Time Warner Cable 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

provision of any given year includes adjustments to prior year income tax accruals that are considered appropriate and any

related estimated interest. The Company’s policy is to recognize, when applicable, interest and penalties on uncertain income

tax positions as part of income tax provision.

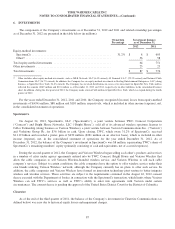

Equity-based Compensation

The Company measures the cost of employee services received in exchange for an award of equity instruments based on

the grant date fair value of the award. That cost is recognized in the consolidated statement of operations over the period

during which an employee is required to provide service in exchange for the award. The Company’s policy is to recognize

the cost of awards not subject to performance-based vesting conditions on a straight-line basis over the requisite service

period and based upon the probable outcome of the performance criteria and requisite service period for each tranche of

awards subject to performance-based vesting conditions. The Company uses the Black-Scholes model to estimate the grant

date fair value of a stock option. Because the option-pricing model requires the use of subjective assumptions, changes in

these assumptions can materially affect the fair value of stock options granted. The volatility assumption is calculated using a

75%-25% weighted average of implied volatility of TWC traded options and the historical stock price volatility of a

comparable peer group of publicly traded companies. The expected term, which represents the period of time that options are

expected to be outstanding, is estimated based on the historical exercise experience of TWC employees. The risk-free rate

assumed in valuing the stock options is based on the U.S. Treasury yield curve in effect at the time of grant for the expected

term of the option. The Company determines the expected dividend yield percentage by dividing the expected annual

dividend by the market price of TWC common stock at the date of grant.

Legal Contingencies

The Company is subject to legal, regulatory and other proceedings and claims that arise in the ordinary course of

business. The Company records an estimated liability for those proceedings and claims arising in the ordinary course of

business when the loss from such proceedings and claims becomes probable and reasonably estimable. The Company

reviews outstanding claims with internal and external counsel to assess the probability and the estimates of loss, including

the possible range of an estimated loss. The Company reassesses the risk of loss as new information becomes available and

adjusts liabilities as appropriate. The actual cost of resolving a claim may be substantially different from the amount of the

liability recorded. Differences between the estimated and actual amounts determined upon ultimate resolution, individually

or in the aggregate, are not expected to have a material adverse effect on the Company’s consolidated financial position but

could possibly be material to the Company’s consolidated results of operations or cash flow for any one period.

Segments

Public companies are required to disclose certain information about their reportable operating segments. Operating

segments are defined as significant components of an enterprise for which separate financial information is available and is

evaluated on a regular basis by the chief operating decision makers in deciding how to allocate resources to an individual

segment and in assessing performance of the segment. The Company has determined that it has only one reportable segment.

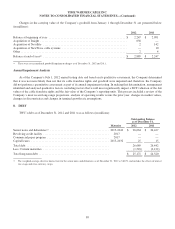

4. EARNINGS PER SHARE

Basic net income per common share attributable to TWC common shareholders is determined using the two-class

method and is computed by dividing net income attributable to TWC common shareholders by the weighted average of

common shares outstanding during the period. The two-class method is an earnings allocation formula that determines

income per share for each class of common stock and participating security according to dividends declared and participation

rights in undistributed earnings. Diluted net income per common share attributable to TWC common shareholders reflects the

more dilutive earnings per share amount calculated using the treasury stock method or the two-class method.

84