Time Warner Cable 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

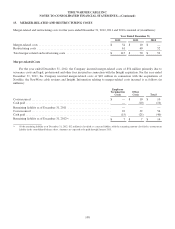

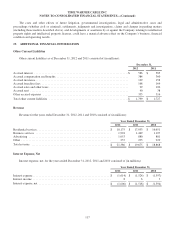

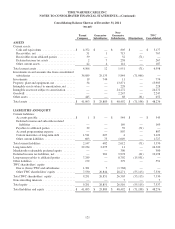

Other Income (Expense), Net

Other income (expense), net, for the years ended December 31, 2012, 2011 and 2010 consisted of (in millions):

Year Ended December 31,

2012 2011 2010

Income (loss) from equity-method investments, net(a)(b) .....................$ 454 $ (88) $ (110)

Gain on sale of investment in Clearwire(b) ................................ 64 — —

Gain (loss) on equity award reimbursement obligation to Time Warner ......... (9) (5) 5

Other investment losses(c) ............................................. (12) — —

Other ............................................................. — 4 6

Other income (expense), net ...........................................

$ 497 $ (89) $ (99)

(a) Income from equity-method investments, net, in 2012 primarily consists of a pretax gain of $430 million associated with SpectrumCo’s sale of its

advanced wireless spectrum licenses to Verizon Wireless (refer to Note 6 for further details).

(b) Loss from equity-method investments, net, in 2011 and 2010 primarily consists of losses incurred by Clearwire Communications. As of the end of the

third quarter of 2011, the balance of the Company’s investment in Clearwire Communications was $0 and, as discussed in Note 6, on September 27,

2012, the Company sold all of its interest in Clearwire, resulting in the gain noted above.

(c) Other investment losses in 2012 represents an impairment of the Company’s investment in Canoe Ventures LLC (“Canoe”), an equity-method investee

engaged in the development of advanced advertising platforms. The impairment was recognized as a result of Canoe’s announcement during the first

quarter of 2012 of a restructuring that significantly curtailed its operations.

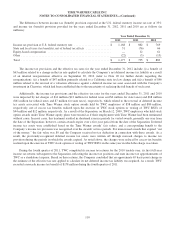

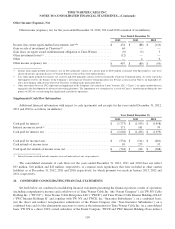

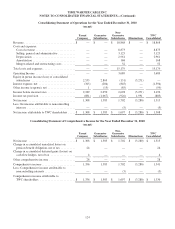

Supplemental Cash Flow Information

Additional financial information with respect to cash (payments) and receipts for the years ended December 31, 2012,

2011 and 2010 is as follows (in millions):

Year Ended December 31,

2012 2011 2010

Cash paid for interest ................................................$ (1,773) $ (1,595) $ (1,458)

Interest income received(a) ............................................ 171 161 99

Cash paid for interest, net .............................................$ (1,602) $ (1,434) $ (1,359)

Cash paid for income taxes ............................................$ (554) $ (111) $ (481)

Cash refunds of income taxes .......................................... 10 273 93

Cash (paid for) refunds of income taxes, net ..............................$ (544) $ 162 $ (388)

(a) Interest income received includes amounts received under interest rate swap contracts.

The consolidated statement of cash flows for the years ended December 31, 2012, 2011 and 2010 does not reflect

$33 million, $18 million and $43 million, respectively, of common stock repurchases that were included in other current

liabilities as of December 31, 2012, 2011 and 2010, respectively, for which payment was made in January 2013, 2012 and

2011, respectively.

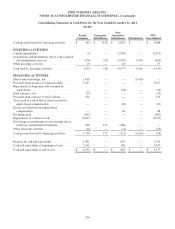

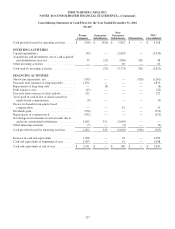

20. CONDENSED CONSOLIDATING FINANCIAL STATEMENTS

Set forth below are condensed consolidating financial statements presenting the financial position, results of operations

(including comprehensive income) and cash flows of (i) Time Warner Cable Inc. (the “Parent Company”), (ii) TW NY Cable

Holding Inc. (“TW NY”), Time Warner Cable Enterprises LLC (“TWCE”) and Time Warner Cable Internet Holdings II LLC

(“TWC Internet Holdings II” and, together with TW NY and TWCE, the “Guarantor Subsidiaries”), on a combined basis,

(iii) the direct and indirect non-guarantor subsidiaries of the Parent Company (the “Non-Guarantor Subsidiaries”) on a

combined basis and (iv) the eliminations necessary to arrive at the information for Time Warner Cable Inc. on a consolidated

basis. TW NY is a direct 100% owned subsidiary of the Parent Company. TWCE and TWC Internet Holdings II are indirect

118