Time Warner Cable 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

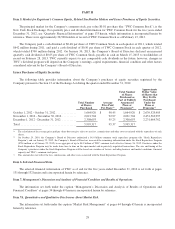

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

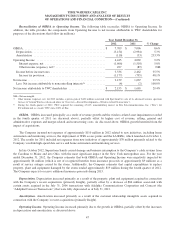

2012 Bond Offerings

On June 27, 2012, TWC issued £650 million (approximately U.S. $1.0 billion) in aggregate principal amount of 5.250%

senior unsecured notes due 2042 and, on August 10, 2012, TWC issued $1.25 billion in aggregate principal amount of

4.500% senior unsecured debentures due 2042, each in a public offering under a shelf registration statement on Form S-3 (the

“2012 Bond Offerings”). At the time of issuance, TWC’s obligations under the debt securities issued in the 2012 Bond

Offerings were guaranteed by the Company’s 100% owned subsidiaries, Time Warner Entertainment Company, L.P.

(“TWE”) and TW NY Cable Holding Inc. (“TW NY”). In connection with an internal reorganization discussed further in

Note 20 to the accompanying consolidated financial statements, as of September 30, 2012, TWC’s obligations under the debt

securities issued in the 2012 Bond Offerings are guaranteed by TW NY, Time Warner Cable Enterprises LLC (“TWCE”) and

Time Warner Cable Internet Holdings II LLC (“TWC Internet Holdings II”), each a 100% owned subsidiary of the Company.

As described further in Note 10 to the accompanying consolidated financial statements, the Company entered into cross-

currency swaps to effectively convert its fixed-rate British pound sterling denominated debt, including annual interest

payments and the payment of principal at maturity, to fixed-rate U.S. dollar denominated debt. See Note 8 to the

accompanying consolidated financial statements for further details regarding the debt securities issued in the 2012 Bond

Offerings.

Revolving Credit Facility and Commercial Paper Program

On April 27, 2012, the Company entered into a credit agreement for a $3.5 billion senior unsecured five-year revolving

credit facility maturing in April 2017 (the “Revolving Credit Facility”). In connection with the entry into the Revolving

Credit Facility, the Company’s $4.0 billion senior unsecured three-year revolving credit facility, scheduled to mature in

November 2013, was terminated. The Company’s unsecured commercial paper program (the “Commercial Paper Program”)

was also reduced from $4.0 billion to $2.5 billion.

The Company’s obligations under the Revolving Credit Facility were initially guaranteed by TWE and TW NY but, in

connection with the internal reorganization discussed above, as of September 30, 2012, the obligations are guaranteed by TW

NY, TWCE and TWC Internet Holdings II. Borrowings under the Revolving Credit Facility bear interest at a rate based on

the credit rating of TWC, which interest rate was LIBOR plus 1.10% per annum as of December 31, 2012. In addition, TWC

is required to pay a facility fee on the aggregate commitments under the Revolving Credit Facility at a rate determined by the

credit rating of TWC, which rate was 0.15% per annum as of December 31, 2012. The Revolving Credit Facility provides

same-day funding capability, and a portion of the aggregate commitments, not to exceed $500 million at any time, may be

used for the issuance of letters of credit.

The Revolving Credit Facility contains a maximum leverage ratio covenant of 5.0 times TWC’s consolidated EBITDA.

The terms and related financial metrics associated with the leverage ratio are defined in the agreement. The Revolving Credit

Facility does not contain any credit ratings-based defaults or covenants or any ongoing covenants or representations

specifically relating to a material adverse change in TWC’s financial condition or results of operations. Borrowings under the

Revolving Credit Facility may be used for general corporate purposes, and unused credit is available to support borrowings

under the Commercial Paper Program.

Insight Acquisition

On February 29, 2012, TWC completed its acquisition of Insight for $1.339 billion in cash, net of cash acquired and

including a third-quarter 2012 post-closing purchase price adjustment of $4 million, and repaid $1.164 billion outstanding

under Insight’s senior secured credit facility (including accrued interest), and terminated the facility. Additionally, during

2012, Insight’s $495 million in aggregate principal amount of 9.375% senior notes due 2018 were redeemed for $579 million

in cash (including premiums and accrued interest). The financial results for Insight, which served subscribers in Kentucky,

Indiana and Ohio representing approximately 1.6 million primary service units as of the acquisition date, have been included

in the Company’s consolidated financial statements from the acquisition date. See Note 5 to the accompanying consolidated

financial statements for additional information on the Insight acquisition.

37