Time Warner Cable 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

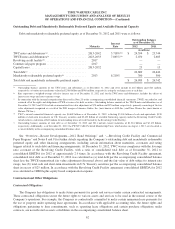

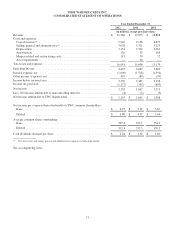

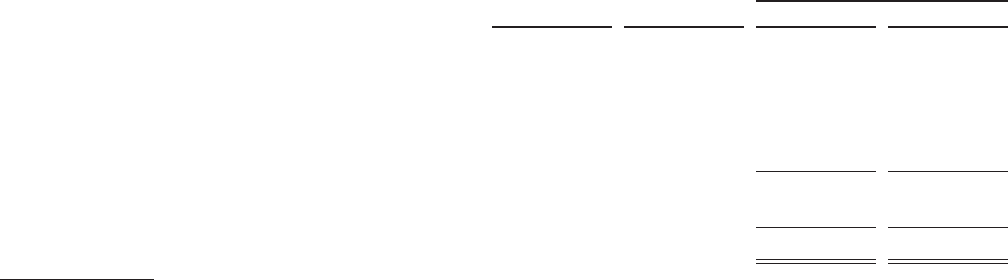

Outstanding Debt and Mandatorily Redeemable Preferred Equity and Available Financial Capacity

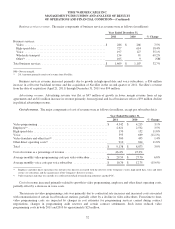

Debt and mandatorily redeemable preferred equity as of December 31, 2012 and 2011 were as follows:

Interest

Rate

Outstanding Balance

as of December 31,

Maturity 2012 2011

(in millions)

TWC notes and debentures(a) .......................... 2013-2042 5.718%(b) $ 24,594 $ 23,744

TWCE notes and debentures(c) ........................ 2023-2033 7.865%(b) 2,070 2,683

Revolving credit facility(d) ............................ 2017 — —

Commercial paper program ........................... 2017 — —

Capital leases ...................................... 2013-2032 25 15

Total debt(e) ....................................... 26,689 26,442

Mandatorily redeemable preferred equity(e) .............. 2013 8.210% 300 300

Total debt and mandatorily redeemable preferred equity .... $ 26,989 $ 26,742

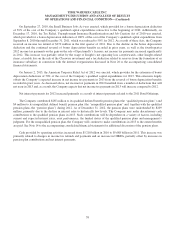

(a) Outstanding balance amounts of the TWC notes and debentures as of December 31, 2012 and 2011 include £1.266 billion and £623 million,

respectively, of senior unsecured notes valued at $2.058 billion and $968 million, respectively, using the exchange rates at each date.

(b) Rate represents a weighted-average effective interest rate as of December 31, 2012 and, for the TWC notes and debentures, includes the effects of

interest rate swaps and cross-currency swaps.

(c) In connection with the internal reorganization discussed in Note 20 to the accompanying consolidated financial statements, TWCE succeeded to, and

assumed, all of the rights and obligations of TWE as issuer of its debt securities. Outstanding balance amounts of the TWCE notes and debentures as of

December 31, 2012 and 2011 include an unamortized fair value adjustment of $70 million and $79 million, respectively, primarily consisting of the fair

value adjustment recognized as a result of the 2001 merger of America Online, Inc. (now known as AOL Inc.) and Time Warner Inc. (now known as

Historic TW Inc.).

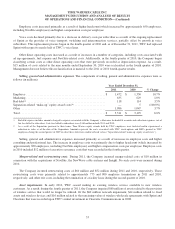

(d) TWC’s unused committed financial capacity was $6.889 billion as of December 31, 2012, reflecting $3.304 billion of cash and equivalents, $150

million of short-term investments in U.S. Treasury securities and $3.435 billion of available borrowing capacity under the Revolving Credit Facility

(which reflects a reduction of $65 million for outstanding letters of credit backed by the Revolving Credit Facility).

(e) Outstanding balance amounts of total debt as of December 31, 2012 and 2011 include current maturities of $1.518 billion and $2.122 billion,

respectively. Additionally, as of December 31, 2012, the TW NY Cable Preferred Membership Units, which mature on August 1, 2013, are classified as

a current liability in the accompanying consolidated balance sheet.

See “Overview—Recent Developments—2012 Bond Offerings” and “—Revolving Credit Facility and Commercial

Paper Program” and Notes 8 and 9 for further details regarding the Company’s outstanding debt and mandatorily redeemable

preferred equity and other financing arrangements, including certain information about maturities, covenants and rating

triggers related to such debt and financing arrangements. At December 31, 2012, TWC was in compliance with the leverage

ratio covenant of the Revolving Credit Facility, with a ratio of consolidated total debt as of December 31, 2012 to

consolidated EBITDA for 2012 of approximately 2.9 times. In accordance with the Revolving Credit Facility agreement,

consolidated total debt as of December 31, 2012 was calculated as (a) total debt per the accompanying consolidated balance

sheet less the TWCE unamortized fair value adjustment (discussed above) and the fair value of debt subject to interest rate

swaps, less (b) total cash and short-term investments in U.S. Treasury securities per the accompanying consolidated balance

sheet in excess of $25 million. In accordance with the Revolving Credit Facility agreement, consolidated EBITDA for 2012

was calculated as OIBDA plus equity-based compensation expense.

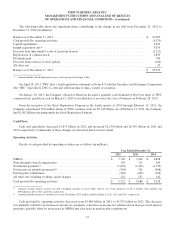

Contractual and Other Obligations

Contractual Obligations

The Company has obligations to make future payments for goods and services under certain contractual arrangements.

These contractual obligations secure the future rights to various assets and services to be used in the normal course of the

Company’s operations. For example, the Company is contractually committed to make certain minimum lease payments for

the use of property under operating lease agreements. In accordance with applicable accounting rules, the future rights and

obligations pertaining to firm commitments, such as operating lease obligations and certain purchase obligations under

contracts, are not reflected as assets or liabilities in the accompanying consolidated balance sheet.

62