Time Warner Cable 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

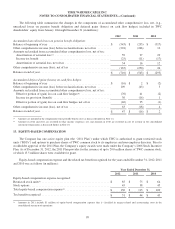

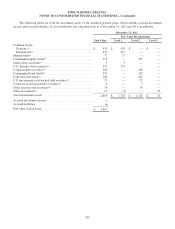

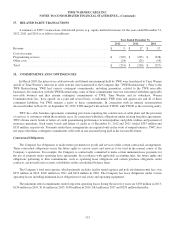

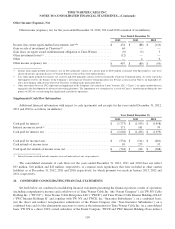

Restructuring Costs

Beginning in the first quarter of 2009, the Company began a restructuring to improve operating efficiency, primarily

related to employee terminations and other exit costs. Through December 31, 2012, the Company incurred costs of $254

million and made payments of $227 million related to this restructuring. Through December 31, 2011, the Company

terminated approximately 2,975 employees and terminated approximately 1,135 additional employees during the year ended

December 31, 2012. The Company expects to incur additional restructuring costs during 2013 in connection with initiatives

intended to improve operating efficiency, primarily related to employee terminations. Information relating to restructuring

costs is as follows (in millions):

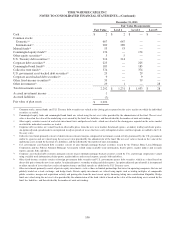

Employee

Termination

Costs

Other

Exit Costs Total

Remaining liability as of December 31, 2009 .............................$ 20 $ 1 $ 21

Costs incurred ...................................................... 33 19 52

Cash paid .......................................................... (39) (12) (51)

Remaining liability as of December 31, 2010 ............................. 14 8 22

Costs incurred ...................................................... 44 16 60

Cash paid .......................................................... (29) (20) (49)

Remaining liability as of December 31, 2011 ............................. 29 4 33

Costs incurred ...................................................... 46 15 61

Cash paid .......................................................... (51) (16) (67)

Remaining liability as of December 31, 2012(a) ............................

$ 24$ 3$ 27

(a) Of the remaining liability as of December 31, 2012, $26 million is classified as a current liability, with the remaining amount classified as a noncurrent

liability in the consolidated balance sheet. Amounts are expected to be paid through March 2014.

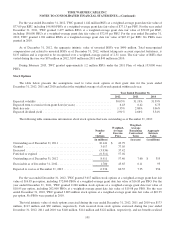

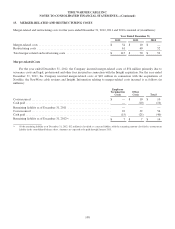

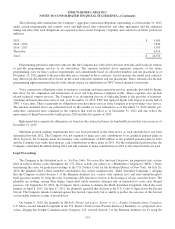

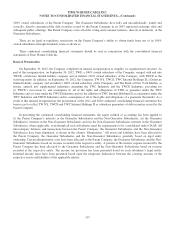

16. INCOME TAXES

The current and deferred income tax (benefit) provision for the years ended December 31, 2012, 2011 and 2010 is as

follows (in millions):

Year Ended December 31,

2012 2011 2010

Federal:

Current .........................................................$ 495 $ 69 $ 127

Deferred ........................................................ 634 843 654

State:

Current ......................................................... 120 88 69

Deferred ........................................................ (72) (205) 33

Total ...........................................................$ 1,177 $ 795 $ 883

109