Time Warner Cable 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

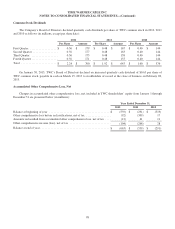

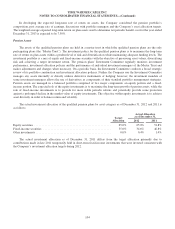

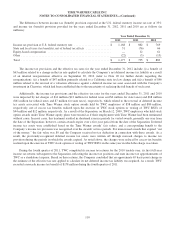

from these exercises of stock options was $69 million, $45 million and $28 million, respectively. Total unrecognized

compensation cost related to unvested stock options as of December 31, 2012, without taking into account expected

forfeitures, is $53 million and is expected to be recognized over a weighted-average period of 2.50 years.

During February 2013, TWC granted options to purchase approximately 2.4 million shares of TWC common stock

under the 2011 Plan, of which 283,000 were PBOs.

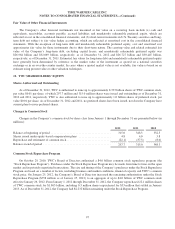

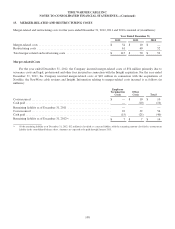

14. EMPLOYEE BENEFIT PLANS

Pension Plans

TWC sponsors two qualified defined benefit pension plans – Time Warner Cable Pension Plan (the “TWC Pension

Plan”) and Time Warner Cable Union Pension Plan (the “Union Pension Plan” and, together with the TWC Pension Plan, the

“qualified pension plans”) – that together provide pension benefits to a majority of the Company’s employees. TWC also

provides a nonqualified defined benefit pension plan for certain employees (the “nonqualified pension plan” and, together

with the qualified pension plans, the “pension plans”). Pension benefits are based on formulas that reflect the employees’

years of service and compensation during their employment period. TWC uses a December 31 measurement date for its

pension plans.

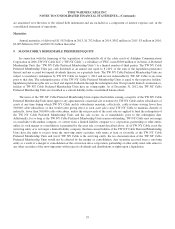

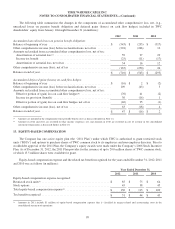

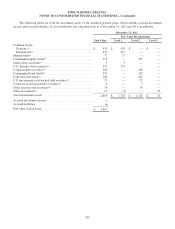

Changes in the Company’s projected benefit obligation, fair value of plan assets and funded status from January 1

through December 31 are presented below (in millions):

2012 2011

Projected benefit obligation at beginning of year .......................................$ 2,342 $ 1,803

Service cost .................................................................. 169 132

Interest cost .................................................................. 131 114

Actuarial loss ................................................................ 465 322

Benefits paid ................................................................. (36) (29)

Projected benefit obligation at end of year ............................................

$ 3,071 $ 2,342

Accumulated benefit obligation at end of year .........................................

$ 2,564 $ 1,900

Fair value of plan assets at beginning of year ..........................................

$ 2,292 $ 1,882

Actual return on plan assets ..................................................... 317 34

Employer contributions ......................................................... 289 405

Benefits paid ................................................................. (36) (29)

Fair value of plan assets at end of year ...............................................

$ 2,862 $ 2,292

Funded status ..................................................................

$ (209) $ (50)

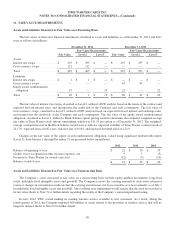

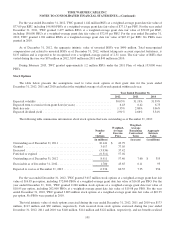

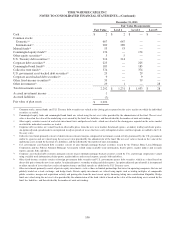

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for the qualified pension

plans and the nonqualified pension plan as of December 31, 2012 and 2011 were as follows (in millions):

Qualified Pension Plans Nonqualified Pension Plan

December 31, December 31,

2012 2011 2012 2011

Projected benefit obligation ...............................$ 3,025 $ 2,305 $ 46 $ 37

Accumulated benefit obligation ............................ 2,520 1,865 44 35

Fair value of plan assets .................................. 2,862 2,292 — —

102