Time Warner Cable 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Senior Notes and Debentures

TWC Notes and Debentures

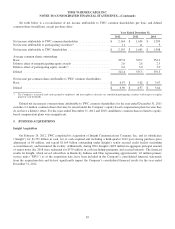

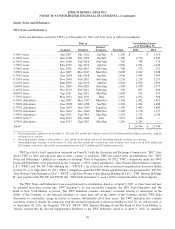

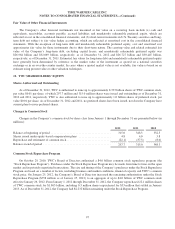

Notes and debentures issued by TWC as of December 31, 2012 and 2011 were as follows (in millions):

Date of Outstanding Balance

as of December 31,

Interest

PaymentIssuance Maturity Principal 2012 2011

5.400% notes ................... Apr2007 July 2012 Jan/July $ 1,500 $ — $ 1,510

6.200% notes ................... June 2008 July 2013 Jan/July 1,500 1,516 1,540

8.250% notes ................... Nov2008 Feb 2014 Feb/Aug 750 768 776

7.500% notes ................... Mar2009 Apr 2014 Apr/Oct 1,000 1,031 1,046

3.500% notes ................... Dec2009 Feb 2015 Feb/Aug 500 523 525

5.850% notes ................... Apr2007 May 2017 May/Nov 2,000 2,167 2,138

6.750% notes ................... June 2008 July 2018 Jan/July 2,000 2,034 1,999

8.750% notes ................... Nov2008 Feb 2019 Feb/Aug 1,250 1,238 1,237

8.250% notes ................... Mar2009 Apr 2019 Apr/Oct 2,000 1,992 1,990

5.000% notes ................... Dec2009 Feb 2020 Feb/Aug 1,500 1,478 1,475

4.125% notes ................... Nov2010 Feb 2021 Feb/Aug 700 697 696

4.000% notes ................... Sep2011 Sep 2021 Mar/Sep 1,000 992 991

5.750% notes(a) ................. May2011 June 2031 June 1,016 1,012 968

6.550% debentures .............. Apr2007 May 2037 May/Nov 1,500 1,492 1,492

7.300% debentures .............. June 2008 July 2038 Jan/July 1,500 1,496 1,496

6.750% debentures .............. June 2009 June 2039 June/Dec 1,500 1,462 1,460

5.875% debentures .............. Nov2010 Nov 2040 May/Nov 1,200 1,178 1,177

5.500% debentures .............. Sep2011 Sep 2041 Mar/Sep 1,250 1,229 1,228

5.250% notes(b) ................. June 2012 July 2042 July 1,057 1,046 —

4.500% debentures .............. Aug2012 Sep 2042 Mar/Sep 1,250 1,243 —

Total(c) ........................ $ 24,594 $ 23,744

(a) Outstanding balance amounts as of December 31, 2012 and 2011 include £623 million valued at $1.012 billion and $968 million, respectively, using the

exchange rate at each date.

(b) Outstanding balance amount as of December 31, 2012 includes £643 million valued at $1.046 billion using the exchange rate at that date.

(c) Outstanding balance amounts as of December 31, 2012 and 2011 include the estimated fair value of interest rate swap assets of $294 million and

$293 million, respectively, and exclude an unamortized discount of $173 million and $170 million, respectively.

TWC has filed a shelf registration statement on Form S-3 with the Securities and Exchange Commission (“SEC”) that

allows TWC to offer and sell from time to time a variety of securities. TWC has issued notes and debentures (the “TWC

Notes and Debentures”) publicly in a number of offerings. Prior to September 30, 2012, TWC’s obligations under the TWC

Notes and Debentures were guaranteed by the Company’s 100% owned subsidiaries, Time Warner Entertainment Company,

L.P. (“TWE”) and TW NY Cable Holding Inc. (“TW NY”). In connection with an internal reorganization discussed further

in Note 20, as of September 30, 2012, TWC’s obligations under the TWC Notes and Debentures are guaranteed by TW NY,

Time Warner Cable Enterprises LLC (“TWCE”) and Time Warner Cable Internet Holdings II LLC (“TWC Internet Holdings

II” and, together with TW NY and TWCE, the “TWC Debt Guarantors”), each a 100% owned subsidiary of the Company.

The TWC Notes and Debentures were issued pursuant to an indenture, dated as of April 9, 2007, as it has been and may

be amended from time to time (the “TWC Indenture”), by and among the Company, the TWC Debt Guarantors and The

Bank of New York Mellon, as trustee. The TWC Indenture contains customary covenants relating to restrictions on the

ability of the Company or any material subsidiary to create liens and on the ability of the Company and the TWC Debt

Guarantors to consolidate, merge or convey or transfer substantially all of their assets. The TWC Indenture also contains

customary events of default. In connection with the internal reorganization discussed further in Note 20, on, and effective as

of, September 30, 2012, the Company, TW NY, TWCE, TWC Internet Holdings II and The Bank of New York Mellon, as

Trustee, entered into the Second Supplemental Indenture to the TWC Indenture, dated as of April 9, 2007, as amended,

90