Time Warner Cable 2012 Annual Report Download - page 129

Download and view the complete annual report

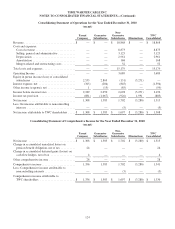

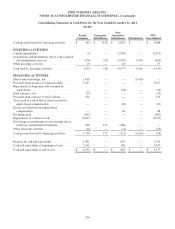

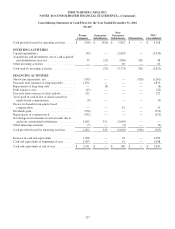

Please find page 129 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

100% owned subsidiaries of the Parent Company. The Guarantor Subsidiaries have fully and unconditionally, jointly and

severally, directly, guaranteed the debt securities issued by the Parent Company in its 2007 registered exchange offer and

subsequent public offerings. The Parent Company owns all of the voting and economic interests, directly or indirectly, of the

Guarantor Subsidiaries.

There are no legal or regulatory restrictions on the Parent Company’s ability to obtain funds from any of its 100%

owned subsidiaries through dividends, loans or advances.

These condensed consolidating financial statements should be read in conjunction with the consolidated financial

statements of Time Warner Cable Inc.

Basis of Presentation

On September 30, 2012, the Company completed an internal reorganization to simplify its organizational structure. As

part of this reorganization, on September 30, 2012, TWE, a 100% owned subsidiary of the Company, merged with and into

TWCE, a Delaware limited liability company and an indirect 100% owned subsidiary of the Company, with TWCE as the

surviving entity. In addition, on September 30, 2012, the Company, TW NY, TWCE, TWC Internet Holdings II, a Delaware

limited liability company and an indirect 100% owned subsidiary of the Company, and The Bank of New York Mellon, as

trustee, entered into supplemental indentures amending the TWC Indenture and the TWCE Indenture, providing for

(i) TWCE’s succession to, and assumption of, all of the rights and obligations of TWE as guarantor under the TWC

Indenture and as issuer under the TWCE Indenture and (ii) the addition of TWC Internet Holdings II as a guarantor under the

TWC Indenture and TWCE Indenture and its assumption of all of the rights and obligations of a guarantor thereunder. As a

result of this internal reorganization, the presentation of the 2011 and 2010 condensed consolidating financial statements has

been recast to reflect TW NY, TWCE and TWC Internet Holdings II as subsidiary guarantors of debt securities issued by the

Parent Company.

In presenting the condensed consolidating financial statements, the equity method of accounting has been applied to

(i) the Parent Company’s interests in the Guarantor Subsidiaries and the Non-Guarantor Subsidiaries, (ii) the Guarantor

Subsidiaries’ interests in the Non-Guarantor Subsidiaries and (iii) the Non-Guarantor Subsidiaries interests in the Guarantor

Subsidiaries, where applicable, even though all such subsidiaries meet the requirements to be consolidated under GAAP. All

intercompany balances and transactions between the Parent Company, the Guarantor Subsidiaries and the Non-Guarantor

Subsidiaries have been eliminated, as shown in the column “Eliminations.” All assets and liabilities have been allocated to

the Parent Company, the Guarantor Subsidiaries and the Non-Guarantor Subsidiaries generally based on legal entity

ownership. Certain administrative costs have been allocated to the Parent Company, the Guarantor Subsidiaries and the Non-

Guarantor Subsidiaries based on revenue recorded at the respective entity. A portion of the interest expense incurred by the

Parent Company has been allocated to the Guarantor Subsidiaries and the Non-Guarantor Subsidiaries based on revenue

recorded at the respective entity. The income tax provision has been presented based on each subsidiary’s legal entity.

Deferred income taxes have been presented based upon the temporary differences between the carrying amounts of the

respective assets and liabilities of the applicable entities.

119