Time Warner Cable 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

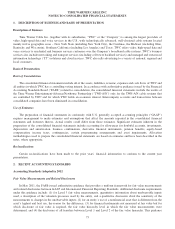

Derivative Financial Instruments

The Company uses derivative financial instruments primarily to manage the risks associated with fluctuations in interest

rates and foreign currency exchange rates and recognizes all derivative financial instruments in the consolidated balance

sheet as either assets or liabilities at fair value. As discussed further in Note 10 to the accompanying consolidated financial

statements, changes in the fair value of a derivative financial instrument designated as a fair value hedge (e.g., the

Company’s interest rate swaps) are recognized in earnings in the period of change together with the offsetting loss or gain on

the hedged item attributable to the risk being hedged. For a derivative financial instrument designated as a cash flow hedge

(e.g., the Company’s cross-currency swaps), the effective portion of the gain or loss on the derivative financial instrument is

initially reported in equity as a component of accumulated other comprehensive income (loss), net, and subsequently

reclassified into earnings when the hedged item (e.g., a forecasted transaction denominated in a foreign currency) affects

earnings. The ineffective portion of the gain or loss is reported in earnings immediately. For a derivative financial instrument

not designated as a hedging instrument (e.g., the equity award reimbursement obligation to Time Warner), the gain or loss is

recognized in earnings in the period of change.

The Company determines the fair value of its interest rate swaps using a DCF analysis based on the terms of the

contract. This requires estimates of future interest rates and judgments about the future credit worthiness of the Company and

each counterparty over the terms of the contracts. Similarly, the Company determines the fair value of its cross-currency

swaps using a DCF analysis based on the terms of the contracts. This valuation requires estimates of future interest rates,

forward exchange rates and judgments about the future credit worthiness of the Company and each counterparty over the

terms of the contracts. The fair value of the Time Warner equity award reimbursement obligation is estimated using the

Black-Scholes model.

Indefinite-lived Intangible Assets and Goodwill

At least annually, the Company performs separate tests to determine if its indefinite lived intangible assets (primarily

cable franchise rights) and its goodwill are impaired. Under the accounting rules, the Company can elect to perform a

qualitative assessment to determine if an impairment is more likely than not to have occurred. If an impairment is more likely

than not to have occurred, then a quantitative assessment is required, which may or may not result in an impairment charge.

The determination of whether an impairment is more likely than not to have occurred requires significant judgment regarding

potential changes in valuation inputs and includes a review of the Company’s most recent long-range projections, analysis of

operating results versus the prior year, changes in market values, changes in discount rates and changes in terminal growth

rate assumptions. As discussed further in Note 7 to the accompanying consolidated financial statements, based on its

qualitative assessment, the Company determined that it was not more likely than not that its cable franchise rights and

goodwill were impaired as of July 1, 2012 and, therefore, the Company did not perform a quantitative assessment as part of

its annual impairment testing.

Income Taxes

From time to time, the Company engages in transactions in which the tax consequences may be subject to uncertainty.

Examples of such transactions include business acquisitions and dispositions, including dispositions designed to be tax free,

issues related to consideration paid or received, investments and certain financing transactions. Significant judgment is

required in assessing and estimating the tax consequences of these transactions. The Company prepares and files tax returns

based on interpretation of tax laws and regulations. In the normal course of business, the Company’s tax returns are subject

to examination by various taxing authorities. Such examinations may result in future tax, interest and penalty assessments by

these taxing authorities. In determining the Company’s income tax provision for financial reporting purposes, the Company

establishes a reserve for uncertain income tax positions unless such positions are determined to be more likely than not of

being sustained upon examination, based on their technical merits. That is, for financial reporting purposes, the Company

only recognizes tax benefits taken on the tax return that it believes are more likely than not of being sustained. There is

considerable judgment involved in determining whether positions taken on the tax return are more likely than not of being

sustained.

66