Time Warner Cable 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

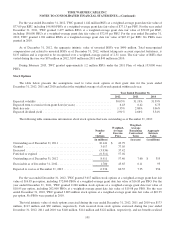

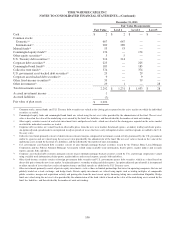

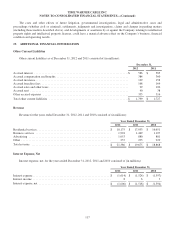

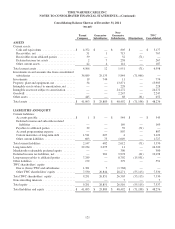

Significant components of TWC’s deferred income tax liabilities, net, as of December 31, 2012 and 2011 are as follows

(in millions):

December 31,

2012 2011

Cable franchise rights and customer relationships, net(a) .................................$ (7,675) $ (6,698)

Property, plant and equipment ..................................................... (4,081) (3,941)

Other ......................................................................... (17) (9)

Deferred income tax liabilities ................................................... (11,773) (10,648)

Net operating loss carryforwards(b) .................................................. 322 67

Tax credit carryforwards(b) ........................................................ 36 37

Other ......................................................................... 470 680

Valuation allowances(c) ........................................................... (18) (67)

Deferred income tax assets ...................................................... 810 717

Deferred income tax liabilities, net(d) ..............................................$ (10,963) $ (9,931)

(a) Cable franchise rights and customer relationships, net, includes deferred income tax assets of approximately $170 million and $500 million as of

December 31, 2012 and 2011, respectively, that relate to intangible assets for which the tax basis exceeds the book basis primarily as a result of the

impairment recorded in 2008. These deferred income tax assets are expected to be realized as the Company amortizes the intangible assets for tax

purposes.

(b) Net operating loss and tax credit carryforwards expire in varying amounts through 2032. Aside from certain state tax credit carryforwards for which a

valuation allowance has been established, the Company does not expect these carryforwards to expire unutilized.

(c) The Company’s valuation allowance for deferred income tax assets recorded as of December 31, 2012, relates to certain state tax credit carryforwards

and, as of December 31, 2011, relates to its equity-method investment in Clearwire Communications, as well as certain state tax credit carryforwards.

The valuation allowance is based upon the Company’s assessment that it is more likely than not that a portion of the deferred income tax asset will not

be realized. The net decrease in the valuation allowance of $49 million during 2012 primarily relates to the reversal of a $46 million valuation allowance

against a deferred income tax asset associated with the Company’s equity-method investment in Clearwire Communications, which had been

established due to the uncertainty of realizing the full benefit of such asset.

(d) Deferred income tax liabilities, net, includes current deferred income tax assets of $317 million and $267 million as of December 31, 2012 and 2011,

respectively.

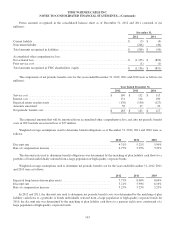

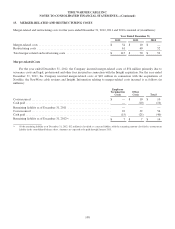

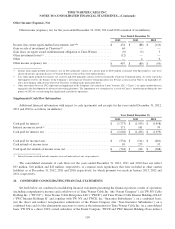

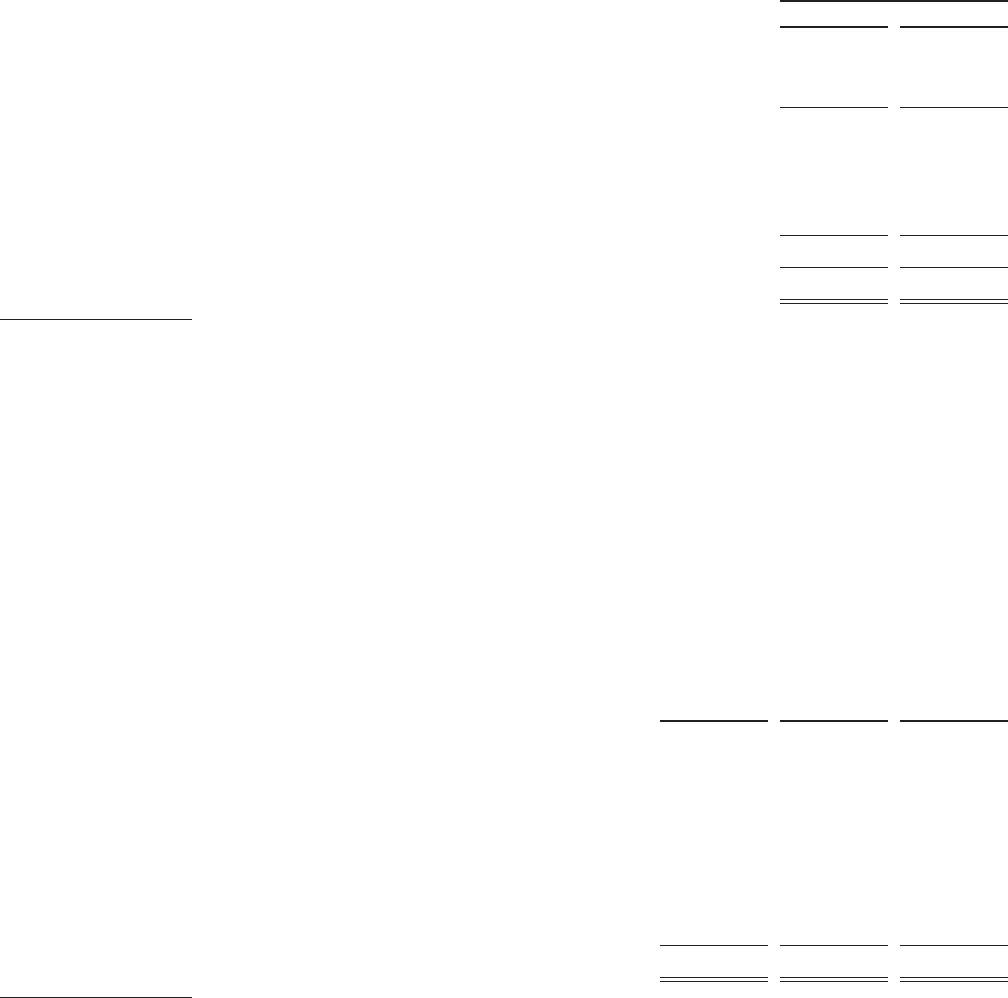

Changes in the Company’s deferred income tax liabilities, net, from January 1 through December 31 are presented

below (in millions):

2012 2011 2010

Balance at beginning of year ..........................................$ (9,931) $ (9,487) $ (8,818)

Deferred income tax provision ......................................... (562) (638) (687)

Business acquisitions(a) ............................................... (530) 65 —

Recorded directly to TWC shareholders’ equity as a component of:

Additional paid-in capital:

Equity-based compensation ....................................... — (43) 45

Accumulated other comprehensive loss, net:

Change in accumulated unrealized losses on pension benefit obligation ..... 100 160 (25)

Change in accumulated deferred gains (losses) on cash flow hedges ....... (40) 12 (2)

Balance at end of year ................................................$ (10,963) $ (9,931) $ (9,487)

(a) Business acquisitions relates to the acquisition of Insight in 2012 and NaviSite in 2011.

111