Time Warner Cable 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

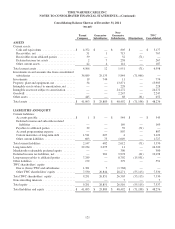

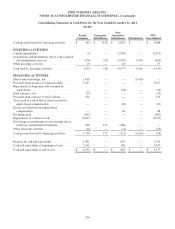

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

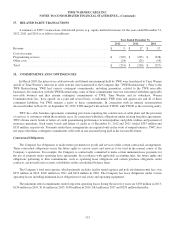

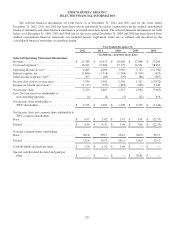

Consolidating Statement of Operations for the Year Ended December 31, 2011

(recast)

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

Revenue ...................................$ — $ — $ 19,675 $ — $ 19,675

Costs and expenses:

Cost of revenue ........................... — — 9,138 — 9,138

Selling, general and administrative ............ — — 3,311 — 3,311

Depreciation ............................. — — 2,994 — 2,994

Amortization ............................. — — 33 — 33

Merger-related and restructuring costs ......... 9 — 61 — 70

Asset impairments ......................... — — 60 — 60

Total costs and expenses ...................... 9 — 15,597 — 15,606

Operating Income (Loss) ..................... (9) — 4,078 — 4,069

Equity in pretax income (loss) of consolidated

subsidiaries .............................. 2,789 3,112 (130) (5,771) —

Interest expense, net ......................... (324) (204) (990) — (1,518)

Other income (expense), net ................... 2 (13) (78) — (89)

Income before income taxes ................... 2,458 2,895 2,880 (5,771) 2,462

Income tax provision ........................ (793) (935) (839) 1,772 (795)

Net income ................................ 1,665 1,960 2,041 (3,999) 1,667

Less: Net income attributable to noncontrolling

interests ................................. — — (2) — (2)

Net income attributable to TWC shareholders .....$ 1,665 $ 1,960 $ 2,039 $ (3,999) $ 1,665

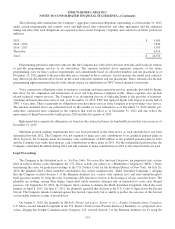

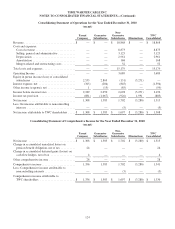

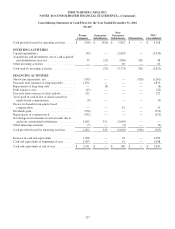

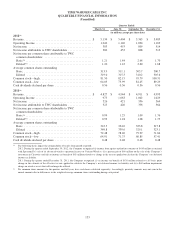

Consolidating Statement of Comprehensive Income for the Year Ended December 31, 2011

(recast)

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

Net income ................................$ 1,665 $ 1,960 $ 2,041 $ (3,999) $ 1,667

Change in accumulated unrealized losses on

pension benefit obligation, net of tax .......... (250) — — — (250)

Change in accumulated deferred gains (losses) on

cash flow hedges, net of tax ................. (18) — — — (18)

Other comprehensive loss ..................... (268) — — — (268)

Comprehensive income ....................... 1,397 1,960 2,041 (3,999) 1,399

Less: Comprehensive income attributable to

noncontrolling interests ..................... — — (2) — (2)

Comprehensive income attributable to TWC

shareholders .............................$ 1,397 $ 1,960 $ 2,039 $ (3,999) $ 1,397

123