Time Warner Cable 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

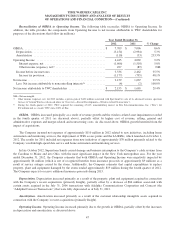

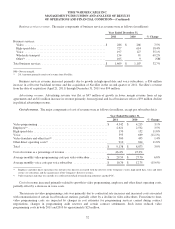

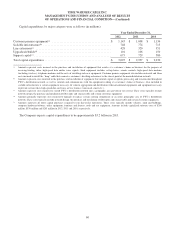

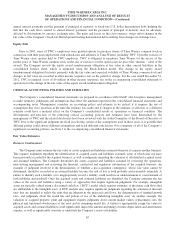

The following table shows the significant items contributing to the change in net debt from December 31, 2011 to

December 31, 2012 (in millions):

Balance as of December 31, 2011 ..............................................................$ 21,265

Cash provided by operating activities ............................................................ (5,525)

Capital expenditures ......................................................................... 3,095

Insight acquisition, net(a) ...................................................................... 3,073

Proceeds from SpectrumCo’s sale of spectrum licenses ............................................. (1,112)

Repurchases of common stock ................................................................. 1,850

Dividends paid ............................................................................. 700

Proceeds from exercise of stock options .......................................................... (140)

All other, net ............................................................................... 29

Balance as of December 31, 2012 ..............................................................$ 23,235

(a) Amount includes the Insight purchase price and repayment of Insight’s debt.

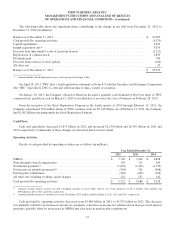

On April 28, 2011, TWC filed a shelf registration statement on Form S-3 with the Securities and Exchange Commission

(the “SEC”) that allows TWC to offer and sell from time to time a variety of securities.

On January 30, 2013, the Company’s Board of Directors declared a quarterly cash dividend of $0.65 per share of TWC

common stock, payable in cash on March 15, 2013 to stockholders of record at the close of business on February 28, 2013.

From the inception of the Stock Repurchase Program in the fourth quarter of 2010 through February 13, 2013, the

Company repurchased 70.8 million shares of TWC common stock for $5.340 billion. As of February 13, 2013, the Company

had $1.902 billion remaining under the Stock Repurchase Program.

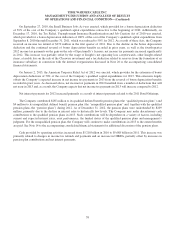

Cash Flows

Cash and equivalents decreased $1.873 billion in 2012 and increased $2.130 billion and $1.999 billion in 2011 and

2010, respectively. Components of these changes are discussed below in more detail.

Operating Activities

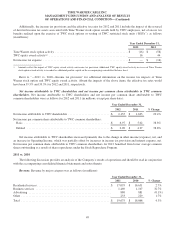

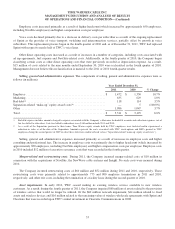

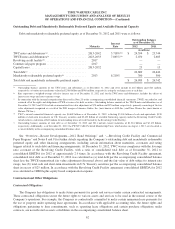

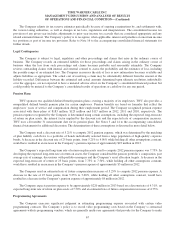

Details of cash provided by operating activities are as follows (in millions):

Year Ended December 31,

2012 2011 2010

OIBDA ...........................................................$ 7,709 $ 7,096 $ 6,818

Noncash equity-based compensation .................................... 130 112 109

Net interest payments(a) ............................................... (1,602) (1,434) (1,359)

Net income tax refunds (payments)(b) .................................... (544) 162 (388)

Pension plan contributions ............................................ (289) (405) (104)

All other, net, including working capital changes .......................... 121 157 142

Cash provided by operating activities ....................................$ 5,525 $ 5,688 $ 5,218

(a) Amounts include interest income received (including amounts received under interest rate swap contracts) of $171 million, $161 million and

$99 million in 2012, 2011 and 2010, respectively.

(b) Amounts include income tax refunds received of $10 million, $273 million and $93 million in 2012, 2011 and 2010, respectively.

Cash provided by operating activities decreased from $5.688 billion in 2011 to $5.525 billion in 2012. This decrease

was primarily related to an increase in income tax payments, a decrease in income tax refunds and an increase in net interest

payments, partially offset by an increase in OIBDA and a decrease in pension plan contributions.

57