Time Warner Cable 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

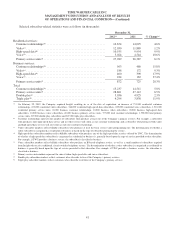

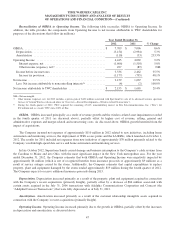

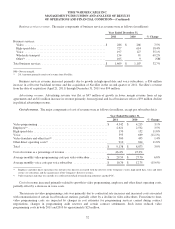

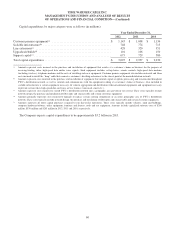

For residential services, average monthly revenue per unit was as follows:

Year Ended December 31,

2011 2010 % Change

Video(a) ........................................................$ 73.18 $ 70.46 3.9%

High-speed data(b) ............................................... 38.32 37.00 3.6%

Voice(c) ........................................................ 36.89 37.08 (0.5%)

Primary service units(d) ........................................... 54.30 53.24 2.0%

(a) Average monthly residential video revenue per unit represents residential video revenue divided by the corresponding average residential video

subscribers for the period.

(b) Average monthly residential high-speed data revenue per unit represents residential high-speed data revenue divided by the corresponding average

residential high-speed data subscribers for the period.

(c) Average monthly residential voice revenue per unit represents residential voice revenue divided by the corresponding average residential voice

subscribers for the period.

(d) Average monthly residential revenue per residential primary service unit represents residential services revenue divided by the corresponding average

residential primary service units for the period.

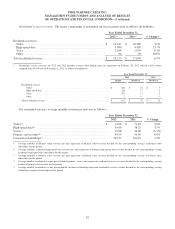

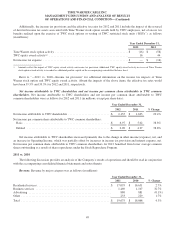

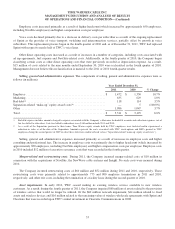

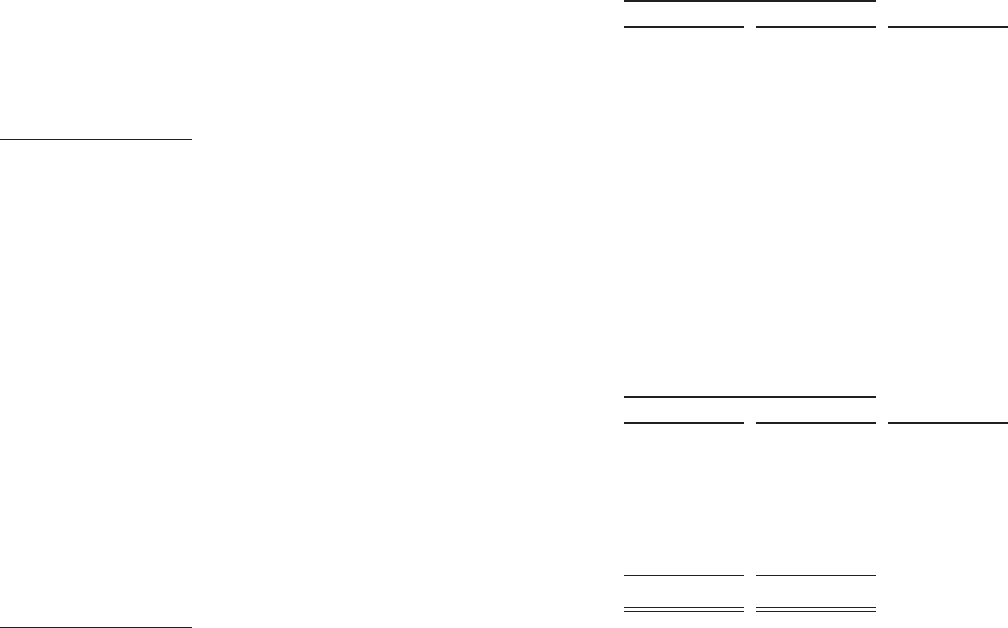

The major components of residential video revenue were as follows (in millions):

Year Ended December 31,

2011 2010 % Change

Programming tiers(a) .............................................$ 6,944 $ 7,006 (0.9%)

Premium networks ............................................... 808 848 (4.7%)

Transactional video-on-demand .................................... 339 365 (7.1%)

Video equipment rental and installation charges ........................ 1,372 1,297 5.8%

DVR service .................................................... 638 581 9.8%

Franchise and other fees(b) ......................................... 488 480 1.7%

Total ..........................................................$ 10,589 $ 10,577 0.1%

(a) Programming tier revenue includes subscriber fees for the Company’s various tiers or packages of video programming services generally distinguished

from one another by the number and type of programming networks they include.

(b) Franchise and other fees include fees collected on behalf of franchising authorities and the FCC.

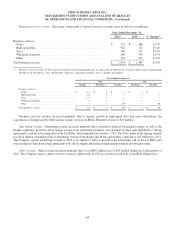

The modest increase in residential video revenue was due to an increase in average revenue per subscriber, partially

offset by a decrease in video subscribers. The increase in average revenue per subscriber was primarily due to price

increases, a greater percentage of subscribers purchasing higher-priced tiers of service and increased revenue from equipment

rentals and DVR service, partially offset by decreases in premium network and transactional video-on-demand revenue.

Residential high-speed data revenue increased due to growth in high-speed data subscribers and an increase in average

revenue per subscriber (due to both price increases and a greater percentage of subscribers purchasing higher-priced tiers of

service).

The increase in residential voice revenue was due to growth in voice subscribers, partially offset by a slight decrease in

average revenue per subscriber.

51