS

Accounting Standards Adopted in 2012

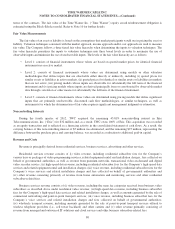

Fair Value Measurements and Related Disclosures

In May 2011, the FASB issued authoritative guidance that provides a uniform framework for fair value measurements

and related disclosures between GAAP and International Financial Reporting Standards. Additional disclosure requirements

under this guidance include: (1) for Level 3 fair value measurements, quantitative information about unobservable inputs

used, a description of the valuation processes used by the entity, and a qualitative discussion about the sensitivity of the

measurements to changes in the unobservable inputs; (2) for an entity’s use of a nonfinancial asset that is different from the

asset’s highest and best use, the reason for the difference; (3) for financial instruments not measured at fair value but for

which disclosure of fair value is required, the fair value hierarchy level in which the fair value measurements were

determined; and (4) the disclosure of all transfers between Level 1 and Level 2 of the fair value hierarchy. This guidance

75